Last Update08 May 25

Key Takeaways

- Strategic divestiture and focus on high-margin opportunities aim to enhance future revenue and margin expansion.

- Long-term agreements and technology adoption are set to boost market share and earnings through cost reductions and innovation.

- New competition and disruptions in vascular closure and challenges in Plasma and China markets may significantly impact Haemonetics' revenue growth and profitability.

Catalysts

About Haemonetics- A healthcare company, provides suite of medical products and solutions in the United States and internationally.

- The strategic divestiture of Haemonetics' Whole Blood business aligns resources towards higher-margin and higher-growth opportunities, which is expected to improve future revenue growth and margin expansion.

- Continued competition in the coronary and peripheral procedures affects Haemonetics’ small bore arterial closure growth. The company is taking steps to improve performance, expecting to positively impact future net margins with these changes.

- Signed long-term agreements with BioLife and Grifols to increase market share through the adoption of advanced technologies in plasma collections. This initiative will likely enhance revenue and earnings growth through technology-driven cost reductions.

- The introduction of VASCADE MVP XL aims to capitalize on emerging catheter-based ablation technologies and expand Haemonetics' share in left atrial appendage closure procedures. This shift could lead to revenue enhancement as electrophysiology market opportunities remain underpenetrated.

- Achieving leadership in blood management technologies and building a broader installed base of the TEG 6S devices point to sustainable revenue growth. Upgrades in device utilization could favorably impact future earnings through increased sales and operational efficiencies.

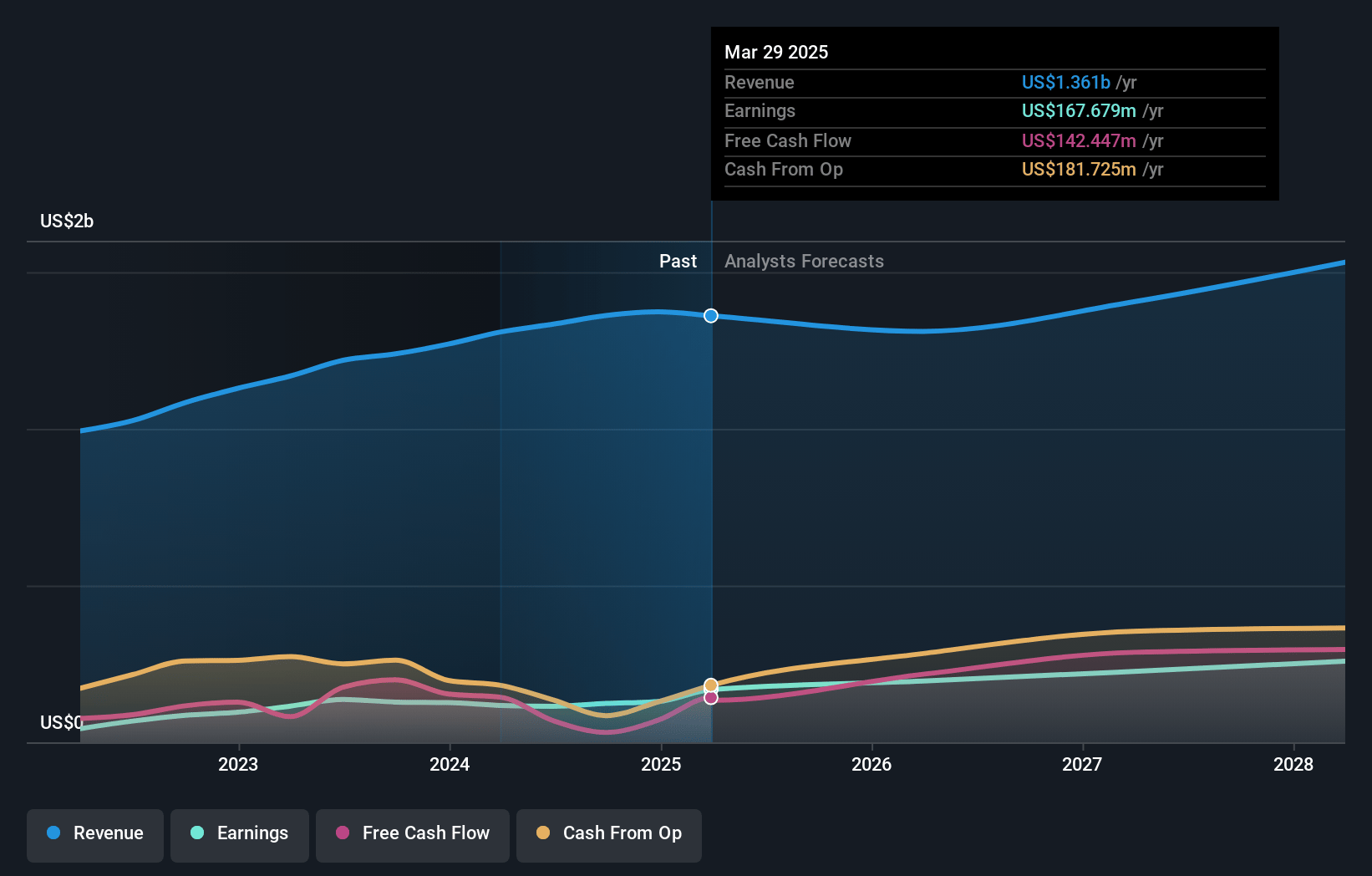

Haemonetics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Haemonetics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Haemonetics's revenue will grow by 6.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 9.5% today to 16.6% in 3 years time.

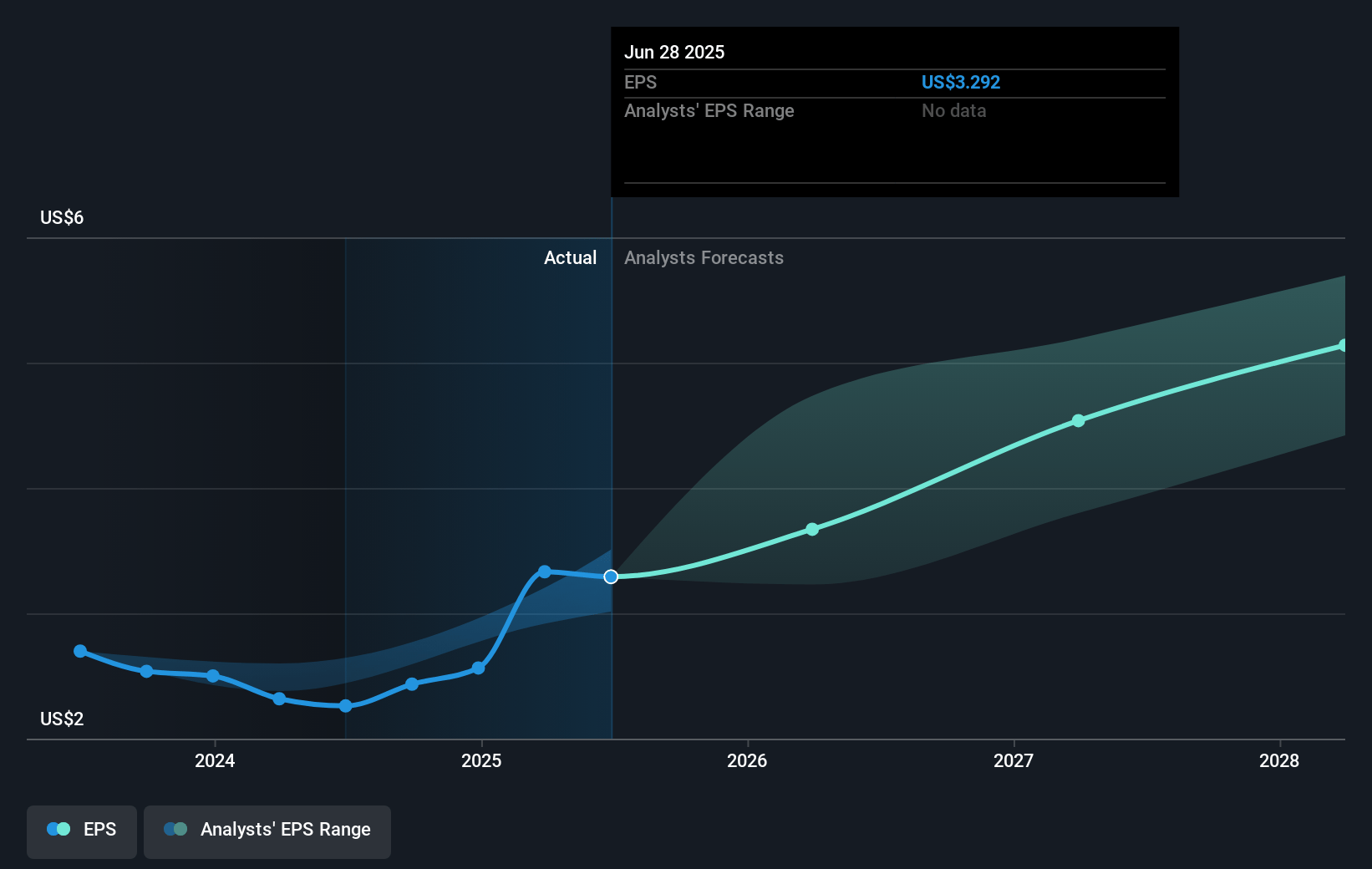

- The bearish analysts expect earnings to reach $273.5 million (and earnings per share of $5.49) by about May 2028, up from $130.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.9x on those 2028 earnings, down from 24.8x today. This future PE is lower than the current PE for the US Medical Equipment industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.8%, as per the Simply Wall St company report.

Haemonetics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The emergence of new competition and disruptive innovations in the vascular closure market, where VASCADE is facing increasing pressure, could negatively impact revenue growth and market share.

- Difficult market conditions in China, particularly reimbursement cutbacks in Hemostasis management, may continue to hamper revenue growth in this significant geography.

- The planned CSL transition significantly impacts plasma revenue, with anticipated declines of 5% to 7%, affecting both revenue and potentially earnings.

- The shortfall in meeting ambitious targets for Sensor Guided Technologies and esophageal cooling indicates challenges in realizing expected revenue and earning potential.

- The slow recovery in plasma collection volumes and transient external market disruptions could cause ongoing revenue volatility and affect the profitability of Haemonetics' plasma business.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Haemonetics is $68.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Haemonetics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $68.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $273.5 million, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 7.8%.

- Given the current share price of $64.25, the bearish analyst price target of $68.0 is 5.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.