Key Takeaways

- Rapid growth in commercial insurance demand and robust client retention drive strong recurring revenue, margin expansion, and increased capital flexibility.

- Technology investments and specialty line expansion diversify revenue streams and position the company for sustained organic and advisory segment growth.

- Exposure to natural disasters, InsurTech competition, acquisition-related inefficiencies, slower organic growth, and pricing challenges threaten Baldwin's profit margins and long-term earnings stability.

Catalysts

About Baldwin Insurance Group- Operates as an independent insurance distribution firm that delivers insurance and risk management solutions in the United States.

- Accelerating small and mid-sized business formation in the U.S., combined with strong sales velocity and robust new business pipelines in Baldwin's Main Street and builder/mortgage channels, points to continued double-digit premium and commission revenue growth as new businesses require commercial insurance coverage.

- Baldwin's aggressive investment in proprietary technology and expansion into specialty lines (e.g., launch of reciprocal exchanges, multifamily captives, acquisition of ILS/reinsurance platforms) are enhancing client experience, improving workflow automation, diversifying revenue streams, and supporting both margin expansion and potentially higher net earnings over time.

- Improved client retention rates (now at ~92%) and successful integration of numerous agency acquisitions, alongside the near completion of earn-out payments, increase operating leverage and free cash flow conversion rates, which should lead to higher net margins and greater capital deployment flexibility.

- Increasing risk awareness and insurance penetration driven by the rising frequency of severe weather and catastrophes is expanding the addressable market for risk management brokering, setting the stage for sustained organic top-line growth and robust commission/fee income in Baldwin's underwriting and advisory segments.

- Aging U.S. demographics and the outperformance in the Medicare division during enrollment periods position Baldwin to capture a growing share of life and health product premiums, supporting long-term recurring revenue growth as the retiree population expands.

Baldwin Insurance Group Future Earnings and Revenue Growth

Assumptions

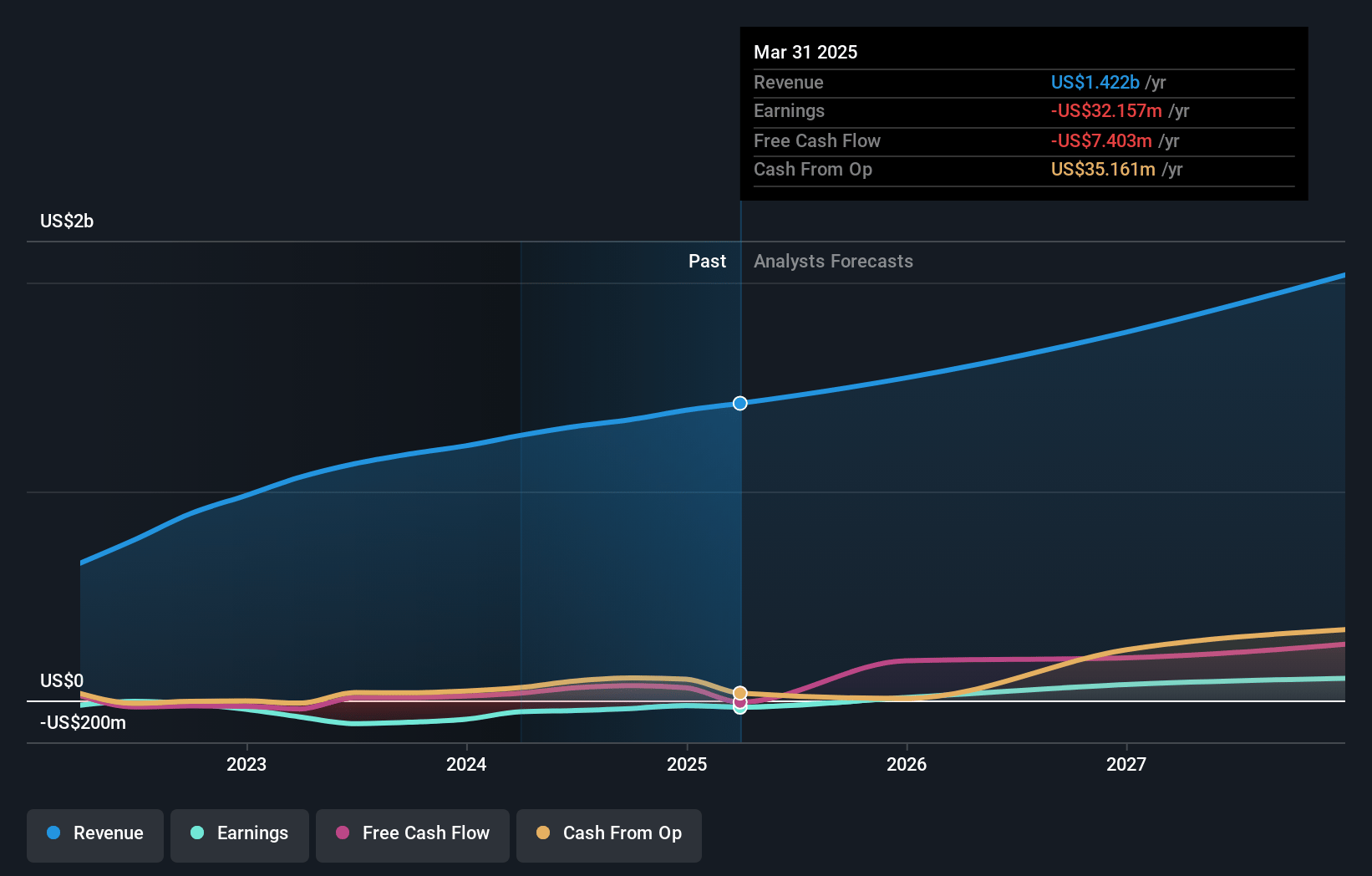

How have these above catalysts been quantified?- Analysts are assuming Baldwin Insurance Group's revenue will grow by 13.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.3% today to 7.8% in 3 years time.

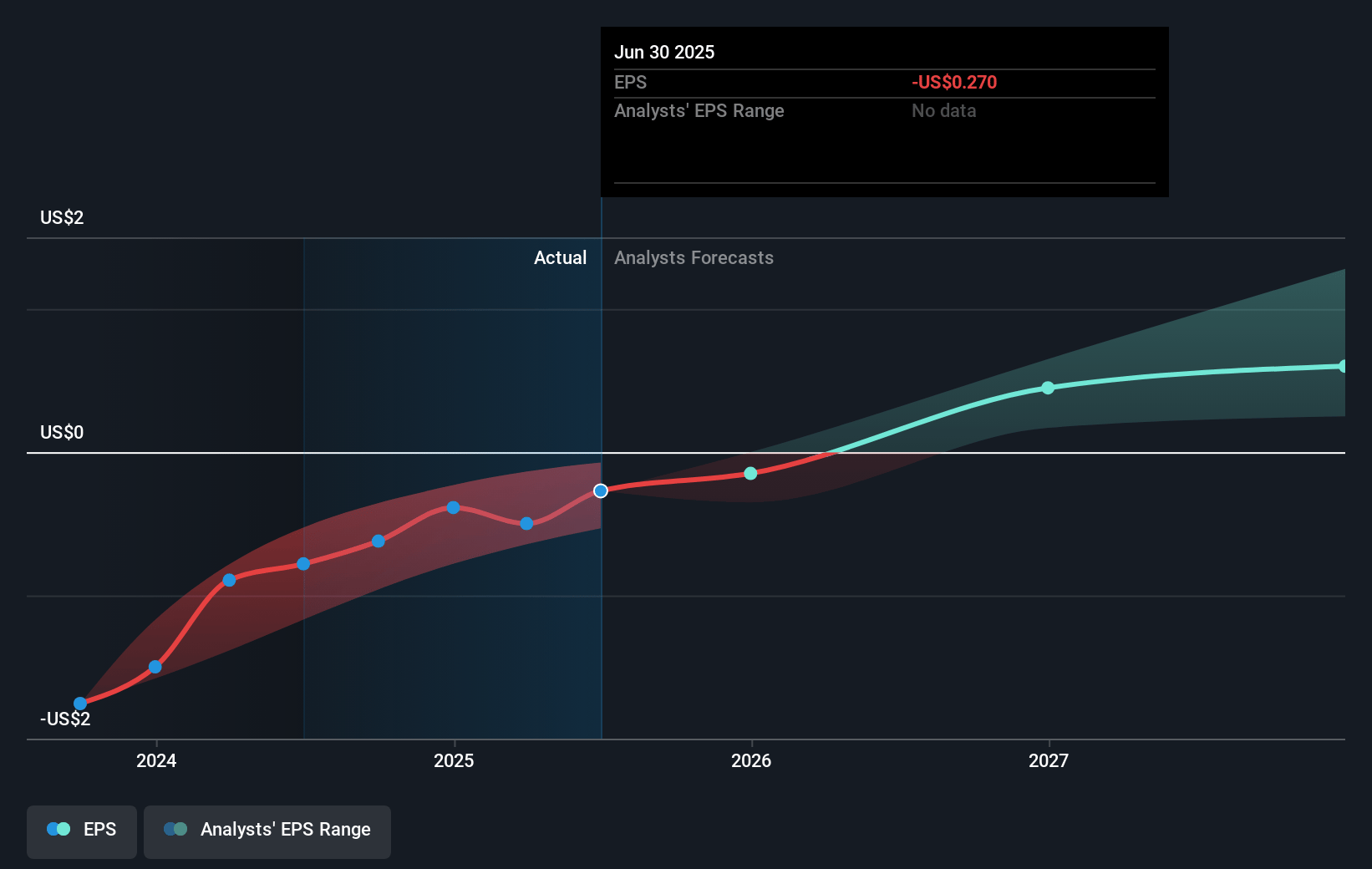

- Analysts expect earnings to reach $161.2 million (and earnings per share of $0.65) by about July 2028, up from $-32.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $194 million in earnings, and the most bearish expecting $26.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.0x on those 2028 earnings, up from -89.7x today. This future PE is greater than the current PE for the US Insurance industry at 14.4x.

- Analysts expect the number of shares outstanding to grow by 5.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.53%, as per the Simply Wall St company report.

Baldwin Insurance Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing prevalence and severity of natural disasters, particularly in regions like Florida and California, could raise claims costs and impact Baldwin's underwriting profitability, potentially pressuring net margins and future earnings.

- Ongoing technological disruption and competition from InsurTech firms and digital-first models may erode traditional brokerage market share and compress margins, presenting a long-term risk to revenue growth and profitability.

- Heavy reliance on acquisitive growth (multiple mentions of earn-outs and recent acquisitions) increases integration risk and can lead to operational inefficiencies or unexpected costs, which may suppress net margins and dampen future earnings growth.

- Recent deceleration in key segments, such as lower organic revenue growth in Insurance Advisory Solutions (IAS) due to competitive rate environment and muted project-based activity, could signal challenges in driving organic revenue and commission growth into the future.

- Persistent downward pressure on insurance pricing due to competitive and transparent rate environments, especially in property and benefits lines, may shrink profit margins and limit revenue growth, threatening longer-term earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $47.625 for Baldwin Insurance Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $161.2 million, and it would be trading on a PE ratio of 50.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of $40.82, the analyst price target of $47.62 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.