Last Update 05 Dec 25

STKL: Raised Revenue Guidance Will Support Fresh Upside Momentum

Analysts have modestly raised their price target on SunOpta to reflect a slightly higher fair value estimate of around 8.00 dollars per share. They cite incremental improvements in long term revenue growth, profit margin assumptions, and future valuation multiples.

What's in the News

- SunOpta raised its 2025 revenue guidance to a range of 812 million dollars to 816 million dollars, slightly above its prior outlook of 805 million dollars to 815 million dollars (Key Developments).

- The company issued 2026 revenue guidance, targeting a range of 865 million dollars to 880 million dollars, signaling continued top line growth expectations beyond 2025 (Key Developments).

- SunOpta recorded unaudited impairment charges of 2.565 million dollars related to property, plant and equipment for the third quarter ended September 27, 2025, reflecting write downs on certain assets (Key Developments).

Valuation Changes

- The fair value estimate has been reaffirmed at approximately 8.00 dollars per share, reflecting no meaningful change from the prior assessment.

- The discount rate has edged down slightly to about 6.96 percent from 6.96 percent previously, indicating a marginally lower perceived risk profile.

- Revenue growth has remained effectively unchanged at around 7.92 percent annually, suggesting stable expectations for top line expansion.

- Net profit margin assumptions are essentially flat at roughly 9.23 percent, indicating no material shift in profitability expectations.

- The future P/E multiple stays nearly identical at about 12.89 times, pointing to a consistent view of SunOpta's longer term valuation framework.

Key Takeaways

- Growing demand for healthy, plant-based products and increased manufacturing capacity position SunOpta for sustained revenue growth and margin improvement.

- Shift toward higher-margin products and strong pricing power support profitability and earnings stability while mitigating risk from input cost pressures.

- Reliance on growth in core categories, high capital needs, trade risks, intense competition, and low brand recognition threaten revenue stability and long-term earnings outlook.

Catalysts

About SunOpta- Engages in the manufacture and sale of plant and fruit-based food and beverage products in the United States, Canada, and internationally.

- Strong and accelerating demand for better-for-you fruit snacks and plant-based beverages, fueled by growing consumer focus on health and wellness and preference for non-dairy, clean-label products, is driving sustained double-digit revenue growth and requires continued capacity expansion (supports top-line revenue growth).

- Expanding manufacturing capacity investments, such as the new manufacturing line for fruit snacks already oversubscribed by existing customers, ensures SunOpta can meet robust customer demand-positioning the company for volume-led revenue increases and improved gross margins through efficiency gains (supports revenues and margin expansion).

- Success in passing through inflationary and tariff-related input costs to customers with minimal volume impact demonstrates strong pricing power and operational discipline, supporting margin resilience and earnings stability (improves gross margins and net earnings).

- Ongoing shift in portfolio mix towards higher-margin private label, contract manufacturing, and value-added products-amid mainstream adoption of plant-based foods in club and foodservice channels-mitigates earnings volatility and drives long-term profitability (improves net margins and reduces earnings volatility).

- Secular growth in the plant-based category and rising environmental and sustainability awareness continue to expand SunOpta's addressable market, underpinning a strong new business pipeline and sustained above-industry growth algorithm for both revenue and EBITDA (supports multi-year revenue and EBITDA CAGR).

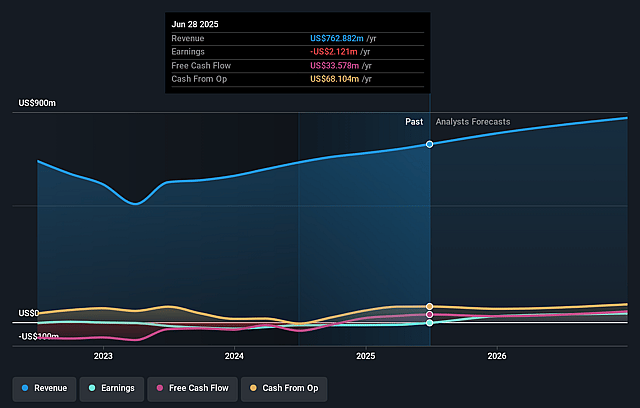

SunOpta Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SunOpta's revenue will grow by 9.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.3% today to 14.2% in 3 years time.

- Analysts expect earnings to reach $141.9 million (and earnings per share of $1.14) by about September 2028, up from $-2.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, up from -349.4x today. This future PE is lower than the current PE for the US Food industry at 19.8x.

- Analysts expect the number of shares outstanding to grow by 1.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

SunOpta Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on continued high growth in fruit snacks and plant-based beverage categories exposes SunOpta to potential category slowdowns or shifts in consumer preferences (e.g., toward "whole food" trends or new health movements), which could pressure future revenue growth and limit long-term earnings potential.

- Ongoing and increased capital expenditure requirements for manufacturing line expansions-including the $25 million fruit snack line and potential future aseptic capacity-may strain free cash flow and raise net leverage, especially if expected demand growth does not fully materialize or if returns on invested capital fall short.

- Heightened exposure to tariff fluctuations and changing trade environments presents persistent risks; while management emphasizes successful pass-through pricing, further increases in tariffs, regulatory changes, or delays in recovery could increase input costs and compress net margins.

- Intensifying competition from larger CPG companies and new entrants in plant-based, organic, and private label food and beverage segments may erode SunOpta's pricing power, limit customer loyalty, and put persistent pressure on gross margins and market share.

- The company's relatively low brand recognition and emphasis on private label/co-manufacturing leaves it vulnerable to both customer consolidation and margin pressure, with the risk that customers may internalize production or switch suppliers, impacting revenue predictability and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.6 for SunOpta based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $141.9 million, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $6.27, the analyst price target of $9.6 is 34.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SunOpta?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.