Narratives are currently in beta

Key Takeaways

- Strategic focus on digital transformation and data analytics aims to drive efficiencies and bolster profitability through operational savings.

- Expansion in high-margin categories and product optimization is expected to enhance profitability and support earnings growth.

- Limited growth in Asia and soft QSR traffic, combined with geopolitical issues and currency headwinds, could pressure McCormick's revenue and margins.

Catalysts

About McCormick- Manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry.

- McCormick's continued investment in brand marketing, innovation, and expanded distribution is expected to sustain volume growth, positively impacting future revenues and earnings.

- The plan to further optimize the product portfolio by focusing on four global categories—Spices and Seasonings, condiments and sauces, branded foodservice, and flavors—suggests an improvement in profitability, which could enhance net margins.

- McCormick's strategic emphasis on leveraging digital transformation and data analytics is anticipated to drive efficiencies and operational savings, potentially leading to improved net margins.

- The company projects gross margin expansion driven by favorable product mix and savings from the Comprehensive Continuous Improvement (CCI) program, which should positively impact earnings.

- Targeted growth in technically insulated high-margin product categories, such as flavors, is expected to enhance profitability and margin expansion, aiding earnings growth.

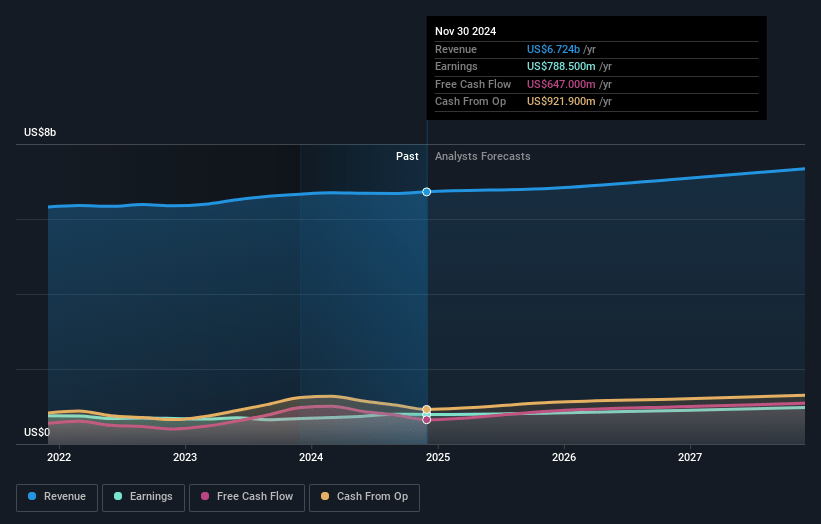

McCormick Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming McCormick's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.7% today to 13.2% in 3 years time.

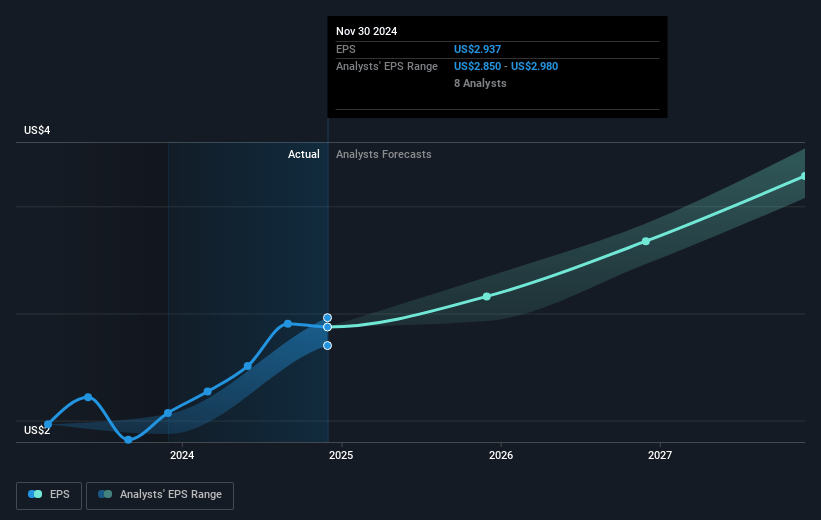

- Analysts expect earnings to reach $971.4 million (and earnings per share of $3.64) by about January 2028, up from $788.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2028 earnings, up from 26.1x today. This future PE is greater than the current PE for the US Food industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

McCormick Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- McCormick's growth opportunities in Asia Pacific are limited due to the ongoing challenging environment in China, which has impacted consumer sentiment and led to lower distributor inventory. This could negatively affect future revenue growth potential in the region.

- The Flavor Solutions segment has faced volume softness with CPG and QSR customers, impacted by customer activity timing and geopolitical issues in the EMEA region. Continued pressure here might impact revenue and margin growth.

- QSR traffic in the Americas and EMEA remains soft, presenting an unpredictable revenue stream for McCormick's Flavor Solutions segment in these regions, potentially affecting earnings.

- Increased investments in technology and brand marketing, while necessary, could increase short-term SG&A costs and potentially pressure net margins if corresponding sales growth does not materialize quickly.

- Expected currency headwinds, especially with the strengthening U.S. dollar against the Mexican peso, are projected to negatively impact income from unconsolidated operations, decreasing earnings in fiscal year 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $83.66 for McCormick based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $96.0, and the most bearish reporting a price target of just $67.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.3 billion, earnings will come to $971.4 million, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 5.9%.

- Given the current share price of $76.69, the analyst's price target of $83.66 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives