Last Update07 May 25Fair value Increased 11%

Key Takeaways

- Strong innovation in plasma and hospital technologies, paired with strategic contracts and global trends, positions the company for recurring growth and expanding profitability.

- Expansion into digital solutions and emerging markets enhances operating leverage and supports sustained improvement in margins and cash flow.

- Global demographic changes, competitive pressures, and operational challenges threaten revenue growth, profitability, and market share amid evolving healthcare and regulatory environments.

Catalysts

About Haemonetics- A healthcare company, provides suite of medical products and solutions in the United States and internationally.

- Advances in automated plasma collection technology and strong multi-year contracts with leading plasma collectors like BioLife and Grifols position Haemonetics to capture additional market share and benefit from a sustained rebound in plasma collection volumes, which are expected to grow at a high single-digit compound annual rate through 2032, directly supporting future revenue growth and EBITDA expansion.

- Ongoing innovation and adoption of higher-margin products in the hospital segment, such as the TEG 6S and VASCADE MVP XL, combined with strong growth trajectories in U.S. and EMEA markets, support both topline growth and significant gross margin expansion over the long term.

- Accelerated rollout and near-total adoption of next-generation plasma technologies (Persona and Express Plus) enable immediate productivity gains and cost reductions for customers, locking in premium pricing for Haemonetics and driving above-average net margin and earnings growth as collection volumes normalize.

- Global demographic shifts—including an aging population and rising prevalence of chronic diseases—will structurally increase demand for blood components, plasma-derived therapies, and surgical solutions, amplifying Haemonetics’ recurring revenue potential and providing reliable long-term tailwinds to both revenues and cash flows.

- Expansion into emerging market healthcare systems and the company’s increasing focus on high-margin, recurring revenue streams from digital solutions and software (e.g., BloodTrack and donor management systems) further boost operating leverage and set the stage for durable net margin and operating income improvement for years ahead.

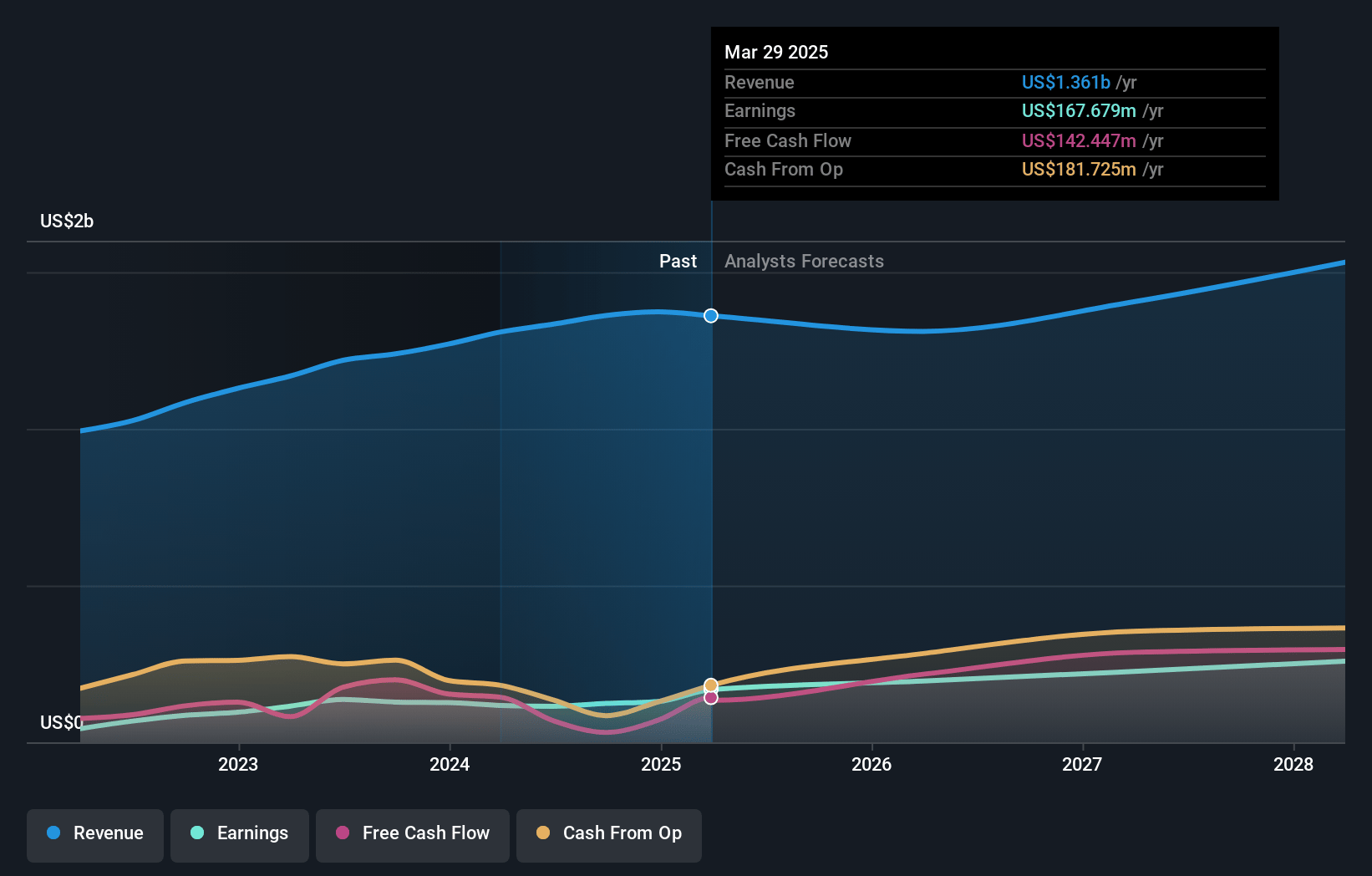

Haemonetics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Haemonetics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Haemonetics's revenue will grow by 6.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.5% today to 16.6% in 3 years time.

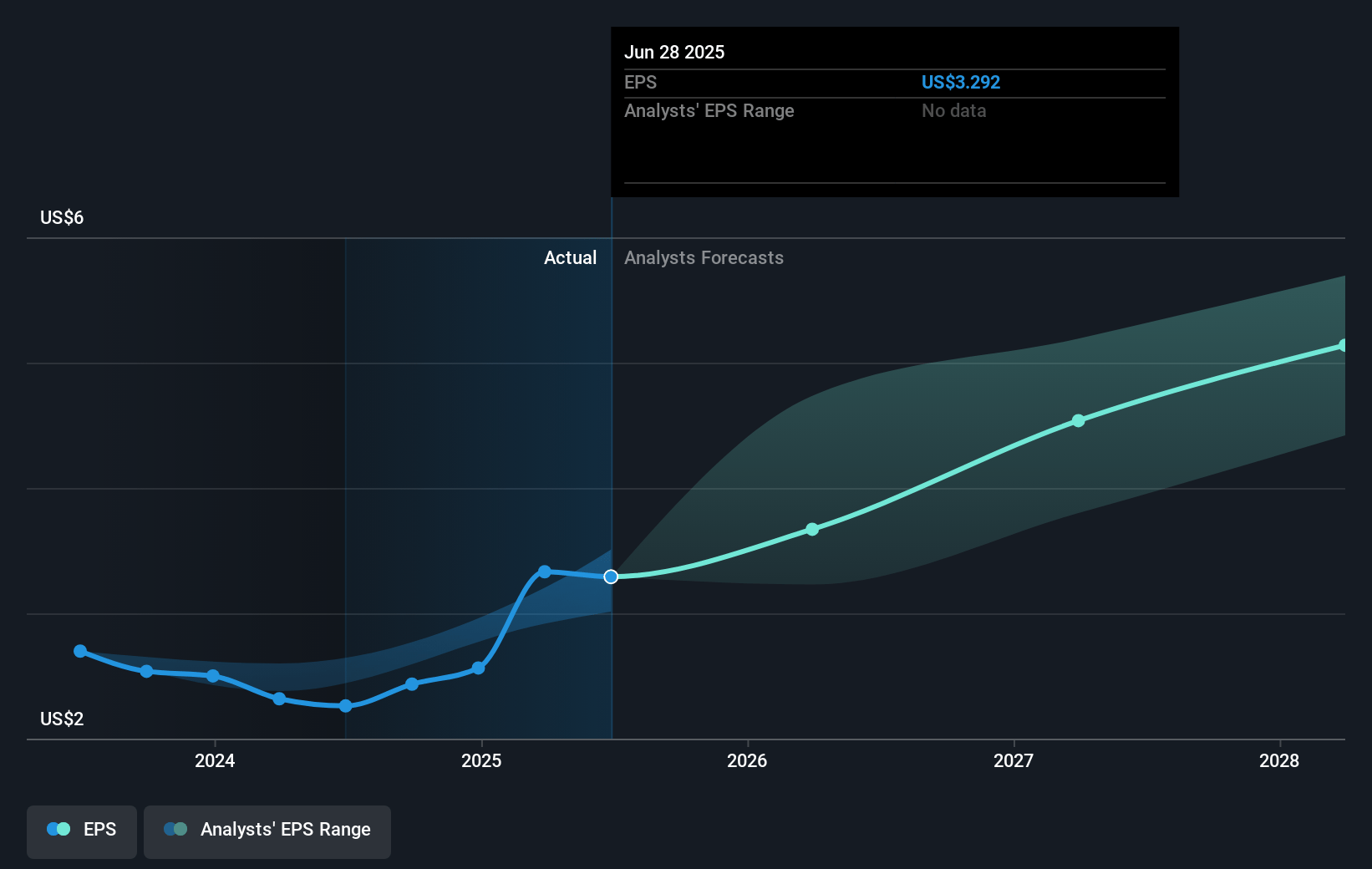

- The bullish analysts expect earnings to reach $273.5 million (and earnings per share of $5.49) by about May 2028, up from $130.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.4x on those 2028 earnings, up from 24.6x today. This future PE is lower than the current PE for the US Medical Equipment industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.81%, as per the Simply Wall St company report.

Haemonetics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global demographic shifts—including aging populations and low birth rates—could gradually reduce demand for blood donations and transfusion procedures, leading to lower long-term growth in Haemonetics’ core revenue streams from blood and plasma management.

- Industry-wide pressure from hospital consolidation and group purchasing organizations is likely to result in tougher negotiations on pricing and contract terms, compressing Haemonetics’ net margins as large customers exert greater bargaining power.

- Rising competition from lower-cost medical device manufacturers in emerging markets, as well as the structural shift towards personalized medicine and alternative therapies that reduce transfusion needs, pose a risk to long-term revenue growth and market share.

- Ongoing operational and integration challenges with recently acquired businesses, particularly with the underperformance of new products and the need to scale sales and clinical resources, threaten the company’s ability to unlock expected synergies, driving up expenses and pressuring overall earnings.

- Increasing regulatory scrutiny, localization pressures, and unfavorable reimbursement trends in key international markets such as China are already leading to persistent headwinds in global revenue growth and raise the risk of higher compliance and operational costs, negatively affecting net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Haemonetics is $120.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Haemonetics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $68.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $273.5 million, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 7.8%.

- Given the current share price of $63.58, the bullish analyst price target of $120.0 is 47.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.