Key Takeaways

- Persistent pricing pressure, data privacy concerns, and a limited addressable market threaten revenue growth and sustainable operating margins.

- Industry shifts toward non-invasive solutions and substantial investment needs may undermine sales volume, profitability, and long-term cash flow.

- Reliance on RNS sales, limited market expansion, regulatory hurdles, rising competition, and high operating costs threaten revenue growth and profitability timelines.

Catalysts

About NeuroPace- Operates as a medical device company in the United States.

- While NeuroPace is positioned to benefit from a rising prevalence of neurological disorders as the population ages, persistent pricing pressure from healthcare payers and governments may limit future reimbursement rates for neurostimulation devices, directly impacting the company's ability to sustain its current pace of revenue growth.

- Although the company's RNS System is strongly aligned with broader trends toward personalized, data-driven medicine and digital healthcare, mounting concerns around device data privacy and cybersecurity could introduce new regulatory hurdles, raising compliance costs and slowing the adoption rate, which would negatively affect operating margins over time.

- Despite impressive clinical data and anticipated label expansions into new indications, such as idiopathic generalized epilepsy and pediatrics, NeuroPace's addressable market for drug-resistant epilepsy may remain limited, and there is a growing risk that revenue growth will stagnate as high-adopter centers reach saturation.

- While strategic partnerships with leading hospital networks and pharmaceutical companies could help NeuroPace access broader markets and unlock value from its extensive long-term brain data, the accelerating shift in the industry toward non-invasive or wearable neurostimulation solutions may erode the value proposition of its implantable device platform, likely reducing sales volumes and weakening topline performance.

- Even with current momentum in gross margins and disciplined expense management, the company's ongoing need for substantial R&D and commercial investment-required to support pipeline growth, next-generation platforms, and expanding indications-could continue to keep NeuroPace from achieving profitability, pressuring net margin improvement and cash flow over the longer term.

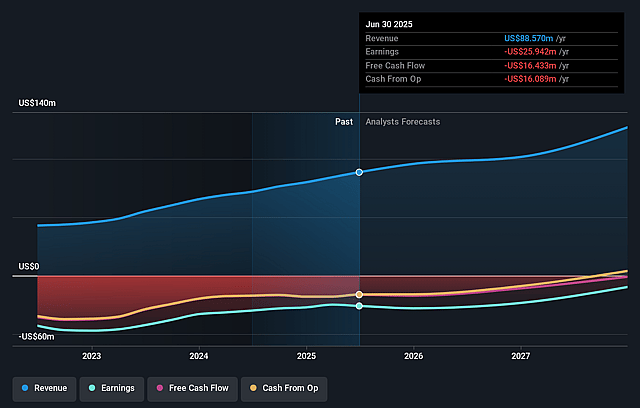

NeuroPace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NeuroPace compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NeuroPace's revenue will grow by 13.2% annually over the next 3 years.

- The bearish analysts are not forecasting that NeuroPace will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate NeuroPace's profit margin will increase from -29.3% to the average US Medical Equipment industry of 12.5% in 3 years.

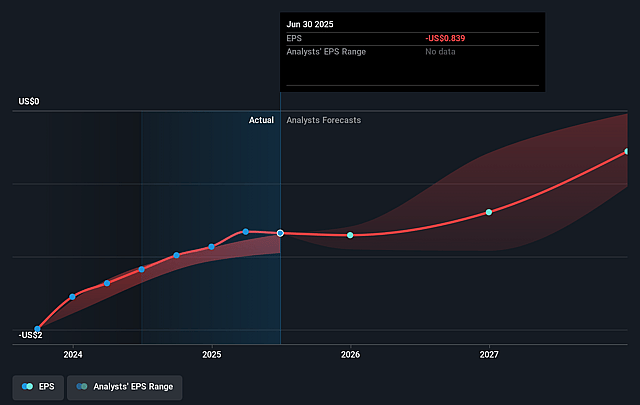

- If NeuroPace's profit margin were to converge on the industry average, you could expect earnings to reach $16.1 million (and earnings per share of $0.4) by about September 2028, up from $-25.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 40.8x on those 2028 earnings, up from -11.7x today. This future PE is greater than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.0%, as per the Simply Wall St company report.

NeuroPace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's long-term revenue growth will face pressure as the wind-down of DIXI Medical product sales removes a mid-teen percentage of 2024 and 2025 revenue, requiring accelerated growth in RNS sales to maintain top-line momentum and leaving overall revenue at risk of a near-term reset.

- NeuroPace's ability to achieve its multi-year growth targets depends on continued expansion in a relatively narrow addressable market segment; if adoption of the RNS system in drug-resistant epilepsy slows or saturates, or if penetration into new indications (such as idiopathic generalized epilepsy and pediatrics) is delayed due to regulatory or clinical hurdles, future revenue and earnings may not meet expectations.

- The company's strategy is highly dependent on successful and favorable regulatory review for label expansion, particularly for the NAUTILUS trial in IGE and the pediatric indication; should the FDA require new clinical trials, restrict approved populations, or delay approvals, projected revenue growth and gross margin improvement would be adversely affected.

- Competitive threats from both established neurostimulation device makers and emerging non-invasive or wearable neurotech solutions are rising; this could lead to pricing pressure, slowed adoption, and potential erosion in gross margin and earnings as hospitals and clinics gain more purchasing power.

- Persistent growth in operating expenses, including elevated R&D and sales and marketing investment needed to drive adoption and pipeline expansion, combined with only modest improvement in cash flow, may push out the timeline for reaching profitability and could negatively impact net margins if revenue growth lags projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NeuroPace is $13.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NeuroPace's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $128.6 million, earnings will come to $16.1 million, and it would be trading on a PE ratio of 40.8x, assuming you use a discount rate of 8.0%.

- Given the current share price of $9.14, the bearish analyst price target of $13.0 is 29.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.