Key Takeaways

- Demographic shifts and economic pressures are shrinking the addressable market, suppressing demand for premium diagnostics, and limiting revenue and margin growth.

- Rising competition, market saturation, and regulatory hurdles could erode pricing power, slow recurring sales, and increase costs, challenging the company's profitable growth model.

- Innovation-led diagnostic adoption, international expansion, and growth of recurring software revenue are driving robust margins, high customer retention, and diversified long-term earnings.

Catalysts

About IDEXX Laboratories- Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

- Demographic changes in developed countries, including declining pet ownership rates due to urbanization and rising living costs, could drive a sustained reduction in IDEXX Laboratories' addressable market, resulting in long-term pressure on overall revenue growth.

- Persistently weak clinic visit volumes in the U.S., highlighted by a 2.5% quarterly decline in same-store clinical visits, may become the norm as economic pressures and shifting consumer priorities make pet owners more price sensitive, suppressing adoption of higher-margin diagnostics and reducing both revenue and net margins over time.

- Heightened competition from low-cost diagnostic providers and digital-first startups threatens to erode IDEXX's premium pricing power; this could force repeated price concessions in contract renewals, leading to compression of gross margins and lower overall earnings.

- As IDEXX's installed base of diagnostic instruments matures and core markets approach saturation, recurring consumable sales growth is likely to slow and replacement cycles may lengthen, capping recurring revenue growth and undermining the company's high-return consumables model.

- Increasing regulatory scrutiny over animal healthcare and tightening data privacy requirements will likely raise compliance costs and slow IDEXX's pace of innovation, resulting in higher operating expenses and a reduced ability to maintain historical levels of net income growth.

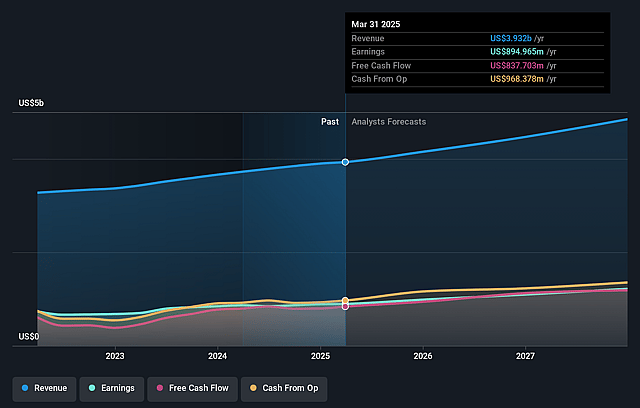

IDEXX Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on IDEXX Laboratories compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming IDEXX Laboratories's revenue will grow by 7.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 24.4% today to 25.1% in 3 years time.

- The bearish analysts expect earnings to reach $1.3 billion (and earnings per share of $15.94) by about September 2028, up from $985.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 35.9x on those 2028 earnings, down from 51.8x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to decline by 2.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

IDEXX Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IDEXX is experiencing significant momentum from innovation and high adoption rates of new diagnostic platforms such as inVue Dx and Catalyst specialty tests, driving double-digit growth in premium instrument placements and consumables, which supports strong recurring revenue and gross margin expansion, ultimately bolstering earnings.

- The company is posting rapid international growth, with double-digit recurring revenue gains outside the United States for ten consecutive quarters, indicating a long runway for market penetration and revenue diversification across geographies, reducing reliance on any single region for consolidated revenue growth.

- IDEXX's strategy to expand its high-margin, subscription-based software and cloud-native solutions, such as ezyVet, Neo, and Vello, is resulting in strong double-digit installed base growth, increasing recurring software and diagnostic engagement, which should positively affect net margins and topline revenue in the long term.

- Customer retention remains in the high 90% range across diagnostic modalities, with increasing integration of new products (like Cancer Dx and innovative testing panels) deepening client relationships and increasing utilization per account, supporting a stable and growing earnings base.

- Management is making focused commercial investments to expand sales reach in both the U.S. and international markets, strengthening IDEXX's position as the partner of choice for new and existing veterinary practices; this investment is driving both near-term volume gains and supporting long-term recurring revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for IDEXX Laboratories is $497.21, which represents two standard deviations below the consensus price target of $695.09. This valuation is based on what can be assumed as the expectations of IDEXX Laboratories's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $785.0, and the most bearish reporting a price target of just $420.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.1 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 35.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of $637.95, the bearish analyst price target of $497.21 is 28.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.