Key Takeaways

- Regulatory shifts and long-term outsourcing trends are boosting demand for Certara's biosimulation and data-driven modeling solutions, supporting recurring revenue growth and market expansion.

- Strategic acquisitions, AI integration, and expanding cloud-based offerings are differentiating Certara's platform, improving margins, and enhancing client value and retention.

- Regulatory uncertainty, cautious pharma clients, a challenging market environment, rising R&D costs, and growing competition threaten Certara's revenue growth, margins, and earnings stability.

Catalysts

About Certara- Provides technology-enabled services and software products for biosimulation in drug discovery, preclinical and clinical research, regulatory submissions, and market access in the United States and internationally.

- The FDA's recent commitment to phasing out animal testing in preclinical drug development is accelerating widespread customer interest in Certara's biosimulation and QSP modeling platforms-this regulatory shift is expected to materially increase adoption of Certara software and services, driving higher bookings, recurring revenues, and future revenue growth.

- The increasing integration of AI, including new software releases like "co-author" and continued R&D investment to enhance next-generation biosimulation and data-driven modeling, is expected to further differentiate Certara's offerings, elevate client value, and improve net margins over time as software penetration increases in a high-margin SaaS model.

- Broad customer engagement (ranging from large pharma to biotechs and even government agencies) in response to evolving regulatory requirements signals expanding market adoption, which, combined with growing uptake of cloud-based and hosted solutions, is likely to support recurring revenue growth and improve software subscription retention rates.

- Recent and ongoing strategic acquisitions (e.g., Chemaxon and Applied Biomass) and integration efforts are expanding Certara's capabilities across discovery, preclinical, and clinical phases, enabling cross-selling and diversification that lessens revenue volatility and enhances both top-line growth and EBITDA margins.

- Sustained long-term outsourcing trends in pharmaceutical R&D, alongside expanding use of precision medicine, are increasing the need for advanced modeling and pharmacometrics solutions-Certara is poised to capture greater share of this growing addressable market, positively impacting future revenue and long-term earnings.

Certara Future Earnings and Revenue Growth

Assumptions

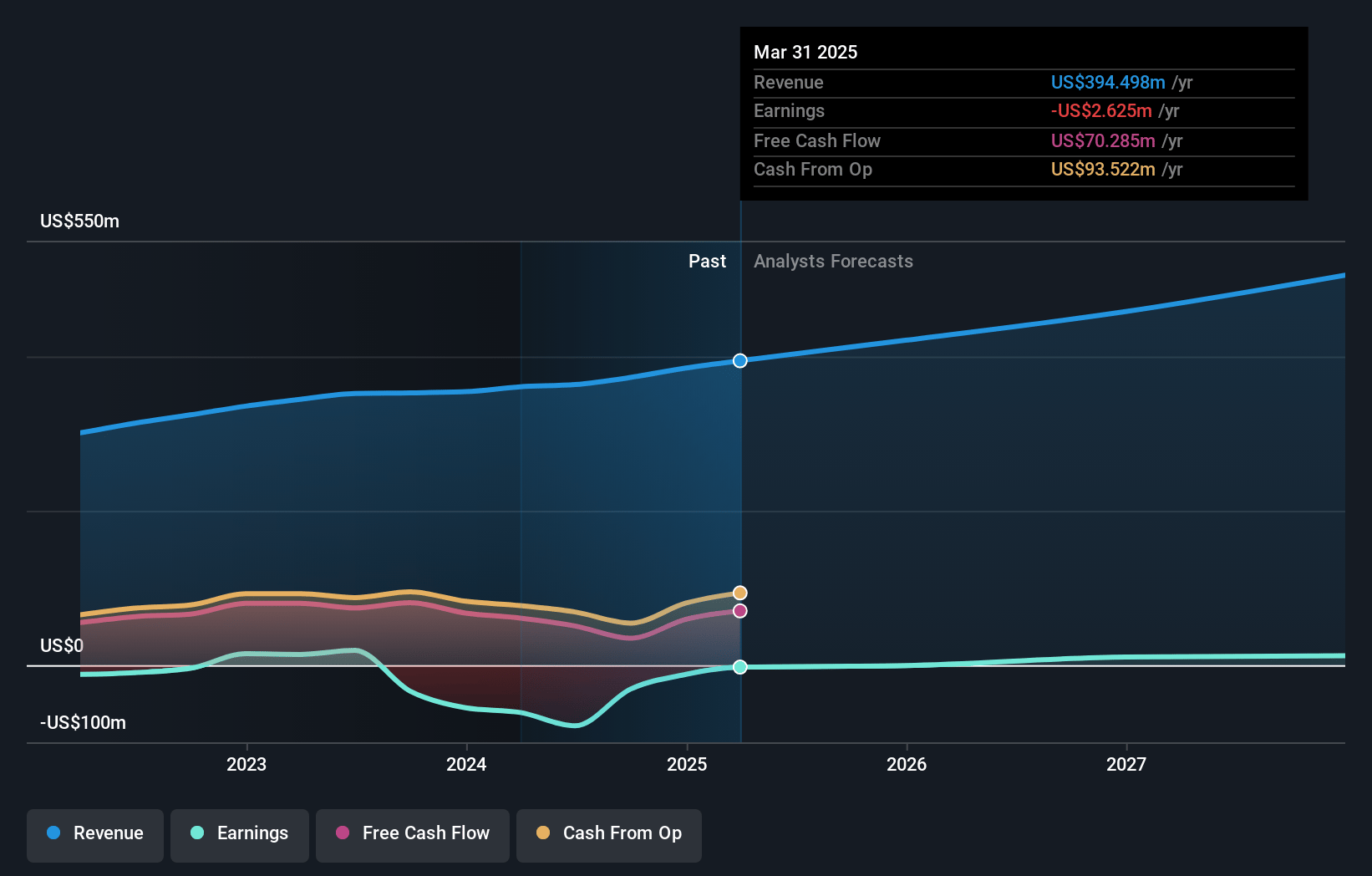

How have these above catalysts been quantified?- Analysts are assuming Certara's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.7% today to 3.2% in 3 years time.

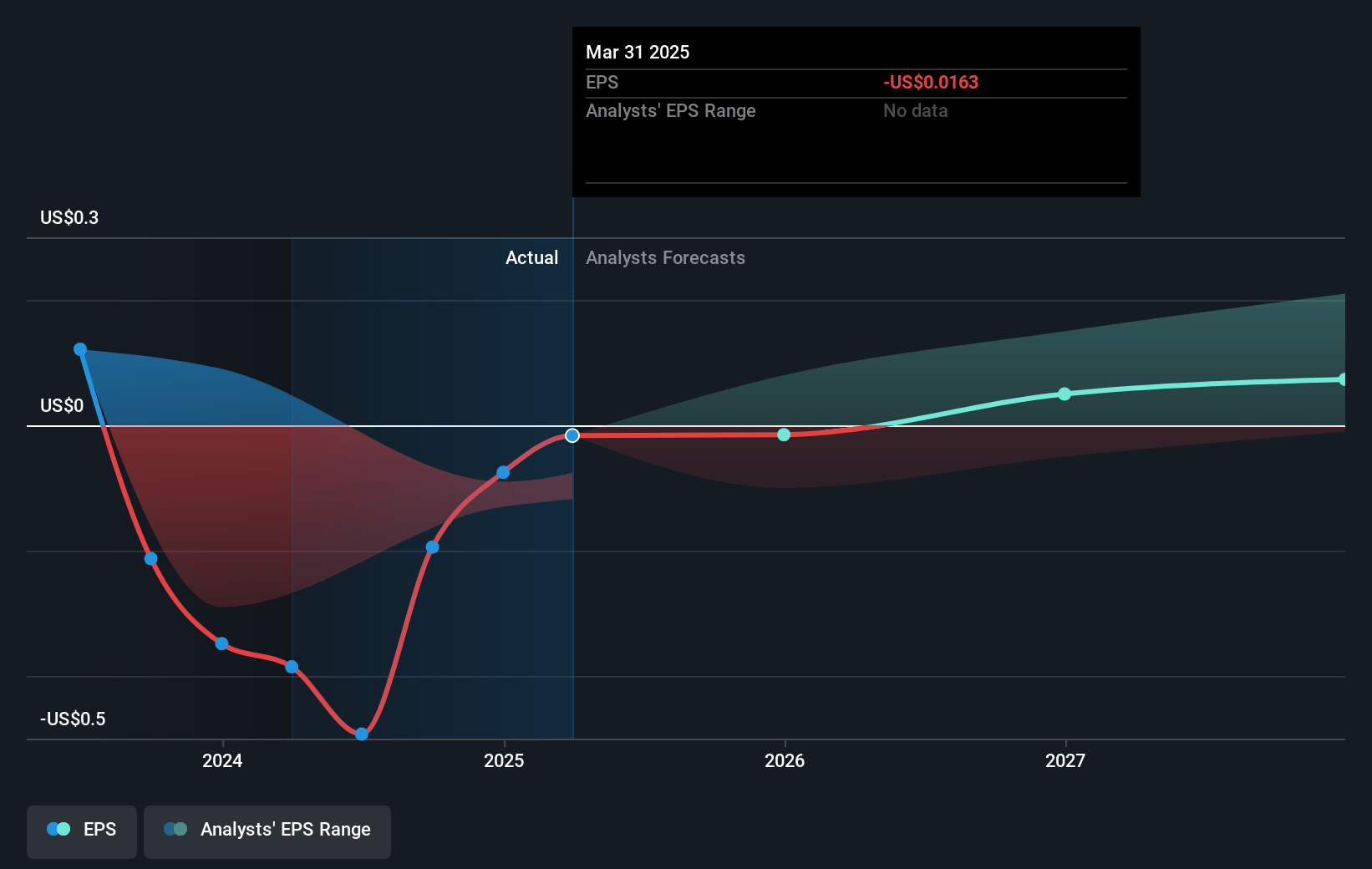

- Analysts expect earnings to reach $16.5 million (and earnings per share of $0.1) by about July 2028, up from $-2.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $33.9 million in earnings, and the most bearish expecting $-1.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 192.1x on those 2028 earnings, up from -643.4x today. This future PE is greater than the current PE for the US Healthcare Services industry at 58.5x.

- Analysts expect the number of shares outstanding to grow by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

Certara Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The speed and extent of regulatory adoption and actual implementation of the FDA's animal testing phase-out remain uncertain; widespread industry transition could be delayed or occur more slowly than anticipated, limiting near-term and possibly long-term growth in Certara's addressable market and thereby restraining revenue upside.

- Customer caution and inertia in drug development processes persist, especially as large pharma clients await clear regulatory precedent before making substantial shifts to model-informed approaches, which could lead to elongated sales cycles and volatility in software bookings and consulting revenues.

- The end-market environment remains challenged, with continued headwinds from IRA price controls, erratic biotech capital-raising, and slow decision-making in Tier 1 pharma-any prolonged downturn would dampen demand for Certara's solutions and directly impact organic revenue growth and margins.

- Increased investments in R&D (especially to expand AI, biosimulation, and preclinical software solutions) paired with slower-than-expected hiring or transition costs could exert pressure on net margins and dilute earnings, particularly if revenue acceleration from new markets or products is slower than management's expectations.

- Competition from other software providers and potential commoditization risk exists as Big Pharma and biotechs increase adoption of (or build their own) AI-driven modeling tools; this could erode Certara's pricing power, compress margins, reduce client stickiness, and negatively impact future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.222 for Certara based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $513.1 million, earnings will come to $16.5 million, and it would be trading on a PE ratio of 192.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $10.41, the analyst price target of $15.22 is 31.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.