Key Takeaways

- Demographic shifts, regulatory hurdles, and cost-containment trends threaten InMode's market size, earnings predictability, and sustainable revenue growth.

- Heavy reliance on device sales and rising competition amplify earnings volatility, margin pressure, and risks tied to international expansion and distributor performance.

- International expansion, product innovation, and strong margins support profitability and growth, while ongoing R&D investment positions InMode for long-term market leadership despite economic headwinds.

Catalysts

About InMode- Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States, Europe, Asia, and internationally.

- Global demographic shifts, including declining birth rates and rapidly aging populations in many developed markets, could significantly dampen the long-term growth trajectory for elective aesthetic procedures, directly limiting InMode's addressable market and putting sustained pressure on revenue growth.

- Ongoing regulatory scrutiny and the tightening of medical device approvals-especially delays in securing key FDA indications for new platforms such as the erectile dysfunction and dry eye segments-risk delaying or diminishing the revenue contribution from new launches, while increasing compliance costs and compressing margins.

- The move toward value-based care and escalating cost-containment measures from governments and insurers threaten to reduce procedural volumes for aesthetic treatments, particularly those not deemed medically necessary, resulting in softer demand and lower utilization rates that weaken both revenue and earnings predictability.

- Intensifying competition from both incumbent medtech firms and new entrants, particularly in the noninvasive and office-based device space, can erode InMode's pricing power and force higher R&D outlays just to maintain share, resulting in long-term margin compression and dampened net profits.

- InMode's persistent dependence on device sales, with only minimal growth in recurring revenue from consumables or services, creates pronounced earnings cyclicality; this cyclical revenue base, combined with international expansion risks and uncertain distributor performance, undermines the company's ability to deliver stable, growing earnings over the long run.

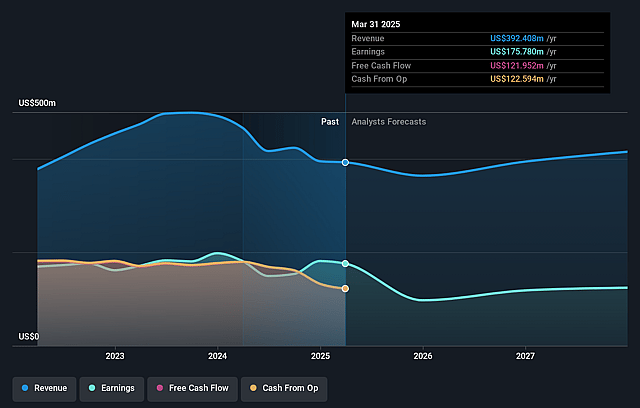

InMode Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on InMode compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming InMode's revenue will decrease by 1.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 44.5% today to 21.5% in 3 years time.

- The bearish analysts expect earnings to reach $82.6 million (and earnings per share of $1.27) by about September 2028, down from $178.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 5.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.23%, as per the Simply Wall St company report.

InMode Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained international expansion into new markets such as Thailand and Argentina, along with strong record performance in Europe, could offset North American weakness and drive top-line revenue growth over the long term.

- Continued innovation, including new product launches in the noninvasive space (e.g., OptimasMAX and Envision platforms), and upcoming products addressing emerging markets like urology and ophthalmology, can create new recurring revenue streams and support gross margin stability.

- Industry-leading GAAP gross margins of 80 percent and a diversified suite of minimally invasive and noninvasive platforms signal robust product differentiation, which strongly supports profitability and earnings resilience even during market downturns.

- Despite a challenging macroeconomic environment, InMode's significant cash reserves of over $510 million, ongoing share buybacks, and willingness to consider dividends or acquisitions provide financial flexibility to weather temporary headwinds and invest for growth, which could underpin future net income and share price appreciation.

- Management's strategy to maintain investment in R&D, sales, and global footprint-rather than cutting costs during cyclical downturns-positions the company well to capture growth as the broader aesthetic and wellness market rebounds, positively impacting future revenue and earnings momentum.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for InMode is $14.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of InMode's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $384.3 million, earnings will come to $82.6 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 9.2%.

- Given the current share price of $15.02, the bearish analyst price target of $14.0 is 7.3% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.