Key Takeaways

- Accelerated adoption in epilepsy centers and new indications could rapidly expand NeuroPace's accessible market, driving sustained outperformance versus expectations.

- Proprietary EEG data and AI analytics are opening lucrative recurring revenue streams and supporting long-term margin improvement.

- Heavy dependence on a single invasive product exposes NeuroPace to adoption risks, competitive threats from non-invasive alternatives, pricing pressure, and uncertain future profitability.

Catalysts

About NeuroPace- Operates as a medical device company in the United States.

- Analyst consensus expects growth from expanding adoption in Level 4 epilepsy centers, but near-term results suggest this ramp could be faster and more durable than anticipated, as implant volumes and prescriber numbers keep hitting records, which positions the company for sustained revenue growth in excess of 20% and possibly above guidance.

- While analysts broadly point to Project CARE as a growth lever, recent center engagement and implant ramping indicate this program could create a step-function expansion in referrals and accessible market, potentially doubling the addressable implant base in the next two years and significantly outpacing consensus revenue expectations.

- The upcoming expansion of NeuroPace's RNS System into broader indications such as idiopathic generalized epilepsy and pediatrics-supported by exceptionally strong secondary endpoint results and an accelerated, collaborative FDA review-could unlock multiple new, high-value market segments, expanding the company's total addressable market by billions and accelerating top-line growth.

- NeuroPace's unique, proprietary long-term EEG dataset and advanced AI/analytics platform are increasingly attracting high-margin, recurring revenue opportunities via pharmaceutical and research partnerships, which could create an additional, underappreciated revenue stream and meaningfully lift gross margins and long-term operating leverage.

- The combination of global demographic shifts-resulting in a rising incidence of neurological disorders-and the increasing adoption of innovative, minimally invasive neurotechnologies, places the company at the center of a structural, multi-year demand surge, providing a runway for both sustained volume growth and premium pricing that drives revenue and net earnings expansion.

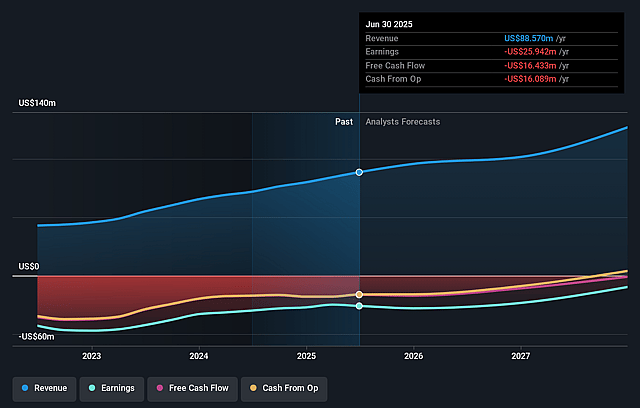

NeuroPace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NeuroPace compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NeuroPace's revenue will grow by 19.6% annually over the next 3 years.

- Even the bullish analysts are not forecasting that NeuroPace will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate NeuroPace's profit margin will increase from -29.3% to the average US Medical Equipment industry of 12.3% in 3 years.

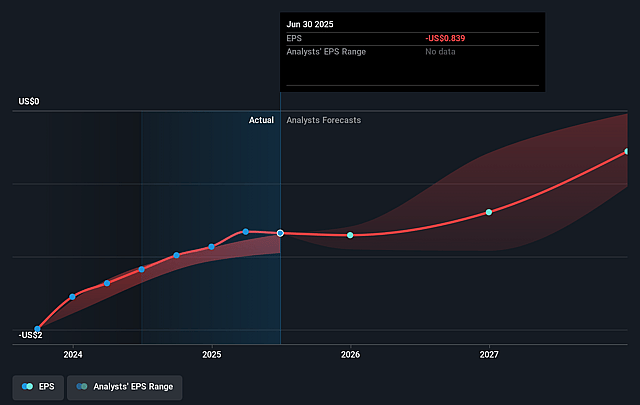

- If NeuroPace's profit margin were to converge on the industry average, you could expect earnings to reach $18.7 million (and earnings per share of $0.47) by about September 2028, up from $-25.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 53.8x on those 2028 earnings, up from -12.7x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

NeuroPace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NeuroPace remains heavily reliant on its core RNS System, with limited contribution from other products or revenue streams, which places the company at significant risk if physician adoption does not accelerate or if new clinical indications or major product updates are delayed, potentially impacting future revenue growth and leading to greater earnings volatility.

- The company's main growth engine depends on surgically implanted neurostimulators, while the medical device landscape is shifting toward non-invasive and digital health platforms; persistent secular movement toward less invasive neuromodulation and AI-powered wearable solutions could shrink the overall addressable market for RNS, ultimately dampening long-term revenue and pressuring margins.

- Reimbursement and pricing pressures loom large due to ongoing government scrutiny and cost-control measures in the U.S. and abroad; future cuts to CMS or private-payer reimbursement rates, especially as utilization increases and healthcare budgets tighten, could drive down average selling prices for RNS and reduce gross margins over time.

- While sales growth is currently robust, the company notes that Project CARE and broader community center adoption of RNS therapy can vary considerably in ramp speed and complexity, suggesting that slower-than-expected uptake by new or non-specialist centers could lead to a disappointing revenue ramp and risk failure to meet growth targets, thus missing the pathway to sustainable net profitability.

- Long-term industry trends indicate growing competition from better-capitalized medtech firms and rising regulatory hurdles for implanted neurostimulation therapies, which could lengthen approval timelines, inflate R&D and commercial costs without guaranteed sales success, and erode NeuroPace's share in a market increasingly favoring large-scale players, putting sustained operating margin improvement at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NeuroPace is $20.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NeuroPace's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $151.5 million, earnings will come to $18.7 million, and it would be trading on a PE ratio of 53.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of $9.97, the bullish analyst price target of $20.0 is 50.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.