Key Takeaways

- Accelerating capital release and a dominant specialty insurance portfolio could drive stronger, recurring revenues and top-line growth with improved net margins.

- Advanced analytics adoption, regulatory tailwinds, and infrastructure finance expertise may structurally boost recurring earnings and strengthen long-term business resilience.

- Shrinking revenue sources, higher catastrophic risks, legal uncertainties, and growing competition threaten Ambac's profitability, margin growth, and long-term earnings capacity.

Catalysts

About Ambac Financial Group- Operates as a financial services holding company.

- Analysts broadly agree that a reduction in legacy RMBS and legal exposures will steadily lower loss reserves, but this view underestimates how rapidly Ambac could unlock capital-accelerating new business expansion and optimizing net margins much sooner than anticipated.

- Analyst consensus sees Ambac's diversification into specialty program insurance driving new revenue, yet this outlook may significantly underplay the scale of recurring, fee-based income Ambac can capture as its acquisition strategy quickly builds a dominant specialty portfolio, turbocharging top-line growth.

- Rapid digitalization in financial services will enable Ambac to lead in adopting advanced data analytics for underwriting and risk management, resulting in superior pricing discipline and loss ratios that could provide a structural lift to earnings.

- Intensifying regulatory requirements will further amplify counterparty demand for robust credit enhancement and guarantee solutions, positioning Ambac's products as essential and likely boosting business volumes well ahead of sector averages, reflected in outsized revenue growth.

- The growing complexity and volume of infrastructure-related structured finance, combined with Ambac's expanding underwriting expertise, could drive a transformation of its business mix-yielding higher fees and strengthening long-term earnings resilience.

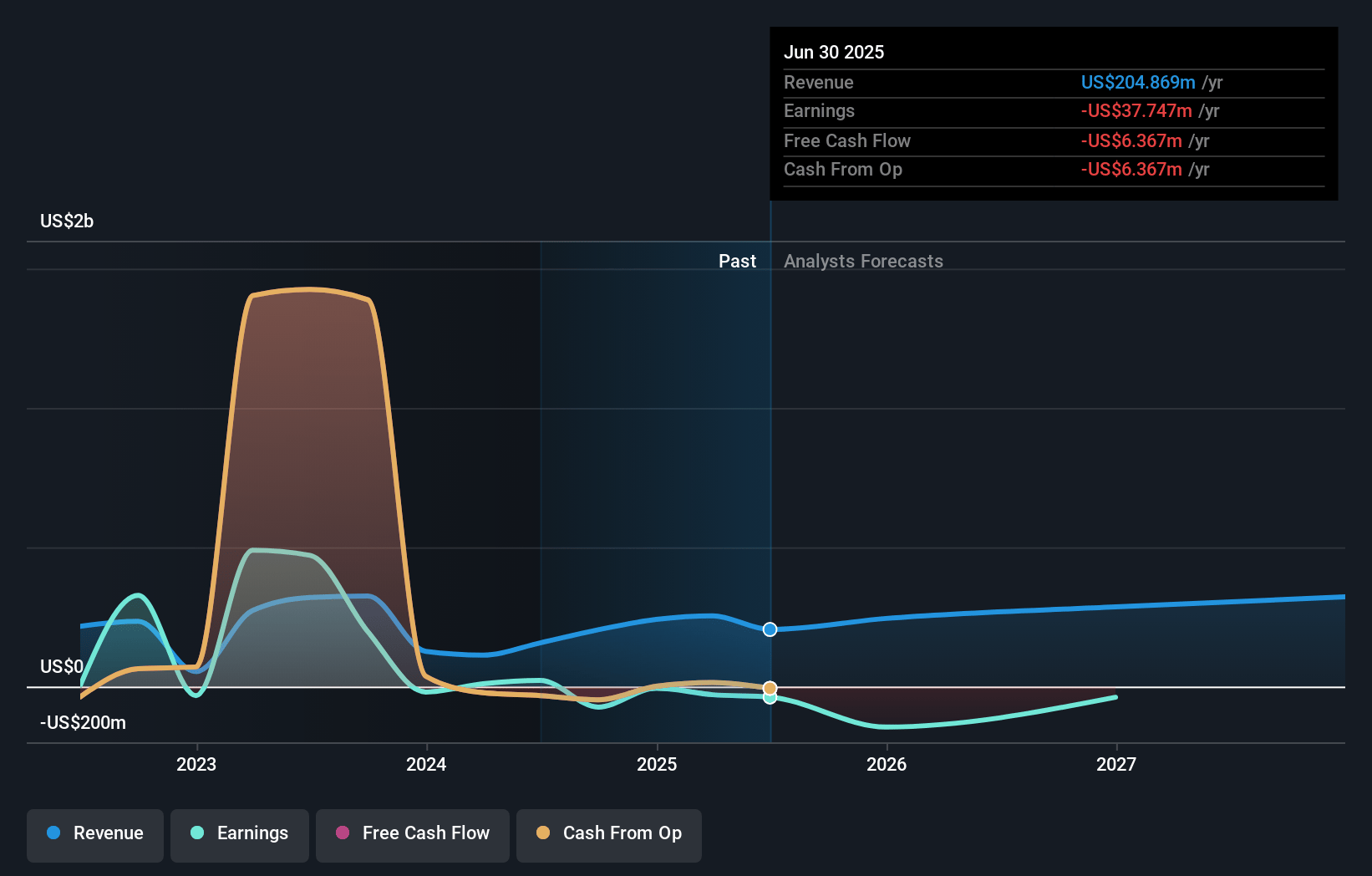

Ambac Financial Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ambac Financial Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ambac Financial Group's revenue will grow by 11.9% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Ambac Financial Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Ambac Financial Group's profit margin will increase from -11.6% to the average US Insurance industry of 10.4% in 3 years.

- If Ambac Financial Group's profit margin were to converge on the industry average, you could expect earnings to reach $37.0 million (and earnings per share of $0.86) by about July 2028, up from $-29.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.8x on those 2028 earnings, up from -13.8x today. This future PE is greater than the current PE for the US Insurance industry at 14.4x.

- Analysts expect the number of shares outstanding to decline by 2.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.58%, as per the Simply Wall St company report.

Ambac Financial Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A prolonged low interest rate environment or persistent yield curve flattening could constrain Ambac Financial Group's investment income, limiting future earnings and reducing net margin growth.

- Climate change trends leading to a greater frequency and severity of catastrophic events raise the risk of defaults on Ambac's insured portfolios, likely increasing claims costs and reducing profitability over time.

- The runoff of legacy insured portfolios with restricted new premium generation threatens Ambac's ability to grow revenues, as future earnings are pressured by a shrinking book of business.

- Persistent legal and litigation uncertainties from historic structured finance and RMBS exposures may lead to adverse judgments or settlements, directly impacting net income and draining company resources.

- Rising competition from new capital providers and digital market participants could erode Ambac's pricing power and compress operating margins, making it harder to drive revenue and sustain return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ambac Financial Group is $19.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ambac Financial Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $355.9 million, earnings will come to $37.0 million, and it would be trading on a PE ratio of 26.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of $8.71, the bullish analyst price target of $19.0 is 54.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.