Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and strong broker relationships are driving substantial growth in the middle market and reinsurance segments, positively impacting revenue and earnings.

- Favorable market conditions and prudent strategies enhance underwriting income and investment earnings, bolstering potential profit margin expansion across segments.

- Increased catastrophe losses, CEO departure, and heightened competition could pressure Arch Capital's margins, revenue growth, and strategic execution.

Catalysts

About Arch Capital Group- Provides insurance, reinsurance, and mortgage insurance products worldwide.

- The acquisition of the mid-corp and Entertainment business from Allianz drove a 20% growth over the same quarter a year ago, expected to further enhance growth in the middle market insurance segment. This is likely to impact revenue positively.

- The reinsurance segment reported more than 24% growth in net premiums written, driven by strong relationships with brokers and demand in property ex-cat, casualty and specialty lines, which is expected to boost earnings.

- Growth in the mortgage segment is supported by strong underlying fundamentals, favorable credit conditions, and house price appreciation, contributing significantly to underwriting income, potentially impacting net margins favorably.

- Arch Investment Management generated substantial net investment income due to significant operating cash flows and robust investment portfolio performance, setting up strong future earnings from investment contributions.

- The favorable cycle in the casualty insurance market and prudent underwriting strategies position the company to achieve attractive risk-adjusted returns and potential expansion of profit margins in their insurance and reinsurance operations.

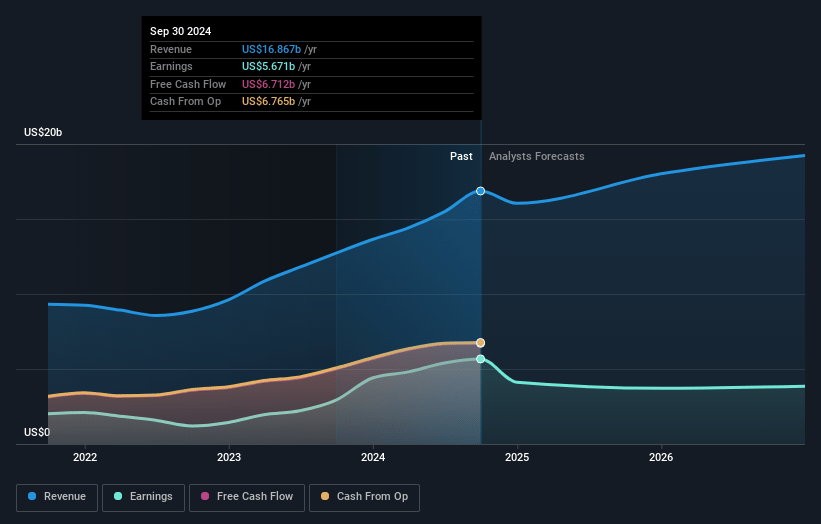

Arch Capital Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arch Capital Group's revenue will grow by 6.4% annually over the next 3 years.

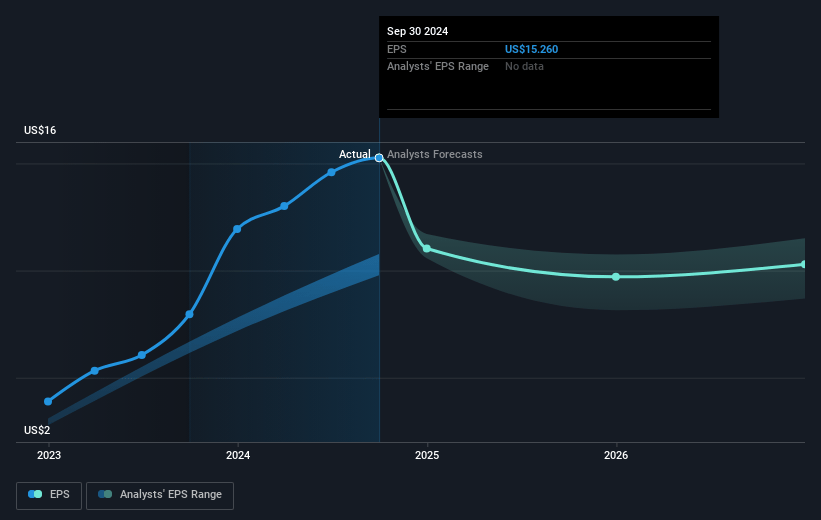

- Analysts assume that profit margins will shrink from 33.6% today to 16.1% in 3 years time.

- Analysts expect earnings to reach $3.3 billion (and earnings per share of $8.55) by about November 2027, down from $5.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2027 earnings, up from 6.7x today. This future PE is greater than the current PE for the US Insurance industry at 13.5x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.94%, as per the Simply Wall St company report.

Arch Capital Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Arch Capital faces risks due to increased catastrophe (cat) losses, which have exceeded $100 billion through the third quarter, impacting underwriting profitability and potentially reducing net margins.

- The departure of long-serving CEO Marc Grandisson could pose execution risks and impact the strategic direction and financial performance, affecting earnings stability.

- Increased competition in property and casualty lines, along with pressure to maintain competitive underwriting and risk mitigation strategies, could compress margins and impact future revenues.

- The reliance on property insurance markets that may exhibit pricing volatility due to catastrophe exposure could affect both revenue growth and return on capital.

- The integration and performance of the recently acquired MidCorp and Entertainment business carry uncertainties that could affect expense ratios and net margins if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $122.13 for Arch Capital Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $143.0, and the most bearish reporting a price target of just $104.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $20.3 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of $101.18, the analyst's price target of $122.13 is 17.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives