Narratives are currently in beta

Key Takeaways

- Expected regulatory clarity and tax credits could enhance margins and demand for renewable diesel and feedstocks, positively impacting net margins.

- Debt reduction and new revenue streams, including sustainable aviation fuel, can lead to improved net margins and earnings.

- Sluggish demand, pricing challenges, and capacity issues risk revenue and margin across segments, impacting earnings, cash flow, and investor confidence.

Catalysts

About Darling Ingredients- Develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally.

- Darling Ingredients is optimistic about 2025 due to expected regulatory clarity on the California low-carbon fuel standard program and the federal tax credit 45Z, which could enhance margins and demand for their renewable diesel and low-carbon feedstocks. This could positively impact net margins.

- The company's sustainable aviation fuel unit is mechanically complete and in the process of commissioning with contracts already announced, providing a new revenue stream and potentially improving earnings.

- Darling Ingredients is focused on expanding their specialty ingredients business with innovations like Nextida GC, which could capture higher margins and improve earnings.

- The company is actively reducing debt and has paid down $192 million in the third quarter, bolstered by dividends from their Diamond Green Diesel joint venture, which can lead to better net margins and earnings through lower interest expenses.

- The transition from the blenders tax credit to the Clean Fuels Producer Credit, known as 45Z, is expected to be favorable for Darling given their capacity to leverage waste fats, which could lead to improved net margins and earnings.

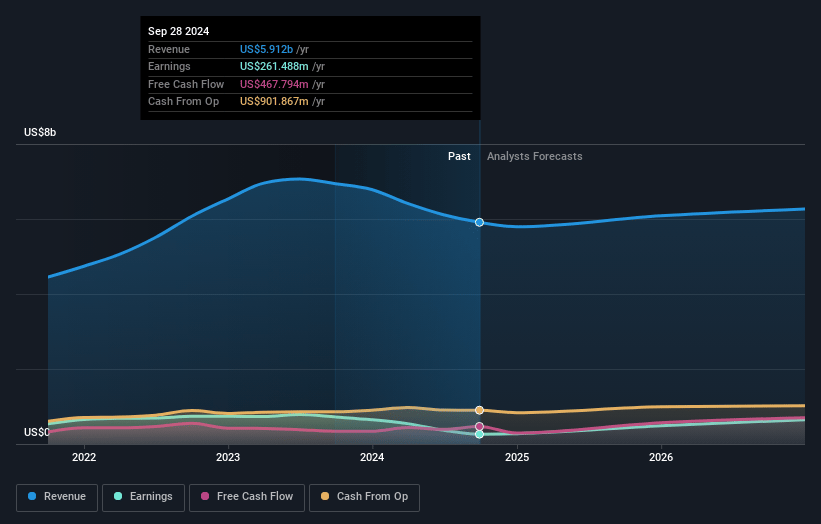

Darling Ingredients Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Darling Ingredients's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 11.6% in 3 years time.

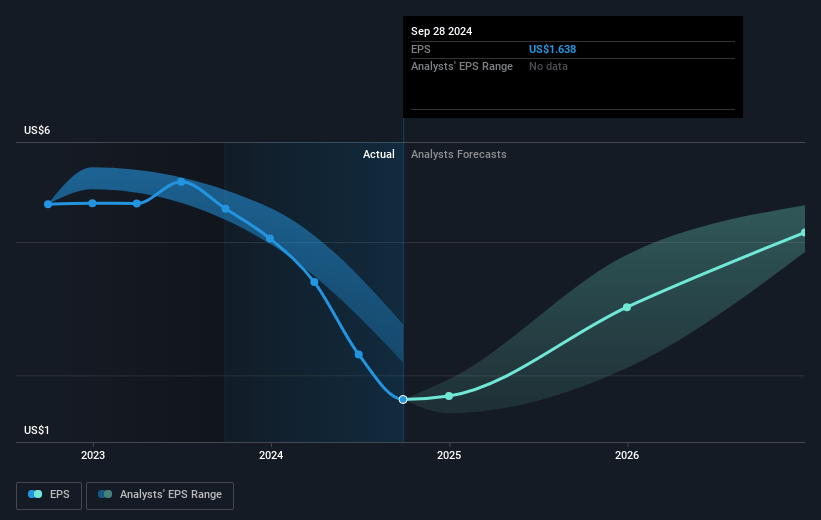

- Analysts expect earnings to reach $741.8 million (and earnings per share of $4.67) by about December 2027, up from $261.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2027 earnings, down from 20.5x today. This future PE is lower than the current PE for the US Food industry at 20.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.09%, as per the Simply Wall St company report.

Darling Ingredients Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sluggish global ingredient demand and challenging pricing conditions could negatively impact revenue and margins, especially if market conditions do not improve.

- Slow recovery in fat prices, affected by challenges in running pretreatment units and imported feedstocks, can restrain revenue and gross margin growth within the Feed Ingredients segment.

- Softer demand from China, combined with capacity additions in Brazil and customer destocking, could pressure revenue and margin performance in the Food segment.

- Weak margins in the renewable diesel market, impacted by delays and lack of clarity in regulatory markets for RINs and LCFS, may adversely affect earnings and cash flows in the Fuel segment.

- A significant decrease in net income compared to the previous year, primarily due to declines in gross margin and earnings from joint ventures, poses a risk to overall financial performance and investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $51.7 for Darling Ingredients based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $6.4 billion, earnings will come to $741.8 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 6.1%.

- Given the current share price of $33.7, the analyst's price target of $51.7 is 34.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives