Narratives are currently in beta

Key Takeaways

- Medifast's revenue and earnings face uncertainty due to competition from GLP-1 medications and declining OPTAVIA coach numbers.

- Strategic transformation and new product launches may pressure profit margins, with high upfront costs and aggressive pricing strategies impacting financial performance.

- Medifast is strategically aligning with the growing GLP-1 market through targeted support, product innovation, and cost management, aiming for expanded revenue and brand credibility.

Catalysts

About Medifast- Through its subsidiaries, engages in the manufacture and sale of weight loss, weight management, and healthy living products in the United States and the Asia-Pacific.

- Medifast faces significant challenges from the widespread adoption of GLP-1 medications, which have rapidly shifted consumer weight management strategies. This could lead to further declines in revenue as the competitive pressure from these medications impacts customer acquisition and retention.

- The number of active earning OPTAVIA coaches has decreased significantly, which directly affects the company's ability to generate revenue. This decline may continue if Medifast fails to recruit or maintain sufficient coaches, further impacting earnings.

- The company is investing in a strategic transformation plan to adapt to the new market realities but has yet to show concrete financial improvements. This transitional period could compress net margins due to upfront costs without immediate revenue benefits.

- Medifast plans to launch new products and programs like OPTAVIA ASCEND in 2025, targeting GLP-1 medication users. However, the need to competitively price these products might pressure profit margins and earnings if price competition intensifies.

- The anticipated $2 million expenditure in clinical studies in 2025 to support their product integration with GLP-1 medications may weigh on operating expenses, affecting net income if not offset by increased revenue from these initiatives.

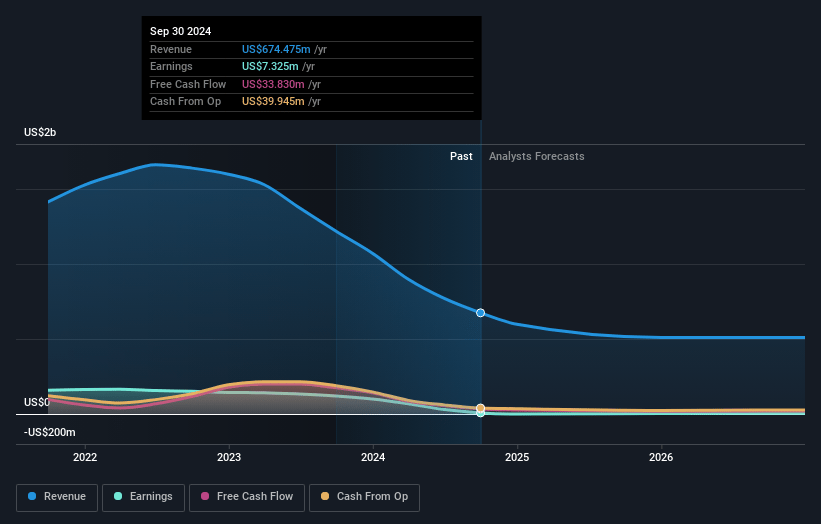

Medifast Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Medifast's revenue will decrease by -13.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.1% today to 1.2% in 3 years time.

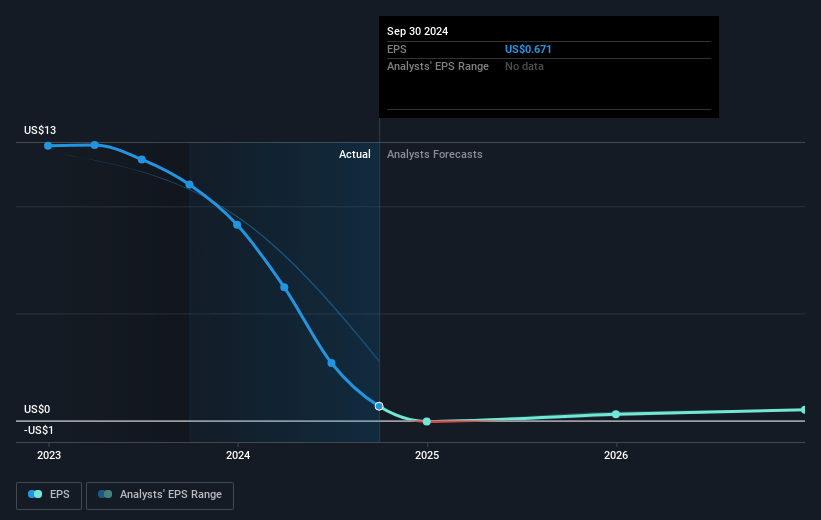

- Analysts expect earnings to reach $5.1 million (and earnings per share of $0.47) by about November 2027, down from $7.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.7x on those 2027 earnings, up from 28.5x today. This future PE is greater than the current PE for the US Personal Products industry at 28.5x.

- Analysts expect the number of shares outstanding to grow by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.86%, as per the Simply Wall St company report.

Medifast Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Medifast is adapting well to the growth of the GLP-1 medication market by training its OPTAVIA coaches to support clients using these medications, potentially expanding its revenue base by capturing a share of this emerging $50 billion market.

- The company has outlined a strategy to target people transitioning off GLP-1 medications, capitalizing on a potential market of individuals seeking sustainable weight maintenance, which could enhance revenue and customer retention.

- By introducing new product lines and programs like OPTAVIA ASCEND tailored to clients utilizing weight loss medications, Medifast can drive customer engagement and retention, potentially boosting revenue and improving net margins.

- Medifast's financial strategy, including proactive cost management and optimizing marketing spend, suggests effective operation control, contributing to stable earnings and maintaining a strong cash position.

- The potential launch of a clinical study to demonstrate the health benefits of integrating OPTAVIA programs with GLP-1 medications may provide Medifast with validated product differentiation, enhancing brand credibility and possibly leading to increased revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.5 for Medifast based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $441.1 million, earnings will come to $5.1 million, and it would be trading on a PE ratio of 39.7x, assuming you use a discount rate of 6.9%.

- Given the current share price of $19.57, the analyst's price target of $16.5 is 18.6% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives