Narratives are currently in beta

Key Takeaways

- Strategic international expansion and product diversification are poised to amplify revenue and sustain business growth.

- Optimizing supply chain efficiency and managing logistics costs could improve net margins and stabilize operations.

- Supply chain disruptions, including inventory challenges and elevated freight costs, risk continued revenue loss and margin compression, while international and promotional efforts face potential setbacks.

Catalysts

About Vita Coco Company- Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

- The resolution of prior inventory shortages, coupled with increased container availability, suggests that Vita Coco is positioned to better meet consumer demand, which could boost future revenues as it recaptures lost sales.

- Expanding international operations, notably in high-growth markets such as Germany, where coconut water consumption is increasing, can amplify revenues and support sustained international business growth.

- The introduction of new products like Vita Coco Treats and expansion into more retailers in 2025 signals potential revenue growth through product innovation and diversification, capturing more consumer interest.

- The development and successful marketing of its Vita Coco Juice, as well as the introduction of its Vita Coco Coconut 1-liter pack in major convenience stores, shows promise for increasing sales volume, positively impacting total revenue.

- Efforts to manage and eventually reduce elevated ocean freight costs, coupled with targeted capacity increases for 2025 and 2026, could enhance supply chain stability and improve net margins as logistics expenses potentially normalize.

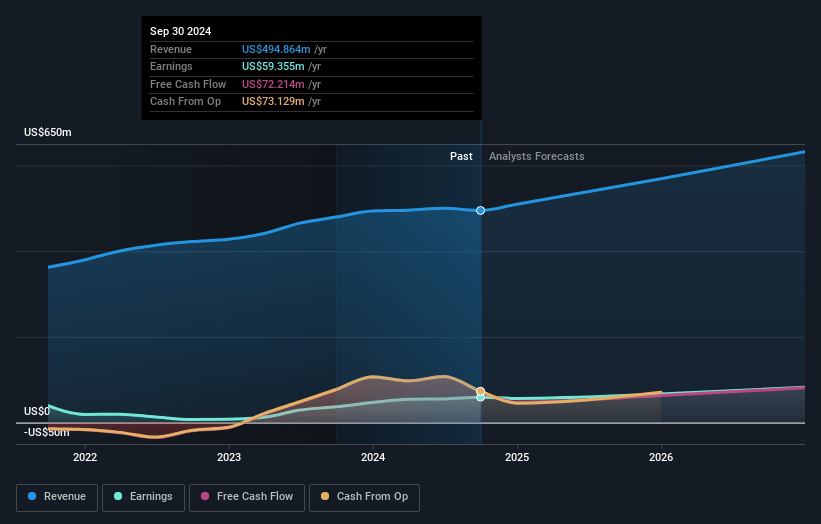

Vita Coco Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vita Coco Company's revenue will grow by 11.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.0% today to 14.0% in 3 years time.

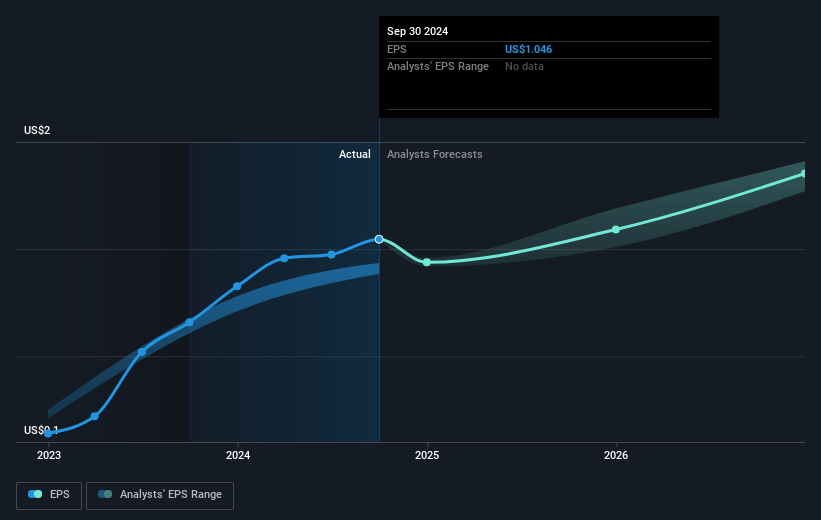

- Analysts expect earnings to reach $96.0 million (and earnings per share of $1.59) by about November 2027, up from $59.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.7x on those 2027 earnings, down from 32.6x today. This future PE is lower than the current PE for the US Beverage industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 2.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Vita Coco Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faced significant inventory challenges due to limited ocean container availability earlier this year, impacting their ability to meet consumer demand and resulting in lost sales growth, which could continue to affect revenue.

- Elevated ocean freight costs have compressed margins, and ongoing volatility in these costs presents a risk to gross margins if rates remain high or increase further.

- The reduction in promotional activity due to inventory constraints, including missing a major club promotion, likely contributed to lower net sales and scans for the quarter, potentially impacting future sales momentum.

- Private label sales have been significantly impacted by inventory shortages, particularly in the coconut oil segment, indicating a risk to revenue if supply chain issues persist.

- Although the international segment is experiencing growth, the restructuring efforts in Asian markets and variability in other Western European markets could present challenges in maintaining consistent international revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.22 for Vita Coco Company based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $686.2 million, earnings will come to $96.0 million, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 5.9%.

- Given the current share price of $34.06, the analyst's price target of $33.22 is 2.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

Vita Coco Company: Strong Growth Trajectory Driven by Coconut Water Success

Catalysts New product innovation: The beverage market is competitive and constantly evolving. Vita Coco could develop new and innovative beverage products that appeal to consumer trends.

View narrativeUS$29.10

FV

20.5% overvalued intrinsic discount11.74%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

2 months ago author updated this narrative