Catalysts

About Penumbra

Penumbra develops and commercializes minimally invasive medical devices to treat vascular conditions such as stroke, venous thromboembolism and peripheral embolization.

What are the underlying business or industry changes driving this perspective?

- Dependence on high procedural growth in VTE and PE interventions could stall if hospital protocol changes from STORM-PE and related data roll out more slowly than expected or hit institutional budget constraints. This could limit incremental procedure volume and dampen revenue growth.

- Intensifying competition in thrombectomy and embolization, including rival clot removal platforms and alternative PE treatment approaches, risks eroding Penumbra's share gains in its fastest growing franchises. This could pressure top line expansion and gross margin mix.

- Heavy recent investment in an expanded commercial footprint and embolization-dedicated sales teams may not scale as efficiently as planned if market growth normalizes. This could lock in elevated SG&A levels and constrain operating margin expansion.

- Regulatory and product cycle risk around next-generation platforms such as Thunderbolt and Lightning Flash 3.0 could delay or dilute expected adoption in neurovascular and VTE. This could mute the anticipated uplift in revenue and limit further gross margin improvement.

- Exposure to reimbursement dynamics and health economic scrutiny of high-cost interventional PE and DVT care could trigger tightening coverage or protocol hurdles. This could slow long-run procedure adoption and cap earnings growth despite strong current clinical data.

Assumptions

This narrative explores a more pessimistic perspective on Penumbra compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

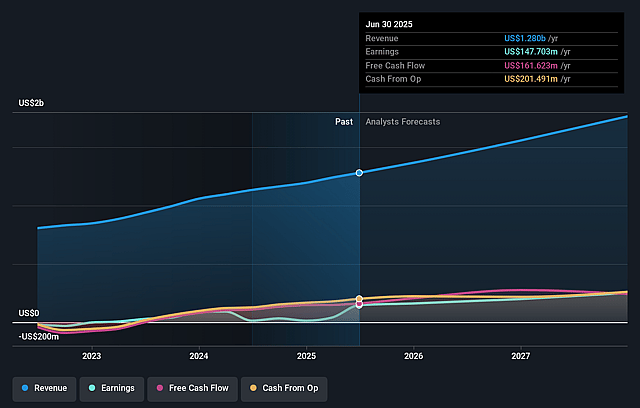

- The bearish analysts are assuming Penumbra's revenue will grow by 13.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 12.3% today to 12.6% in 3 years time.

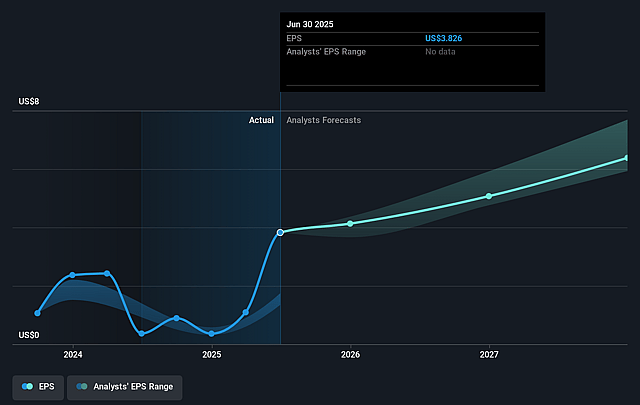

- The bearish analysts expect earnings to reach $244.7 million (and earnings per share of $6.26) by about December 2028, up from $164.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $339.5 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 50.3x on those 2028 earnings, down from 75.4x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.7x.

- The bearish analysts expect the number of shares outstanding to grow by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.72%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company is already delivering robust double digit revenue growth of 17.8% year over year with management raising full year revenue guidance to as much as $1.38 billion. This suggests that strong execution and demand momentum could sustain or accelerate top line expansion rather than support a declining share price, which would positively impact revenue and earnings growth over time.

- Penumbra is leveraging powerful long term secular trends in minimally invasive vascular care, with CAVT technology gaining share across VTE, PE, DVT, arterial clot and stroke, supported by new FDA cleared platforms like Lightning Flash 3.0 and Lightning Bolt 16. This could extend its competitive moat and lift procedure volumes and pricing power, boosting revenue and gross margins.

- Level 1 clinical data from STORM PE and reinforcing evidence from STRIKE PE are catalyzing a shift in hospital protocols and PE treatment practices in favor of CAVT. This is potentially expanding the treated patient pool and increasing adoption across both interventional and non interventional communities, which would be a structural tailwind for long run revenue and earnings growth.

- The dedicated embolization sales force and new products like Ruby XL and Swift coils are driving faster than expected embolization and access growth of 22% year over year worldwide and 21.2% sequentially in the U.S. This suggests a durable second growth engine that could support sustained mix improvement, margin expansion and higher long term earnings.

- Penumbra’s financial position is strengthening with gross margin already at 67.8% and targeted to exceed 70% by 2026, operating margins expanding, adjusted EBITDA margin near 19% and a debt free balance sheet with over $470 million in cash. This provides resilience through cycles and capital to invest in growth, supporting higher long term net margins and earnings than implied by a bearish share price view.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Penumbra is $238.98, which represents up to two standard deviations below the consensus price target of $327.94. This valuation is based on what can be assumed as the expectations of Penumbra's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $388.0, and the most bearish reporting a price target of just $186.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $244.7 million, and it would be trading on a PE ratio of 50.3x, assuming you use a discount rate of 7.7%.

- Given the current share price of $315.9, the analyst price target of $238.98 is 32.2% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Penumbra?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.