Last Update30 Apr 25Fair value Increased 0.86%

Key Takeaways

- Launches of advanced diagnostics platforms, software integration, and focus on preventive care are strengthening recurring revenue streams and deepening clinic relationships for long-term growth.

- Global expansion and increased pet healthcare spending, especially in emerging markets, are driving revenue diversification and enhancing margin stability through geographic spread.

- Persistent clinic traffic declines, rising expenses, and tightening price sensitivity threaten IDEXX’s recurring revenue growth amid intensifying competition and regulatory, macroeconomic, and international expansion risks.

Catalysts

About IDEXX Laboratories- Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

- The rapid uptake of groundbreaking diagnostics platforms such as IDEXX inVue Dx and the expansion of advanced oncology screening panels like Cancer Dx are expected to materially raise global diagnostic utilization rates in clinics, driving recurring revenue growth and expanding IDEXX’s share of a rising addressable market.

- Increased pet ownership and the ongoing humanization of pets worldwide, fueled by rising global middle-class wealth especially in emerging markets, are set to translate into sustained growth in veterinary care spending, supporting international revenue diversification and lessening reliance on mature North American markets.

- Double-digit growth in the international premium instrument installed base, together with strengthened commercial operations in Europe and Asia Pacific, is likely to accelerate adoption of consumables and recurring services, resulting in robust top-line revenue gains and improved margin stability due to geographic diversification.

- Strategic investments and innovation in cloud-based veterinary software solutions, such as Vello and cloud-native PIMS, are deepening clinic integration and customer lock-in, which increases the proportion of high-margin, recurring software revenue and supports ongoing net margin expansion.

- IDEXX’s leadership in preventive care diagnostics, along with expanding test menus and workflow-optimizing platform updates, positions the company to capture incremental testing volumes from a long-term industry shift toward proactive and early disease detection, driving both revenue and earnings growth above current market expectations.

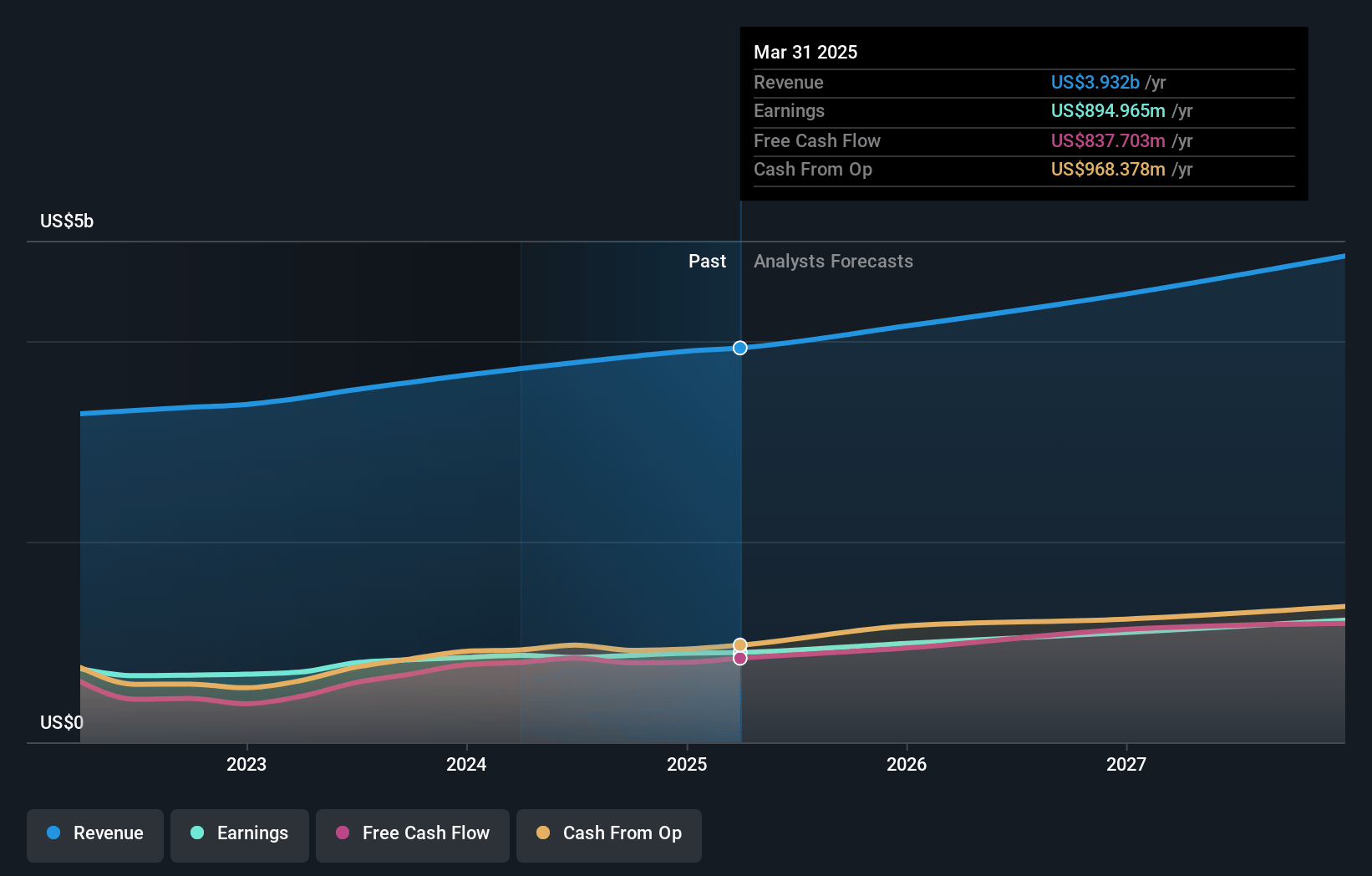

IDEXX Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on IDEXX Laboratories compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming IDEXX Laboratories's revenue will grow by 7.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 22.8% today to 25.2% in 3 years time.

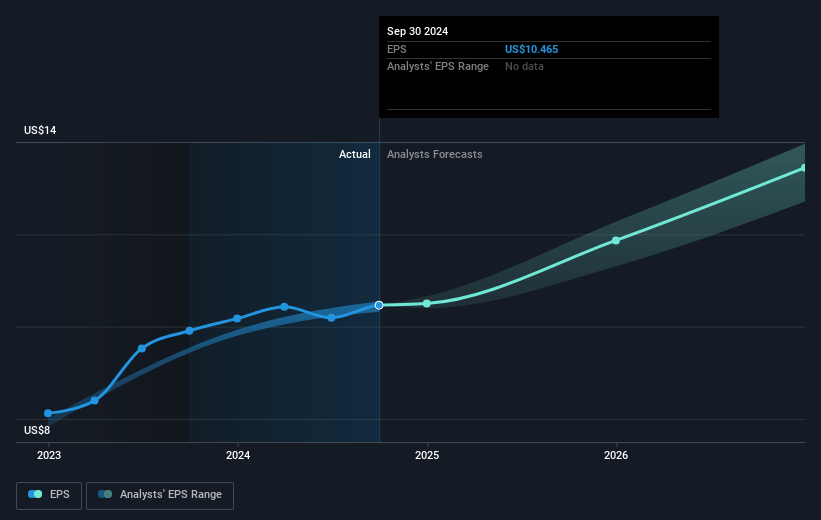

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $15.57) by about April 2028, up from $887.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 43.6x on those 2028 earnings, up from 39.9x today. This future PE is greater than the current PE for the US Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to decline by 1.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.95%, as per the Simply Wall St company report.

IDEXX Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent declines in U.S. same-store veterinary clinic visit growth, cited as down about two to three percent in 2024 with no expected improvement in 2025, could signal longer-term demand stagnation caused by macroeconomic pressures or changes in pet ownership, directly threatening IDEXX’s recurring revenue growth.

- Rising R&D and operational expenses, which IDEXX management noted are increasing to support new innovation initiatives like inVue Dx and Cancer Dx, could strain net margins if revenue growth slows or remains pressured by market headwinds and increased competition.

- Heightened scrutiny of healthcare costs and price sensitivity among pet owners, evidenced by sharper declines in wellness visits and growing concerns about consumer ability to absorb price hikes, could limit IDEXX’s pricing power and slow revenue growth at a time when the company depends on 4 to 4.5 percent net price realization.

- Expansion of open, non-proprietary, or lower-cost diagnostic platforms by competitors and potential shifts in clinic preferences could erode IDEXX’s market share and margin profile, particularly given the company’s heavy reliance on recurring consumable and reagent revenue from a proprietary installed base.

- Regulatory and macroeconomic uncertainties, including international expansion risks, potential new tariffs, data privacy challenges, and foreign exchange headwinds (with effects noted as a two percent expected negative impact on 2025 revenue), could undermine both IDEXX’s revenue and operating profit growth as it increases reliance on global markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for IDEXX Laboratories is $566.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IDEXX Laboratories's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $566.0, and the most bearish reporting a price target of just $385.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 43.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of $436.97, the bullish analyst price target of $566.0 is 22.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.