Narratives are currently in beta

Key Takeaways

- Expanding avocado production and penetrating new market channels are expected to boost revenue and enhance margins.

- Strategic asset monetization and real estate ventures aim to improve cash flow and financial stability.

- Limoneira faces revenue challenges due to weather impacts on lemon sales, lower avocado volumes, real estate dependency, and execution risks in strategic shifts.

Catalysts

About Limoneira- Operates as an agribusiness and real estate development company in the United States and internationally.

- Limoneira's strategic decision to expand avocado production by 1,000 acres through fiscal year 2027 is expected to drive significant EBITDA growth, capitalizing on robust consumer demand trends. This expansion is aimed at increasing revenue and improving earnings.

- The company anticipates meaningful market penetration of its lemon offering into foodservice and quick service restaurant channels in fiscal year 2025, which could boost revenue and enhance net margins as lemon volumes are projected to grow.

- The Harvest real estate development project, a joint venture with the Lewis Group of Companies, is performing well and expected to provide a significant increase in cash flow projections by 46%. This real estate success will positively impact earnings and cash flow.

- Limoneira plans to monetize valuable water resources in fiscal year 2025, particularly in the Santa Paula Water Basin, where water rights transactions could generate significant value. This could improve earnings and cash flow through new revenue streams.

- The company is exploring strategic alternatives and asset monetization opportunities, which, combined with a strong balance sheet and reduced net debt, could maximize stockholder value and positively impact earnings per share (EPS) and financial stability.

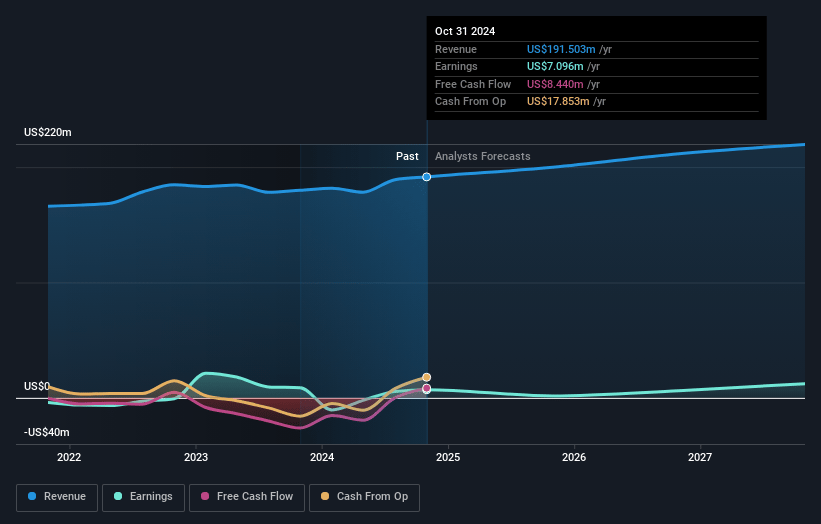

Limoneira Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Limoneira's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 5.6% in 3 years time.

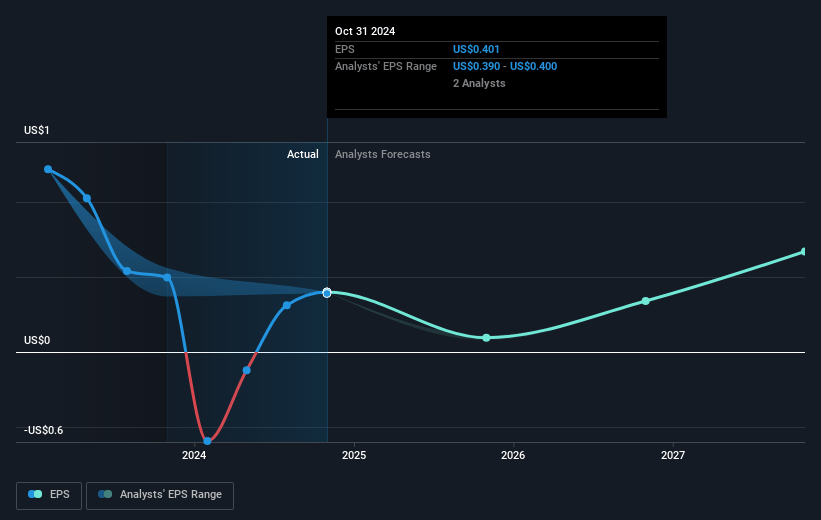

- Analysts expect earnings to reach $12.3 million (and earnings per share of $2.67) by about January 2028, up from $7.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 59.1x today. This future PE is lower than the current PE for the US Food industry at 19.9x.

- Analysts expect the number of shares outstanding to decline by 36.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Limoneira Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Limoneira's revenue from fresh packed lemon sales decreased significantly in fiscal year 2024 compared to 2023 due to lower fresh utilization rates influenced by weather-driven events, potentially impacting future earnings if unfavorable weather persists.

- The company anticipates lower avocado volumes in fiscal year 2025 compared to 2024 because of the alternate bearing nature of avocado trees, which could affect revenue from this segment in the near term.

- Although Limoneira's real estate joint venture is performing well, the dependency on residential unit sales and regulatory approvals poses risks, as any downturn in the real estate market or regulatory setbacks could negatively impact cash flow projections and future revenue.

- The transition towards an asset-lighter business model and strategic repositioning, while potentially rewarding in the long term, involves execution risks that may lead to unforeseen costs or lower-than-expected returns, impacting net margins.

- Limoneira relies on water monetization strategies, such as those involving the Colorado River and Santa Paula Basin, which are subject to regulatory and environmental uncertainties that could delay or reduce anticipated financial benefits, thus impacting projected earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.0 for Limoneira based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $219.6 million, earnings will come to $12.3 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 5.9%.

- Given the current share price of $23.2, the analyst's price target of $28.0 is 17.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives