Key Takeaways

- New wellness platform and likely regulatory clearances could unlock major, underserved medical markets, significantly expanding growth opportunities in devices and recurring revenue streams.

- Aggressive global expansion and shifting demographics are expected to drive sustained international growth, higher margins, and increasing profitability through premium product adoption and recurring sales.

- Regulatory delays, shifting procedure demand, persistent economic pressures, and intensifying competition threaten InMode's revenue growth, margin stability, and overall market position.

Catalysts

About InMode- Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States, Europe, Asia, and internationally.

- While analysts broadly agree the new wellness platform may bolster future revenue growth, they may be dramatically underestimating its transformative impact; with FDA clearance for erectile dysfunction and dry eye indications highly likely in the next year, InMode could break into two massive, underserved medical markets, driving an order-of-magnitude step-up in addressable market and device placements, which would fundamentally boost top-line revenue and recurring consumable sales.

- The analyst consensus expects international expansion to partially offset U.S. challenges, but the company's aggressive direct-sales buildout in high-growth emerging markets like Asia-Pacific and Latin America is likely to result in sustained double-digit international growth, rapidly shifting the geographic mix and driving substantially higher overall revenue, profitability, and operational leverage as these less-penetrated markets mature.

- InMode's high-margin, recurring consumables and disposables model is poised for accelerating expansion as younger, wellness-focused demographics and the aging population drive consistently higher procedure volumes per installed platform, which will gradually increase gross margins and expand operating income even during flat equipment cycles.

- The rapid professionalization and consolidation of med spas and clinics, combined with social media–driven demand for minimally and noninvasive procedures, is likely to create an upgrade cycle favoring premium, multi-modality platforms like InMode's, directly boosting average selling prices and net margins as value-driven buying intensifies.

- With $500 million in cash and industry-leading profitability, InMode is uniquely positioned to capitalize on any macro weakness through opportunistic acquisitions or accelerated R&D, which could accelerate product innovation and allow for outsized earnings growth and market share capture when industry conditions rebound.

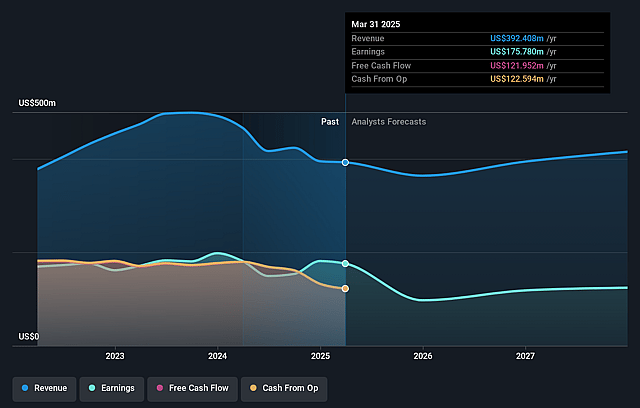

InMode Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on InMode compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming InMode's revenue will grow by 5.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 44.5% today to 26.4% in 3 years time.

- The bullish analysts expect earnings to reach $125.3 million (and earnings per share of $2.03) by about September 2028, down from $178.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.9x on those 2028 earnings, up from 5.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.23%, as per the Simply Wall St company report.

InMode Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and delays in FDA approvals for new platforms like those targeting erectile dysfunction and dry eye are slowing product launches, which is likely to impede future revenue growth and postpone recognition of related sales.

- Persistent macroeconomic headwinds and reduced discretionary spending in core U.S. markets are causing capital purchases by physicians to lag expectations for consecutive quarters, posing a long-term risk to sustained revenue and earning stability if these trends continue.

- The growing shift in demand from minimally invasive, higher-priced procedures towards more commoditized and lower-revenue noninvasive treatments is likely to compress overall average selling prices and ultimately put pressure on gross margins and total earnings.

- Ongoing reliance on initial device sales rather than recurring consumable revenue exposes InMode to volatility; with signs that the number of procedures is plateauing, this could hurt both revenue predictability and net margins, especially if new hardware demand wanes.

- Heightening competition from peers with approved or pending competing technologies, especially as patent protections evolve and non-device alternatives emerge, could force InMode to lower prices, increase marketing and R&D spend, or lose market share, negatively impacting both revenue growth and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for InMode is $21.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of InMode's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $474.5 million, earnings will come to $125.3 million, and it would be trading on a PE ratio of 10.9x, assuming you use a discount rate of 9.2%.

- Given the current share price of $15.07, the bullish analyst price target of $21.0 is 28.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.