Key Takeaways

- Higher claims costs, regulatory burdens, and legacy reserve issues are putting significant pressure on profitability and financial stability.

- Disruptive technology and increased competition threaten core revenue streams and future growth prospects in key business segments.

- Strategic shift to profitable E&S segments, tech-driven efficiencies, and a lower risk profile are expected to enhance underwriting results and support stable, sustainable earnings.

Catalysts

About James River Group Holdings- Provides specialty insurance services.

- The growing frequency and severity of climate-related natural disasters will likely increase insured losses and risk exposures for James River Group Holdings, leading to higher claims costs and pressure on underwriting margins and net income over the long term.

- Rapid advances in autonomous vehicles and driver-assistance technology threaten to reduce demand for certain commercial auto insurance lines-an area where James River has had material exposure-potentially curbing revenue growth in a key business segment.

- Continued regulatory tightening and evolving insurance rules are expected to raise compliance costs and introduce greater uncertainty, directly impacting expense ratios and squeezing net margins.

- Ongoing legacy reserving challenges could require future reserve strengthening, which would erode net margins and reduce shareholders' equity as adverse development emerges from historical business lines.

- Intensifying competition, both from large, diversified insurers and insurtech startups, is likely to compress pricing power and diminish underwriting profitability for James River, heightening the risk of stagnant or declining earnings in future periods.

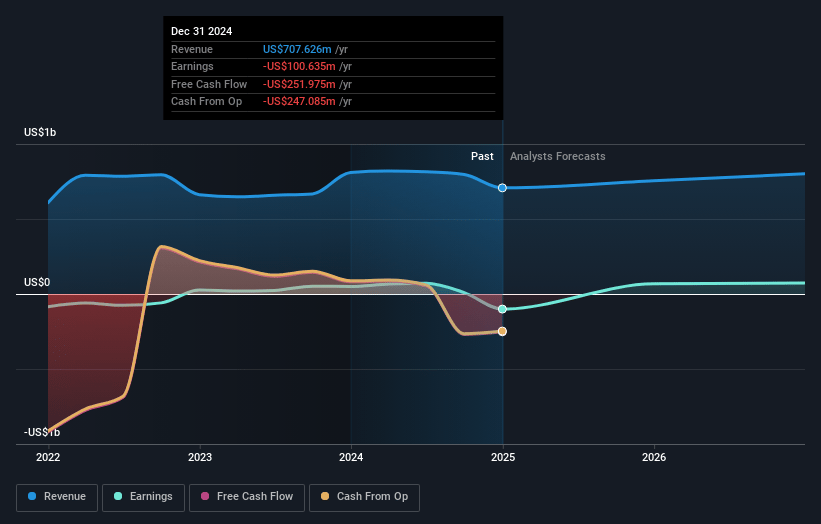

James River Group Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on James River Group Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming James River Group Holdings's revenue will grow by 5.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -16.6% today to 12.7% in 3 years time.

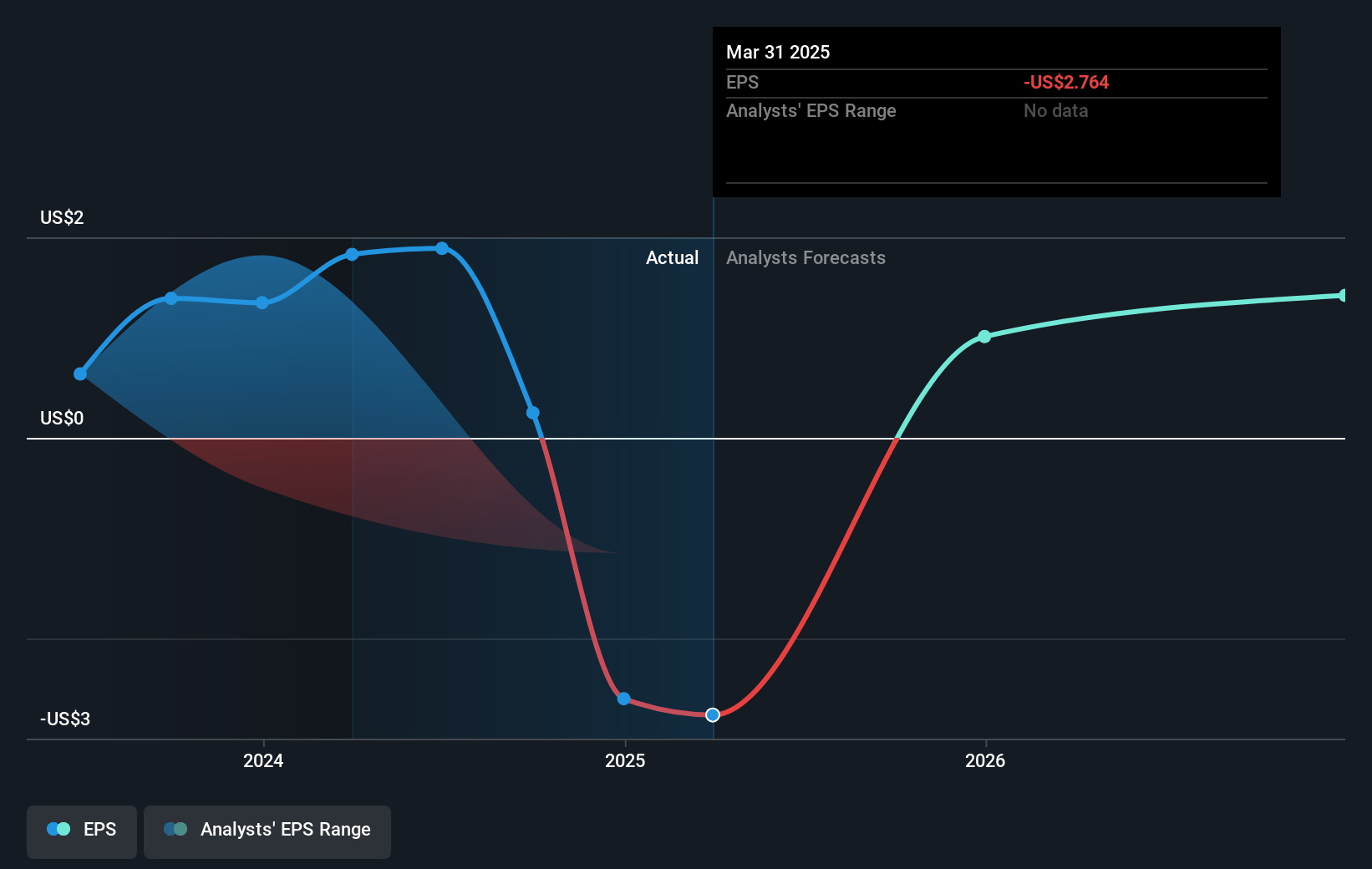

- The bearish analysts expect earnings to reach $101.0 million (and earnings per share of $5.11) by about July 2028, up from $-112.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 3.3x on those 2028 earnings, up from -2.4x today. This future PE is lower than the current PE for the US Insurance industry at 14.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

James River Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reports continued robust growth in submissions and premium growth in profitable segments like Environmental, Manufacturers & Contractors, and Small Business, supported by a strong E&S market and high renewal rates, which could support increases in both revenue and net margins over time.

- Strategic focus on profitable, smaller E&S accounts alongside divestitures and reduced risk in underperforming or volatile segments like commercial auto and the Specialty Admitted division is likely to improve overall underwriting profitability and enable sustainable earnings growth.

- Ongoing investments in technology and intelligent data processing are intended to drive improved efficiency, greater quote activity, and better risk selection, which should reduce the expense ratio and enhance net margins.

- Management expects a reduction in the effective tax rate as they redomicile to the United States, resulting in a recurring expense savings of $3 million to $6 million annually and a one-time benefit of up to $13 million, which directly supports net income and earnings per share.

- The company has a sizable prepaid legacy reinsurance coverage and has experienced minimal prior year reserve development, reducing the risk of large unexpected charges and allowing for greater earnings stability and predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for James River Group Holdings is $5.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of James River Group Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $792.6 million, earnings will come to $101.0 million, and it would be trading on a PE ratio of 3.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $5.82, the bearish analyst price target of $5.0 is 16.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.