Key Takeaways

- Expansion into international and underpenetrated markets, combined with ongoing product innovation, strengthens InMode’s position in the growing non-surgical aesthetic sector.

- Commitment to R&D and salesforce investment supports sustained growth and margin recovery as economic conditions and consumer confidence improve.

- Weak demand, regulatory pressures, and poor cost management are constraining profitability, while ineffective share buybacks have limited strategic flexibility and hindered earnings growth.

Catalysts

About InMode- Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States, Europe, Asia, and internationally.

- A rebound in consumer demand for minimally invasive aesthetic procedures as macroeconomic conditions and consumer confidence improve is anticipated to drive renewed growth in system sales and procedure volumes, significantly impacting top-line revenue and supporting robust long-term earnings.

- Continued expansion into international markets, including Europe and underpenetrated regions, positions InMode to benefit from broader global demand for non-surgical cosmetic treatments, boosting incremental revenue alongside improved operating leverage as scale in these markets increases.

- Launch of new platforms targeting the wellness segment and ongoing innovation within InMode’s product suite increases the company’s ability to capture a larger share of the growing market for elective, self-paid, and minimally invasive treatments, aiding both revenue growth and sustaining premium gross margins over time.

- The rising global focus on aesthetics and active lifestyles, combined with increased willingness among consumers to invest in elective procedures, is enlarging InMode’s total addressable market and enabling organic growth in both capital equipment sales and recurring consumable revenues, which disproportionately benefits long-term profitability because of the high-margin model.

- Strategic decisions to maintain investment in R&D, salesforce expansion, and new product development, even during industry downturns, position InMode for outsized market share gains and margin recovery as cyclical headwinds fade, allowing the company to translate secular demand trends into sustained earnings growth when normalized conditions return.

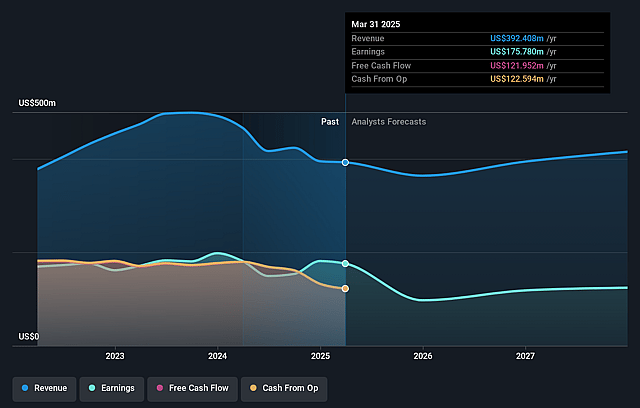

InMode Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on InMode compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming InMode's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 44.8% today to 32.3% in 3 years time.

- The bullish analysts expect earnings to reach $148.1 million (and earnings per share of $2.21) by about July 2028, down from $175.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, up from 5.2x today. This future PE is lower than the current PE for the US Medical Equipment industry at 31.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.09%, as per the Simply Wall St company report.

InMode Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged macroeconomic uncertainty and soft consumer demand, especially in the U.S. where elective aesthetic procedures are among the first to be reduced during slowdowns, is contributing to declining revenues and limiting earnings growth.

- InMode’s guidance and financial results indicate that new product launches have not generated significant momentum during the current downturn, underscoring the risk that increased innovation may not sufficiently offset slowing adoption or competitive market pressures, affecting both top-line growth and net margins.

- The company faces increased exposure to tariffs and regulatory uncertainty, with U.S. tariffs at 10% already projected to reduce gross margins by two to three percent, and lack of pricing power in the market constraining the ability to offset these cost headwinds, directly impacting profitability.

- Management’s decision to maintain a stable workforce and salesforce despite lower volumes is driving higher operating expenses relative to declining sales, further compressing operating margins and putting long-term pressure on earnings.

- Record share repurchase spending, totaling $508 million at prices significantly above the current share price, has failed to support stock value and has reduced flexibility for strategic moves such as acquisitions, weakening the company’s future prospects for capital allocation and potentially hampering earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for InMode is $24.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of InMode's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $458.0 million, earnings will come to $148.1 million, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 9.1%.

- Given the current share price of $14.41, the bullish analyst price target of $24.0 is 40.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.