Key Takeaways

- Strategic expansion in emerging and European markets, along with new product launches, diversifies revenue and supports global growth.

- Focus on minimally invasive treatments and strong marketing boosts demand, market penetration, and maintains high profit margins.

- Challenges from weak demand, regulatory delays, tariff pressures, rising expenses, and a shift toward lower-margin treatments threaten profitability and limit long-term growth prospects.

Catalysts

About InMode- Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States, Europe, Asia, and internationally.

- Expansion of direct operations in emerging international markets like Thailand and Argentina, along with a rapidly growing European presence, is expected to drive continued growth in non-U.S. sales, leveraging increasing access to healthcare and higher disposable incomes globally to boost revenue and diversify geographic risk.

- Launch of new platforms targeting underpenetrated end markets such as urology (blood circulation and pain relief) and ophthalmology (Envision for dry eye and facial rejuvenation) positions InMode to capture demand from the broader adoption of aesthetic and wellness procedures, opening new revenue streams and supporting future top-line growth.

- Sustained consumer focus on minimally invasive and non-invasive aesthetic treatments, amplified by social media and wellness trends, continues to expand the addressable market, reinforcing demand for InMode's upgraded device portfolio and supporting unit volume growth and recurring consumables revenue.

- Ongoing investment in specialized sales teams and marketing, especially for new product categories and direct international expansion, improves market penetration and strengthens customer relationships, which is likely to support both near-term and long-term revenue and margin expansion.

- Maintenance of industry-leading gross margins (80%) despite macroeconomic headwinds, enabled by a high-margin consumables model and operational scalability, underpins robust earnings and free cash flow generation as demand recovers and new platforms gain traction.

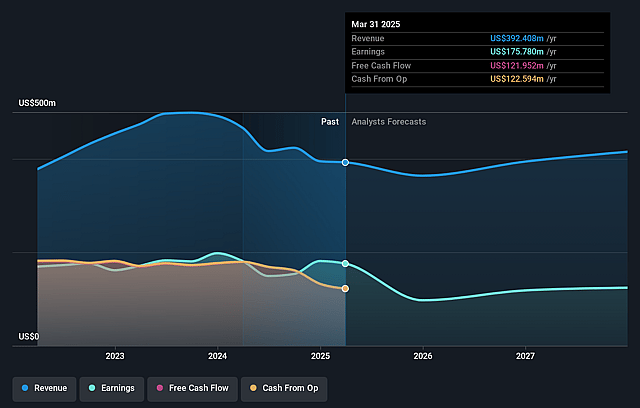

InMode Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming InMode's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 44.5% today to 23.0% in 3 years time.

- Analysts expect earnings to reach $94.2 million (and earnings per share of $1.75) by about September 2028, down from $178.7 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $139 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, up from 5.1x today. This future PE is lower than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.33%, as per the Simply Wall St company report.

InMode Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged macroeconomic headwinds and reduced consumer discretionary spending, especially in the U.S., are suppressing demand for capital equipment purchases and minimally invasive aesthetic procedures, raising the risk of continued revenue shortfalls versus prior expectations.

- Persistent regulatory hurdles and lack of FDA indications for key new product launches in urology and ophthalmology (e.g., erectile dysfunction, dry eye treatments) could delay or limit access to new growth markets, constraining future revenue and earnings expansion.

- Heightened exposure to U.S. import tariffs (currently at 10%, with a potential to rise), threatens to erode gross margins by 2–3% annually, putting pressure on profitability unless offset by price increases or cost reductions.

- Rising sales and marketing expenses-up 9% year-over-year due to continued investments in direct sales force and expansion into new countries-may outpace revenue growth during flat or declining markets, compressing net margins and operating leverage if sales do not accelerate as anticipated.

- Shifts in procedural trends, with noninvasive treatments (lower-priced and lower-margin) gaining share at the expense of higher-priced, minimally invasive procedures, could dilute overall revenue per procedure and compress long-term earnings potential if the trend persists.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.25 for InMode based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $409.0 million, earnings will come to $94.2 million, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 9.3%.

- Given the current share price of $14.51, the analyst price target of $16.25 is 10.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.