Catalysts

About Riley Exploration Permian

Riley Exploration Permian is an independent oil and gas company focused on low cost, oil weighted development in the Permian Basin, supported by integrated midstream and power infrastructure.

What are the underlying business or industry changes driving this perspective?

- Although the integration of the Silverback acquisition has quickly lifted production well above underwriting and unlocked early cost synergies, the asset mix includes a large base of higher cost vertical wells that could limit how much LOE per BOE can actually decline. This may cap improvements to net margins and free cash flow.

- While the New Mexico gathering, compression and transmission build out is designed to remove takeaway constraints and support multi year oil and gas volume growth, the substantial remaining capital requirement and potential project level financing could dilute future upstream cash flow and pressure earnings if commodity prices soften.

- Although expanded gas handling capacity and improved access to Gulf Coast linked markets should eventually enhance realized prices and uplift revenue, persistent regional gas price volatility and the risk of prolonged weak basis differentials may blunt the benefit and hold back EBITDAX margin expansion.

- While behind the meter power generation and water and oil infrastructure projects are intended to structurally lower operating costs and improve development flexibility, execution risk, rising power equipment costs and competing opportunities in the broader energy transition could slow cost reductions and keep net margins below potential.

- Although disciplined capital allocation and low reinvestment rates have supported strong free cash flow and a growing dividend, sustaining double digit volume growth alongside midstream and power spending in a lower for longer oil price environment may force tougher trade offs. This may constrain future revenue growth and earnings per share.

Assumptions

This narrative explores a more pessimistic perspective on Riley Exploration Permian compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

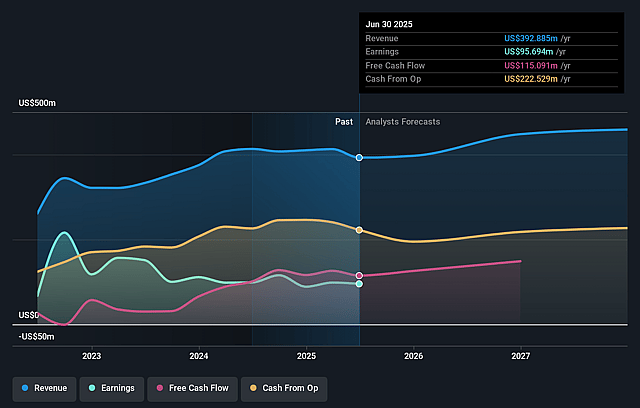

- The bearish analysts are assuming Riley Exploration Permian's revenue will grow by 8.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 21.7% today to 48.0% in 3 years time.

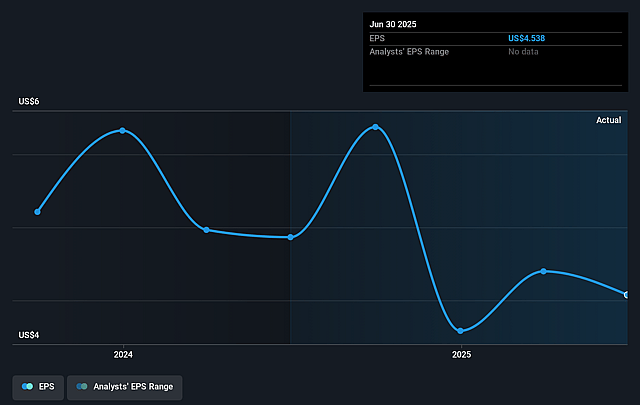

- The bearish analysts expect earnings to reach $241.3 million (and earnings per share of $10.73) by about December 2028, up from $86.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.3x on those 2028 earnings, down from 7.0x today. This future PE is lower than the current PE for the US Oil and Gas industry at 13.3x.

- The bearish analysts expect the number of shares outstanding to grow by 2.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.23%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The long term build out of New Mexico midstream infrastructure requires roughly $130 million of capital and potentially additional expansion. If oil prices sit near or below $55 for an extended period, project level financing or higher leverage could crowd out upstream investment and put pressure on free cash flow and earnings.

- Silverback brought a large base of higher cost vertical wells with LOE of about $13 per barrel compared to legacy $8.50 levels. If workover intensity remains elevated or synergies are slower than expected, structurally higher operating costs could cap margin expansion and reduce net margins.

- Persistent regional weakness in Permian gas and NGL markets, as seen with negative gas and NGL revenues and widespread voluntary shut ins, could continue despite added compression and takeaway. This could limit uplift from associated gas and constrain revenue and EBITDAX margins over the long term.

- The strategy depends on maintaining and growing oil volumes with a relatively low reinvestment rate. If service costs fail to fall further, drilling and completion savings reverse, or well performance in New Mexico underwhelms, sustaining double digit growth could require higher CapEx, which could erode free cash flow and dividend coverage.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Riley Exploration Permian is $36.0, which represents up to two standard deviations below the consensus price target of $46.0. This valuation is based on what can be assumed as the expectations of Riley Exploration Permian's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $56.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $502.7 million, earnings will come to $241.3 million, and it would be trading on a PE ratio of 4.3x, assuming you use a discount rate of 7.2%.

- Given the current share price of $27.35, the analyst price target of $36.0 is 24.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Riley Exploration Permian?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.