Key Takeaways

- Tether partnership could enable transformational expansion, digitalization, and financial innovation, positioning Adecoagro as a dominant, high-margin agribusiness and renewable energy leader.

- Superior climate resilience, crop productivity, and exposure to rising food and renewable energy demand provide unique advantages for sustained pricing power, growth, and stronger earnings quality.

- Exposure to commodity price swings, climate disruption, regulatory shifts, and input cost inflation threatens earnings stability and future profitability across core markets.

Catalysts

About Adecoagro- Engages in agricultural and agro-industrial activities in Argentina, Brazil, Chile, and Uruguay.

- Analyst consensus expects Tether's capital and technological backing to accelerate Adecoagro's growth, but this may understate the potential for transformational M&A and vertically integrated expansion as Tether's access to both global financial markets and advanced digital infrastructure enables Adecoagro to scale into a dominant pan-Latin American agribusiness and renewable energy powerhouse-driving step-change increases in revenue and earnings power.

- While the consensus narrative sees value in partnership-driven tech adoption, the magnitude of digitalization could be hugely underestimated: with Tether's blockchain and tokenization expertise, Adecoagro is poised to pioneer real-time, automated commodity trading and asset-backed security structures, unlocking hidden value in land, inventory, and carbon credits, which could radically enhance return on equity and expand net margins beyond traditional agribusiness limits.

- Global investor interest in "tangible reserve assets"-including farmland and operating platforms-remains underappreciated; as Adecoagro's land and vertically integrated assets become properly capitalized and made investable through new financial structures, persistent NAV discounts are likely to reverse, leading to significant upward rerating of the stock and unlocking billions in latent balance sheet value.

- Adecoagro's best-in-class climate resilience, water management, and productivity in key crops position it to capture accelerating value from weather-volatile markets and supply disruptions-enabling outsized pricing power and margin gains as global food security concerns rise, which will underpin more stable, high-quality earnings streams through future commodity cycles.

- With surging middle class populations in emerging markets and global shifts toward renewable transport policies (such as expanded ethanol adoption), Adecoagro's exposure to both food and energy demand is uniquely positioned for compounding volume growth at premium margins, resulting in a multi-year tailwind to consolidated top-line and cash flow growth that is not yet reflected in current valuations.

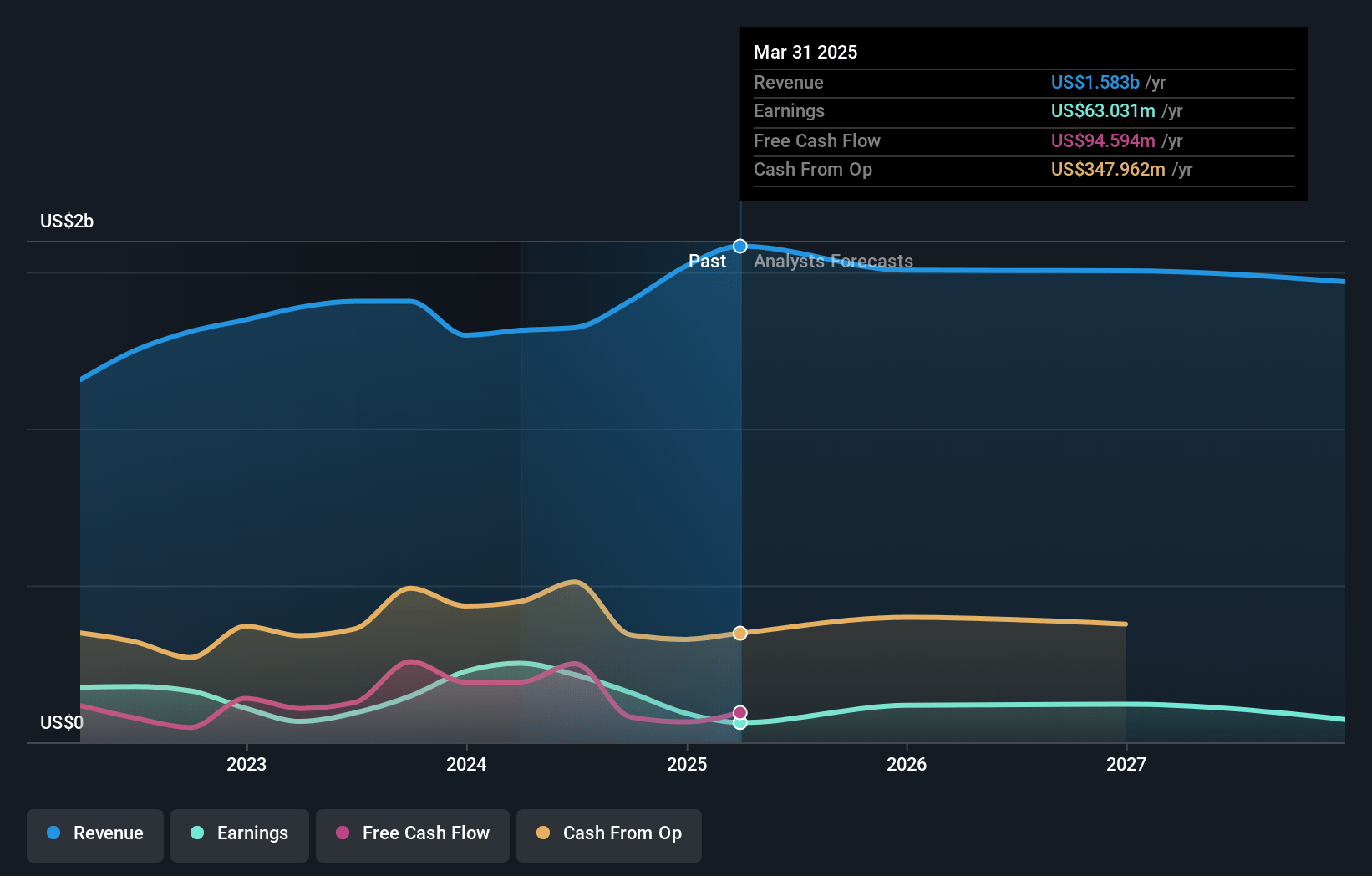

Adecoagro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Adecoagro compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Adecoagro's revenue will decrease by 1.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.0% today to 18.0% in 3 years time.

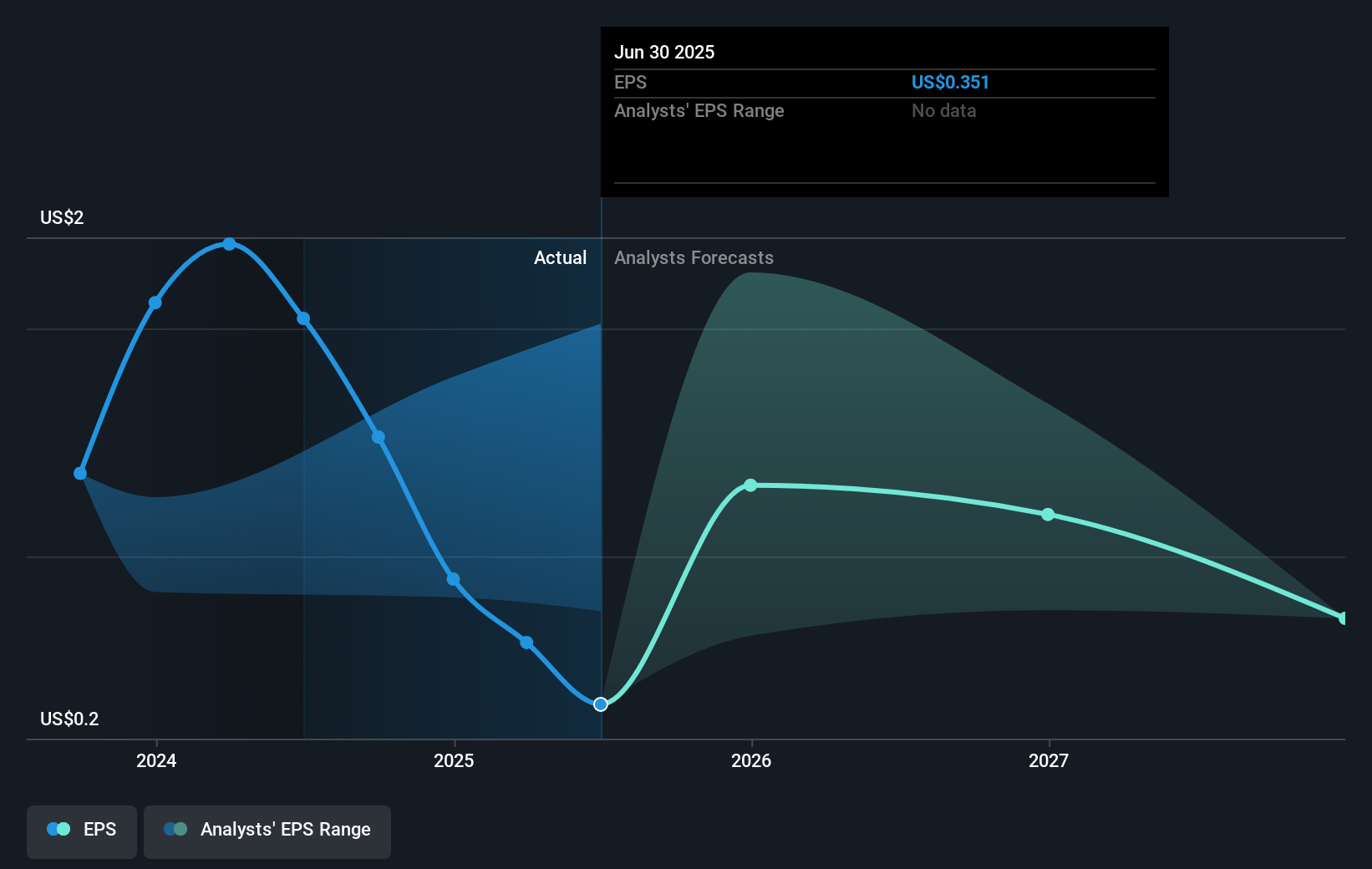

- The bullish analysts expect earnings to reach $273.6 million (and earnings per share of $1.02) by about July 2028, up from $63.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.0x on those 2028 earnings, down from 15.0x today. This future PE is lower than the current PE for the US Food industry at 19.5x.

- Analysts expect the number of shares outstanding to decline by 2.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.88%, as per the Simply Wall St company report.

Adecoagro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Adecoagro's heavy reliance on volatile global commodity prices, particularly for crops, sugar, and ethanol, exposes its revenues and net margins to pronounced swings during market downturns, as reflected in the recent quarter's 60% year-over-year reduction in adjusted EBITDA despite higher sales.

- Persistent climate change effects, such as recurring droughts and erratic rainfall in Argentina and Brazil, continue to disrupt yields and productivity, leading to lower production volumes and elevated costs, which contributes to ongoing earnings volatility and can undermine future profitability.

- Rising global sustainability regulations and shifting consumer demand towards alternative proteins threaten the long-term revenue potential of traditional crop and dairy segments, which may struggle to maintain demand and pricing power as these secular trends accelerate.

- Adecoagro's asset concentration in volatile economies like Argentina, Brazil, and Uruguay leaves the company highly exposed to currency devaluations and political risk, which can erode earnings and lead to substantial volatility in financial results when translated into US dollars.

- Increasing costs for critical inputs such as seeds, fertilizers, energy, and labor-exacerbated by inflation and global supply chain disruptions-pose a structural risk to operating margins, particularly in a context where productivity gains may lag those achieved in regions investing more aggressively in agtech and automation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Adecoagro is $17.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Adecoagro's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $9.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $273.6 million, and it would be trading on a PE ratio of 7.0x, assuming you use a discount rate of 6.9%.

- Given the current share price of $9.45, the bullish analyst price target of $17.0 is 44.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.