Key Takeaways

- Strong adoption of innovative diagnostics and software ecosystem is accelerating recurring revenue growth, margin expansion, and customer retention beyond expectations.

- International growth and industry leadership in AI-enabled preventive care position the company to substantially expand its addressable market and gain operating leverage.

- Shifting market dynamics, increased competition, regulatory risks, and evolving care models threaten IDEXX's premium pricing, recurring revenue streams, and long-term earnings growth.

Catalysts

About IDEXX Laboratories- Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

- Analyst consensus expects a strong impact from the IDEXX Cancer Dx launch, but this likely dramatically understates the long-term recurring revenue potential as the test menu expands beyond lymphoma and is incorporated broadly into standard wellness panels, driving not only much higher reference lab volumes but also expanding IDEXX's share of wallet at both independent and corporate accounts.

- While inVue Dx is expected by analysts to significantly drive placements and consumables growth, current adoption rates, highly positive customer feedback, and rapid expansion of testing categories such as FNA suggest a faster ramp and larger installed base than anticipated, which will create an outsized and accelerating impact on both recurring revenues and long-term gross margins.

- The company's investments to further densify international sales coverage and physical infrastructure are occurring at a point when emerging market pet ownership and willingness to pay for diagnostics are inflecting upwards, implying international CAG growth could soon exceed U.S. rates-substantially expanding total addressable market and operating leverage for IDEXX over the next decade.

- Highly successful integration and rapid uptake of cloud-native practice management software, diagnostic imaging, and pet-owner engagement tools are creating a deeply embedded ecosystem, dramatically increasing customer stickiness and ARPU, and positioning IDEXX to win share as veterinary practice consolidation accelerates, all supporting higher-margin, recurring software revenue growth that is not yet fully reflected in consensus.

- IDEXX's unique integration of point-of-care AI-enabled diagnostics and proprietary data analytics positions it as the dominant provider as the industry moves toward predictive, preventive animal health care, capturing the long tail of routine and specialized tests, boosting diagnostic frequency per visit and enabling structurally higher net margins through both innovation and operational scale.

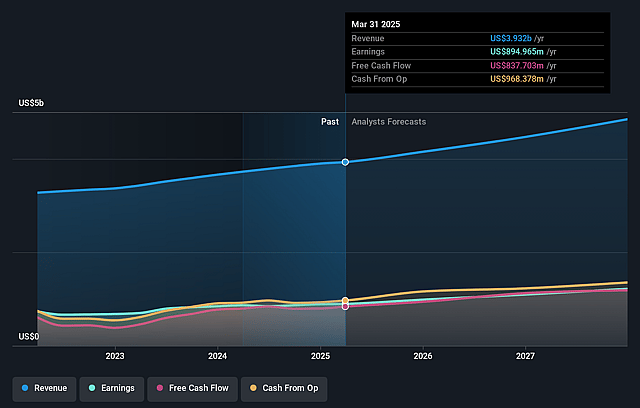

IDEXX Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on IDEXX Laboratories compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming IDEXX Laboratories's revenue will grow by 9.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 24.4% today to 25.8% in 3 years time.

- The bullish analysts expect earnings to reach $1.4 billion (and earnings per share of $17.81) by about September 2028, up from $985.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 52.4x on those 2028 earnings, down from 53.2x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to decline by 2.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

IDEXX Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent declines in U.S. same-store clinical visits, as highlighted by the 2.5% drop in the recent quarter, signal that economic or sector pressures may limit the addressable market for IDEXX's advanced diagnostics, ultimately constraining recurring revenue growth.

- Rising adoption of cost-conscious and value-based veterinary care models could limit discretionary spending on IDEXX's premium diagnostic products and consumables, restricting the company's ability to sustain its net margin expansion and premium pricing over the long term.

- Heightened competition from both emerging diagnostic startups and larger diversified healthcare companies, coupled with ongoing product launches by rivals, poses a threat to IDEXX's market share and may exert downward pressure on revenue and gross margins.

- The company's heavy reliance on proprietary platforms and bundled consumables could be at risk if future regulations demand open-system compatibility, which would undercut IDEXX's recurring consumables revenue stream and negatively affect net margins.

- Advances in automation and AI in diagnostic testing, including those utilized by IDEXX itself, may accelerate commoditization in the industry, leading to price compression and making it more difficult for IDEXX to sustain its historical earnings growth and premium gross margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for IDEXX Laboratories is $785.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IDEXX Laboratories's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $785.0, and the most bearish reporting a price target of just $420.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.3 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 52.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of $655.6, the bullish analyst price target of $785.0 is 16.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.