Key Takeaways

- Expansion into new channels and ongoing product innovation position Reed's to capitalize on health trends and broaden its consumer base.

- Operational improvements and digital initiatives are expected to enhance efficiency, profitability, and recurring revenue streams.

- Ongoing operational issues, persistent losses, and heightened competition threaten Reed's recovery prospects, profitability, market share, and future financial stability.

Catalysts

About Reed's- Engages in the manufacture and distribution of natural beverages in the United States.

- Reed's accelerated expansion into food service and convenience channels, spearheaded by leadership with deep industry experience, positions the company to access new high-growth markets and broaden its consumer base, supporting future revenue and volume growth.

- Ongoing product innovation, particularly in the functional wellness beverage segment with successful early adoption and national retail distribution (including major grocers and co-ops), aligns Reed's with increasing consumer interest in health-oriented products, likely boosting future revenues and potentially improving net margins through product mix.

- Newly optimized supply chain and inventory management, along with the transition from glass to cans, is expected to lower logistics costs and improve operational efficiencies over time, directly benefiting gross margin and net margins as volumes recover.

- Strengthened relationships and regained shelf placements at large retail partners (e.g., Costco, Safeway, Whole Foods) provide opportunities to recapture lost revenue streams and improve topline growth as retail reset periods occur in upcoming quarters.

- Enhanced direct-to-consumer initiatives (new website, subscription growth focus) tap into digital channel expansion, supporting recurring revenue streams and potentially improving profitability through higher-margin online sales.

Reed's Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Reed's's revenue will grow by 18.1% annually over the next 3 years.

- Analysts are not forecasting that Reed's will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Reed's's profit margin will increase from -45.4% to the average US Beverage industry of 12.0% in 3 years.

- If Reed's's profit margin were to converge on the industry average, you could expect earnings to reach $7.1 million (and earnings per share of $0.12) by about August 2028, up from $-16.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.1x on those 2028 earnings, up from -3.0x today. This future PE is lower than the current PE for the US Beverage industry at 27.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

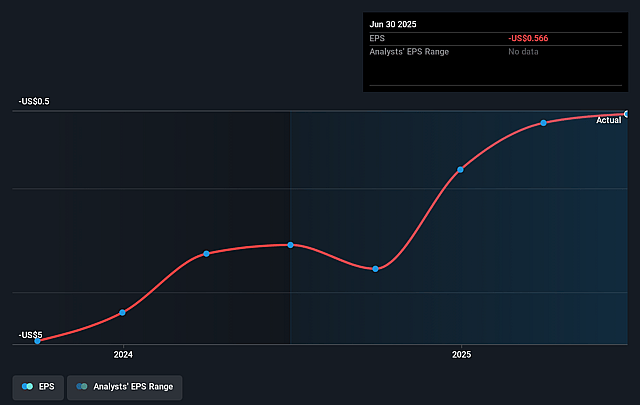

Reed's Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Loss of key retail placements due to prior operational challenges has directly reduced store presence and shelf space, and management acknowledges that regaining these placements will be a slow, uncertain process, which may continue to constrain revenue and market share in the long term.

- Persistent unprofitability, as evidenced by ongoing net losses, declining gross margins, increased SG&A, and negative EBITDA, raises concerns about Reed's ability to achieve scale or generate positive earnings, limiting resources available for strategic investment.

- Heavy reliance on debt and ongoing operational cash burn ($5 million used in Q2 2025 with only $2.7 million of cash on hand and $9.7 million in debt) increases the risk of future shareholder dilution or liquidity crises, negatively impacting net margins and earnings.

- Greater trade spend and elevated delivery/handling costs signal ongoing cost pressures that, if not improved swiftly, could further erode margins, offsetting any gains from new distribution or product innovation.

- Intensifying competition in the functional and craft beverage categories, coupled with market fragmentation and risk of shifting consumer preferences away from Reed's core ginger-based products, may limit their ability to reclaim growth, compress pricing power, and sustain or grow revenue over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.0 for Reed's based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $59.4 million, earnings will come to $7.1 million, and it would be trading on a PE ratio of 20.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $1.0, the analyst price target of $2.0 is 50.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.