Last Update27 Aug 25Fair value Increased 2.28%

The analyst price target for Archer-Daniels-Midland has been raised to $58.30, reflecting early stabilization in Nutrition, a more favorable Ag Services outlook, improved execution, and an expected Q2 EBITDA beat, partially offset by weaker North American crush margins.

Analyst Commentary

- Early signs of stabilization in the Nutrition segment are emerging.

- A more constructive backdrop in Ag Services is expected to drive upside.

- Improved execution and increased policy visibility support a higher valuation.

- Expected Q2 EBITDA forecast ($916M) is set to beat consensus estimates by 6%.

- Anticipated weaker crush margins in North America partially offset bullish factors.

What's in the News

- ADM entered a production partnership with OCOchem to build a demonstration plant co-located at ADM's Decatur, Illinois corn processing complex, utilizing OCOchem's Carbon FluX Electrolyzer to convert biogenic CO2 from ethanol production into value-added formate molecules.

- The collaboration aims to support ADM's industrial carbon management and sustainable molecule production strategies, targeting existing and emerging applications such as crop protection, fertilizers, water treatment, and industrial solvents with carbon-negative products.

- OCOchem's technology uses the world’s largest gas diffusion electrode and advanced electrochemical processing, offering high efficiency and zero waste, with product selectivity and productivity.

- ADM did not repurchase any shares in the period from April 1 to June 30, 2025, and has completed its buyback program with a total of 185,235,951 shares (33.03%) acquired for $10,122.9 million since November 2014.

Valuation Changes

Summary of Valuation Changes for Archer-Daniels-Midland

- The Consensus Analyst Price Target has risen slightly from $57.00 to $58.30.

- The Consensus Revenue Growth forecasts for Archer-Daniels-Midland has fallen from 2.5% per annum to 2.3% per annum.

- The Future P/E for Archer-Daniels-Midland has risen slightly from 15.29x to 15.71x.

Key Takeaways

- Policy and regulatory support for biofuels and ramping up production facilities will directly improve margins and profitability across ADM's key business segments.

- Cost management, network optimization, and innovation in Nutrition are lowering the cost base and enabling stable, higher-margin growth aligned with global demand trends.

- ADM faces ongoing earnings volatility and margin pressure from regulatory uncertainty, declining demand, operational headwinds, and heightened compliance and reputational risks.

Catalysts

About Archer-Daniels-Midland- Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally.

- Policy clarity and ongoing government support for biofuels-including the extension of the 45Z tax credit, favorable RVOs, and domestic feedstock incentives-are expected to drive increased soybean oil demand and improved crush margins, directly supporting ADM's revenue and net margins from late 2025 into 2026.

- ADM's ramp-up of key production facilities, notably the Decatur East plant, will eliminate significant cost headwinds experienced in prior quarters and restore higher-margin specialty ingredient capacity, enhancing overall Nutrition segment profitability and net margins moving forward.

- Strategic network optimizations, cost management initiatives (targeted $500–$750 million savings over 3–5 years), and focus on portfolio simplification are structurally lowering ADM's cost base and setting up for sustained improvements in operating earnings and return on invested capital.

- Growth in the Nutrition segment-driven by geographic expansion, innovation in probiotics and flavors, and the shift to higher-margin specialty and health ingredients-aligns with changing consumer preferences for processed and convenience foods, providing ADM with a path to higher revenue growth and greater margin stability.

- ADM's integrated model and strong balance sheet position it to capitalize on global demand growth, especially across Asia and Africa, as population and income trends drive higher consumption; this supports long-term volume gains and earnings expansion.

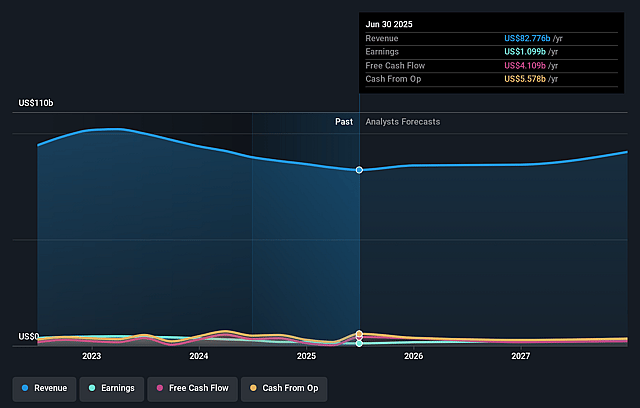

Archer-Daniels-Midland Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Archer-Daniels-Midland's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.3% today to 2.5% in 3 years time.

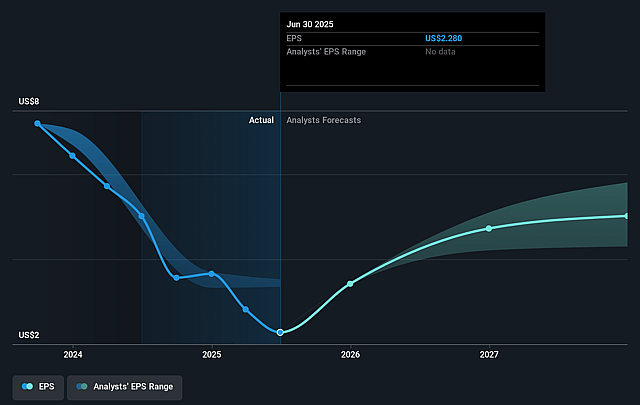

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $4.82) by about August 2028, up from $1.1 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $2.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 27.5x today. This future PE is lower than the current PE for the US Food industry at 21.0x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Archer-Daniels-Midland Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent uncertainty and frequent changes in biofuel policy and regulatory clarity, including timing issues with Renewable Volume Obligations (RVOs) and biofuel tax credits, may continue to cause earnings volatility and limit ADM's ability to fully capitalize on uplifted margins, impacting long-term margin stability and earnings growth.

- Declining margins and volumes in core Ag Services & Oilseeds (AS&O) and Carbohydrate Solutions segments, driven by trade policy uncertainty, lower global commodity prices, currency fluctuations, and reduced demand for traditional agricultural commodities, represent structural risks to ADM's revenue base and net margins.

- Climate

- and crop-related challenges-such as ongoing corn quality issues in EMEA and greater input cost volatility-threaten reliable supply chains and margin performance, leading to potential headwinds for revenue and increased operational costs.

- Shifting consumer preferences and softening demand in key end markets, such as high fructose corn syrup and certain paper/starch applications, coupled with strategic exits from "non-core" facilities, may reduce ADM's scale advantages and long-term revenue prospects in traditional lines.

- Residual risks from recent internal control material weaknesses and past regulatory scrutiny increase the likelihood of elevated compliance costs or reputational impacts, potentially weighing on net earnings and investor confidence over the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.3 for Archer-Daniels-Midland based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $54.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $88.6 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $62.82, the analyst price target of $58.3 is 7.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.