Last Update 02 Dec 25

IDXX: Recent Performance and Pipeline Progress Will Support Long-Term Shareholder Value

The average analyst price target for IDEXX Laboratories has been raised, reflecting a series of upward revisions. Several targets now surpass $750, as analysts cite stronger-than-expected Q3 results and a constructive outlook on growth, innovation, and recurring revenues.

Analyst Commentary

Recent analyst commentary on IDEXX Laboratories presents a blend of optimism about the company's prospects and caution regarding its valuation and future growth trajectory.

Bullish Takeaways- Several bullish analysts have increased their price targets, now surpassing $750, citing a strong third quarter and raised guidance for 2025.

- There is increased conviction in IDEXX's long-term growth potential, supported by a robust innovation pipeline that is considered one of the most compelling in the company's history.

- The company's strong execution in both U.S. and international recurring diagnostic businesses highlights a large market opportunity and the ability to capitalize on it through effective growth levers.

- Recurring revenues, especially from Companion Animal Group diagnostics, are expected to accelerate over the next few years, aided by resilient visit volumes and the strengthening “IDEXX premium.”

- Some cautious analysts maintain neutral ratings, noting that while performance was impressive in the latest quarter, current stock valuation may already reflect much of this recent strength.

- Concerns have been raised about the stock trading at a significant premium to earnings estimates, suggesting that future outperformance may be needed to justify present multiples.

- Although macroeconomic conditions are showing modest improvement, risks remain that could temper near-term growth expectations.

- There is a view that while current trends are robust, a step-down in price realization could limit upside in certain recurring revenue streams over the longer term.

What's in the News

- Completed a repurchase of 411,180 shares, representing 0.51% of outstanding shares, for $241.57 million between July 1 and September 30, 2025. The total buyback since August 1999 now stands at 73,923,960 shares, or 61.91% of shares, for $7.70 billion (Key Developments).

- Raised 2025 financial guidance: revenue is now expected to be between $4,270 million and $4,300 million, up from the previous range of $4,205 million to $4,280 million (Key Developments).

- The company anticipates reported revenue growth between 9.6% and 10.3%, an increase from the earlier forecast of 7.7% to 9.7% (Key Developments).

- Projected 2025 EPS has been revised upward to $12.81–$13.01, from prior guidance of $12.40–$12.76, with reported EPS growth now estimated at 20% to 22% (Key Developments).

Valuation Changes

- Fair Value Estimate remains essentially unchanged and stays at $754.83 per share.

- Discount Rate has risen slightly, moving from 7.72% to 7.74%.

- Revenue Growth projection is nearly flat, with a minor decrease from 9.20% to 9.20%.

- Net Profit Margin shows a negligible uptick and increases from 25.47% to 25.48%.

- Future P/E Ratio is up marginally, rising from 51.19x to 51.22x.

Key Takeaways

- Expansion in innovative diagnostic platforms and international markets is driving recurring revenue growth, margin expansion, and enhanced geographic diversification.

- Strong customer retention and broader adoption of cloud solutions create stable, high-margin revenue streams and position the company for sustained long-term earnings growth.

- Slowing U.S. clinical visit growth, international adoption challenges, reliance on instrument placements, rising competition, and price sensitivity all threaten IDEXX's long-term revenue and margin prospects.

Catalysts

About IDEXX Laboratories- Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

- Rapid adoption of innovative diagnostic platforms such as inVue Dx, Catalyst Cortisol, and Cancer Dx are expanding IDEXX's addressable market and boosting recurring consumables demand, which is likely to drive sustained revenue and margin growth as new product usage ramps and menu breadth increases.

- Expansion of commercial investments in underpenetrated international markets-combined with localization strategies and tailored product offerings-is fueling double-digit recurring diagnostic revenue growth outside North America, providing geographic diversification and supporting long-term top-line growth.

- Increasing utilization rates of advanced diagnostics per clinical visit, supported by pet owners' willingness to spend on preventive and early detection care for an aging pet population, are driving higher diagnostic frequency and supporting recurring revenue and net margin expansion.

- Broader adoption and enhancement of cloud-based practice management and analytics solutions is strengthening customer retention, raising multi-product utilization, and increasing customer lifetime value, translating to improved recurring revenue and net margins.

- High customer retention and growing installed base of premium instruments provide IDEXX with stable, high-margin recurring revenue streams, positioning the company to compound earnings growth over time as industry consolidation and elevated care standards continue.

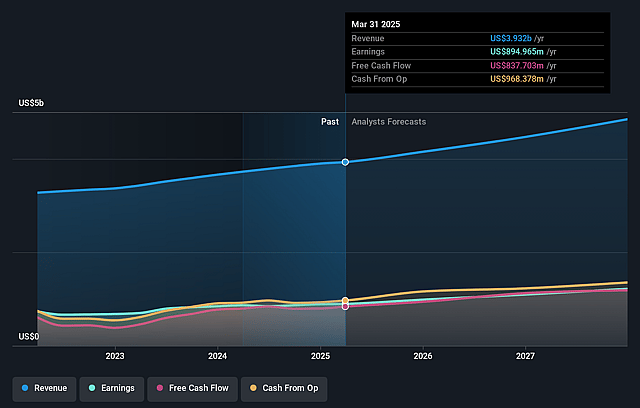

IDEXX Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IDEXX Laboratories's revenue will grow by 8.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.4% today to 25.3% in 3 years time.

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $16.93) by about September 2028, up from $985.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.5x on those 2028 earnings, down from 53.2x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to decline by 2.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

IDEXX Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained declines in U.S. clinical visit growth (down 2.5% in the quarter and forecasted to remain soft) suggest that underlying veterinary visit frequency is under pressure and could limit CAG Diagnostic recurring revenue growth over the long term, directly impacting revenue and earnings resilience.

- International markets, while delivering strong growth now, are described as "more embryonic" and dependent on expanding diagnostic use among smaller clinics; slower adoption or inability to replicate U.S.-style diagnostic penetration may temper future global revenue expansion and earnings diversification.

- The consumables revenue surge is highly linked to rapid instrument placements (notably inVue Dx); if future instrument placement growth slows or installed base saturation is reached (implied by management's expectation of a relative slowdown in 2H placements compared to 2Q), recurring consumable revenue growth and margin improvements could decelerate, affecting long-term net margins.

- Intensifying competition, including from new entrants and disruptive startups targeting point-of-care and specialty diagnostics, is acknowledged as ongoing; any failure to maintain IDEXX's innovation pace or if competitors introduce faster/cheaper solutions could erode pricing power and market share, negatively impacting both revenue growth and net margins.

- Heavy reliance on price increases for recent revenue gains (e.g., 4%+ global net price realization), combined with macroeconomic pressures, regulatory risk, and the possibility of large veterinarian groups negotiating lower prices, could squeeze long-term operating margins and restrict IDEXX's ability to sustain high earnings growth rates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $695.091 for IDEXX Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $785.0, and the most bearish reporting a price target of just $420.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 48.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of $655.6, the analyst price target of $695.09 is 5.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on IDEXX Laboratories?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.