Key Takeaways

- Coca-Cola's all-weather strategy and digital integration are expected to drive sustainable global top-line growth and revenue improvements.

- Expansion into alcohol and AI-driven retail partnerships aims to boost scalability and earnings diversification.

- Currency headwinds, consumer hesitancy, inflation, tax disputes, and supply chain vulnerabilities pose significant threats to Coca-Cola's earnings, revenue growth, and profitability.

Catalysts

About Coca-Cola- A beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide.

- The implementation of Coca-Cola's all-weather strategy, which focuses on leveraging its extensive brand portfolio, ongoing marketing innovations, and the integration of digital solutions, is anticipated to drive sustainable top-line growth and improved revenue in diverse global markets.

- The company is focusing on driving affordability and premiumization across its product range, with strategic investments in affordable packaging and premium offerings expected to enhance net margins through improved pricing/mix dynamics.

- Coca-Cola's expansion into the alcohol segment through partnerships and brand extensions is positioned for long-term scalability and diversification, potentially contributing to future earnings growth as the market develops.

- Initiatives to boost manufacturing capacity, such as the expansion of fairlife's production facilities, aim to meet increasing consumer demand and drive revenue growth in high-potential categories, providing a long-term positive impact on earnings.

- The company is investing in digital capabilities and AI integration to enhance execution efficiency, particularly in retail partnerships, which could lead to improved operational margins and contribute to overall earnings growth.

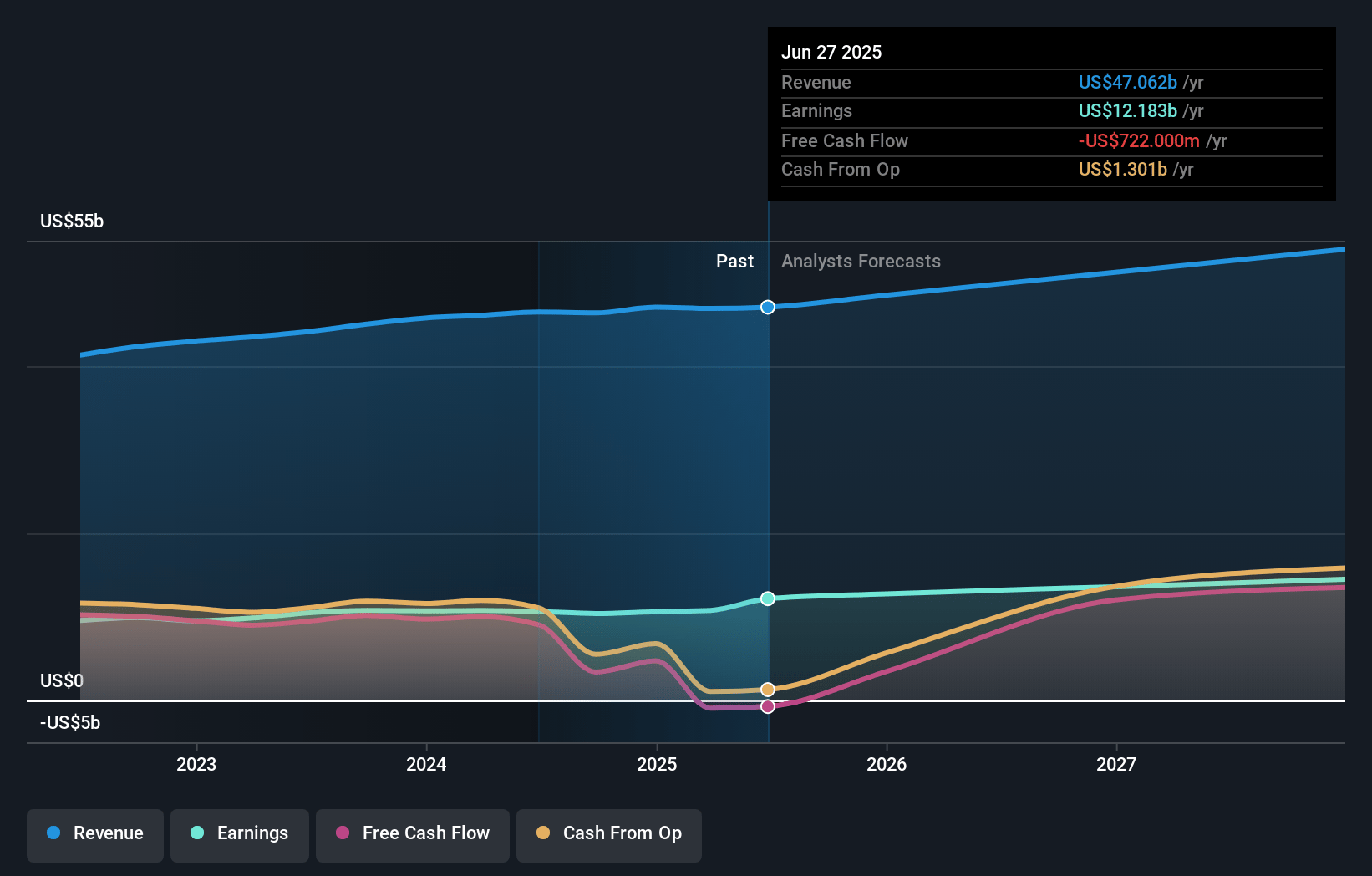

Coca-Cola Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coca-Cola's revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 22.4% today to 27.4% in 3 years time.

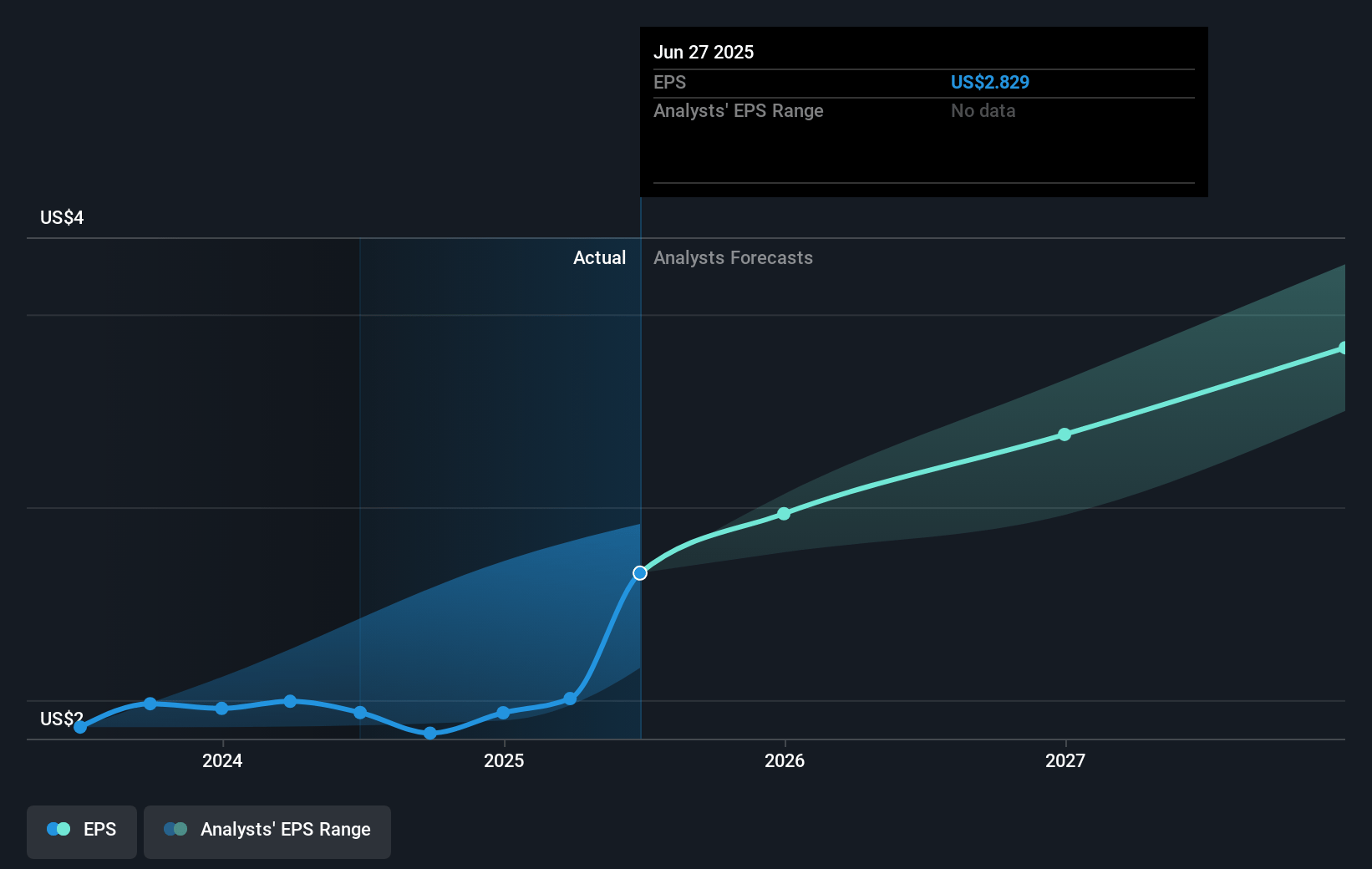

- Analysts expect earnings to reach $14.1 billion (and earnings per share of $3.3) by about January 2028, up from $10.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, down from 25.8x today. This future PE is greater than the current PE for the US Beverage industry at 22.3x.

- Analysts expect the number of shares outstanding to decline by 0.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Coca-Cola Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Currency headwinds, particularly in emerging markets, have been impacting Coca-Cola's earnings, and this trend is expected to continue into 2025, affecting comparable net revenues and earnings per share. (Earnings)

- There are concerns about consumer hesitancy and volume decline, especially in key markets like China and regions experiencing macroeconomic challenges such as Eurasia and the Middle East, which could negatively impact overall revenue growth. (Revenue)

- High inflation in some markets has led to intense pricing strategies, which may not be sustainable and could risk affecting consumer demand and mix, ultimately impacting profitability if price increases can't be maintained. (Net Margins)

- The ongoing IRS tax dispute, including a significant deposit made by Coca-Cola, presents a potential financial risk that could impact net earnings due to elevated net interest expenses and future financial obligations. (Earnings)

- Vulnerabilities in the supply chain and commodity markets, especially regarding agricultural commodities, pose a risk of future cost increases, affecting gross margins if mitigation strategies are insufficient or delayed. (Net Margins)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $71.43 for Coca-Cola based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $59.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $51.3 billion, earnings will come to $14.1 billion, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 5.9%.

- Given the current share price of $62.36, the analyst's price target of $71.43 is 12.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

RI

Equity Analyst and Writer

Lack Of Revenue Diversification And Growth Options Will Hurt Valuation Multiple

Key Takeaways Coca-Cola’s PE ratio has risen to the high 20s due to a recent revival in profit growth. However, several non-recurring factors have driven these improvement in margins and growth.

View narrativeUS$54.61

FV

30.7% overvalued intrinsic discount5.50%

Revenue growth p.a.

9users have liked this narrative

0users have commented on this narrative

10users have followed this narrative

5 months ago author updated this narrative

SI

Simply Wall St User

Community Contributor

Iconic Coke is a bit overpriced and needs to appeal to people trying to get healthy

I think it is a great stock with an invaluable brand, but I am skeptical that it will do well in the next few years. Coke is fighting all the weight loss peptides developed by Lilly and Novo Nordisk.

View narrativeUS$60.00

FV

18.9% overvalued intrinsic discount2.06%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

5 months ago author updated this narrative

TO

Tokyo

Community Contributor

KO is still a good base investment

My main narrative for KO: Strong brands Well established distribution network (starting from the source (water) over botteling and delivery to selling points) with an "all world" footprint To grow revenue KO now sells also Coffee (Costa) and other beverages over the existing network. The idea is to have the beverage for every daytime, so the offering and with that revenue will still increase To optimize finance (less investments) botteling in several countries is outsourced as a franchise Strong growth in Latin Amerika But: I miss innovations or trend setting Basically they purchase niche players or lower Top5 brands and scale them through their distribution network Or cooperate, in case of Monster beverage I focus also on: ...

View narrativeUS$62.00

FV

15.1% overvalued intrinsic discount5.28%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

5users have followed this narrative

6 months ago author updated this narrative

ST

Equity Analyst and Writer

Coca-Cola Can Draw Minor Benefits from Prolonged Economic Uncertainty

Key Takeaways KO can remain a reliable performer in a mature but growing category. Its diversified portfolio of beverages means it can handle shifting beverage preferences Its reduction of debt will help it endure any market volatility, like it has in the past Dividend payout ratio is rising and management will eventually have to address it.

View narrativeUS$64.00

FV

11.5% overvalued intrinsic discount4.00%

Revenue growth p.a.

9users have liked this narrative

0users have commented on this narrative

7users have followed this narrative

8 months ago author updated this narrative