Narratives are currently in beta

Key Takeaways

- Post Holdings leverages strong cash flow and improved operations for growth via M&A, signaling financial stability and potential earnings increase.

- Optimization efforts in manufacturing and a premium brand relaunch aim to enhance margins and boost market share in the pet segment.

- Post Holdings faces organic growth challenges, supply chain and manufacturing issues, and macroeconomic pressures, potentially impacting margins, revenue growth, and market share retention.

Catalysts

About Post Holdings- Operates as a consumer packaged goods holding company in the United States and internationally.

- Post Holdings has achieved a 45% increase in adjusted EBITDA over the past two years, driven by organic growth and pet acquisitions. This has led to the generation of strong free cash flow, which they aim to continue leveraging for growth in FY '25. Impact: Earnings growth.

- The company has significantly improved its manufacturing supply chains and expects a more normalized operating environment in FY '25, which could help stabilize or improve net margins despite consumer pressure and non-receding inflation. Impact: Net margins stabilization.

- Post Holdings has reduced its net leverage by over a full turn in the last two years and has extended its debt maturities. This provides them the flexibility to pursue M&A opportunities and other capital allocations to drive growth. Impact: Financial stability and potential EPS increase.

- There is an ongoing optimization of the company’s cereal and pet food manufacturing networks, which should enhance capacity utilization and efficiency, potentially leading to improved margins and cost savings. Impact: Net margins and operational efficiency.

- The planned relaunch of the Nutrish premium brand in FY '25 is aimed at strengthening the company’s branded offerings in the pet segment, with the potential to increase market share and revenue in this category. Impact: Revenue growth in the pet segment.

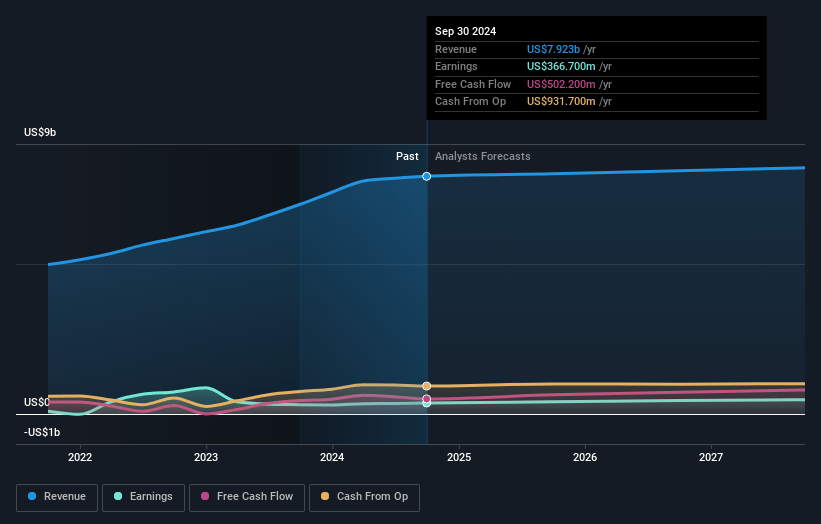

Post Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Post Holdings's revenue will grow by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 5.8% in 3 years time.

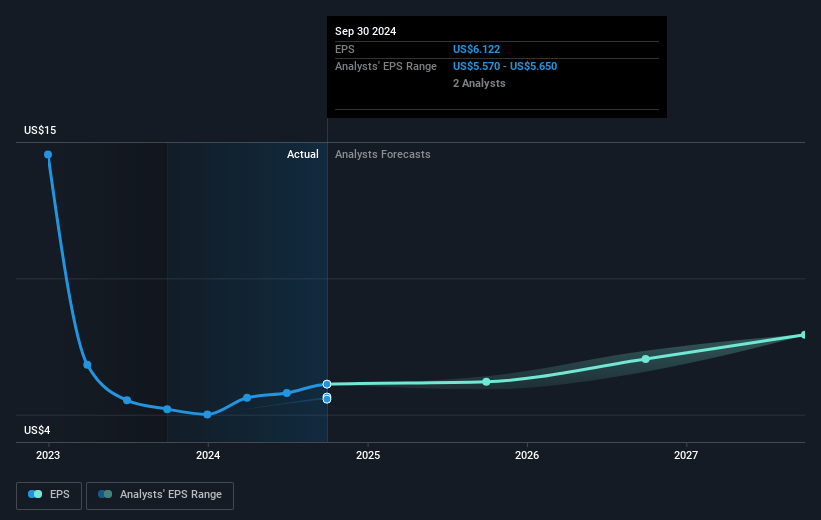

- Analysts expect earnings to reach $473.6 million (and earnings per share of $7.96) by about January 2028, up from $366.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from 17.0x today. This future PE is lower than the current PE for the US Food industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.43%, as per the Simply Wall St company report.

Post Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Inflationary pressures, particularly in key input costs like eggs, could persist, leading to potential margin compression if Post is unable to continue passing on costs through price increases. This could impact net margins and earnings.

- Post Holdings faces challenges in its supply chain and manufacturing, as evidenced by delays in its aseptic shake manufacturing reaching planned run rates, potentially affecting revenue growth and operational efficiency in Foodservice.

- The company has organic growth challenges, evidenced by declines in retail volumes across many segments (excluding acquisitions), which could hinder sustainable revenue growth in the long term.

- The pet segment, while outperforming expectations post-acquisition, saw decreased consumption volumes due to reduced distribution points and price elasticity, which might suggest challenges in retaining market share and generating consistent revenue growth.

- There is pressure from external macroeconomic factors, such as variability in consumer confidence and inflation in key markets like the U.K., affecting segments like Weetabix, and impacting overall volume growth and margin recovery efforts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $126.1 for Post Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $144.0, and the most bearish reporting a price target of just $105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.2 billion, earnings will come to $473.6 million, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $106.99, the analyst's price target of $126.1 is 15.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives