Last Update06 May 25

Key Takeaways

- Strategic infrastructure investments in New Mexico enhance operational control and create new revenue opportunities, positively affecting future earnings.

- Improved operational efficiencies and strategic capital allocation support better net margins and free cash flow, enhancing growth potential and earnings.

- The company's focus on infrastructure projects in New Mexico and ERCOT power generation carries significant financial and operational risks that could impact revenue and cash flow.

Catalysts

About Riley Exploration Permian- An independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil, natural gas, and natural gas liquids in Texas and New Mexico.

- The shift in development activity to New Mexico, where Riley Exploration Permian sees significant long-term growth potential, is expected to impact future revenue growth positively. The investment in midstream infrastructure will enhance operational control, optimize gas flow, and open commercial opportunities with third-party producers, contributing to increased future revenue.

- Riley's strategic development of a high-pressure natural gas pipeline and related infrastructure projects in New Mexico signifies improved transportation and processing capabilities. These enhancements will secure current takeaway needs while facilitating future production growth and third-party volumes, which could potentially increase future earnings through added revenue streams.

- The expansion of the power joint venture to include new power generation for the sale of energy into the ERCOT market underscores a move to capitalize on favorable market fundamentals. This initiative is likely to support improved net margins due to the higher-margin nature of energy sales.

- Ongoing improvements in operational efficiencies, such as cost reductions in lateral drilling and workovers, will likely support better net margins. The decreased drilling and completion costs per foot coupled with proactive maintenance strategies indicate a capability to maintain or lower operating expenses, thus positively affecting future earnings.

- Riley's commitment to maintaining balance sheet flexibility and strategic capital allocation, alongside the potential acceleration of the midstream project to start generating midstream revenue sooner, is poised to enhance free cash flow and support future growth initiatives, thereby positively impacting overall earnings.

Riley Exploration Permian Future Earnings and Revenue Growth

Assumptions

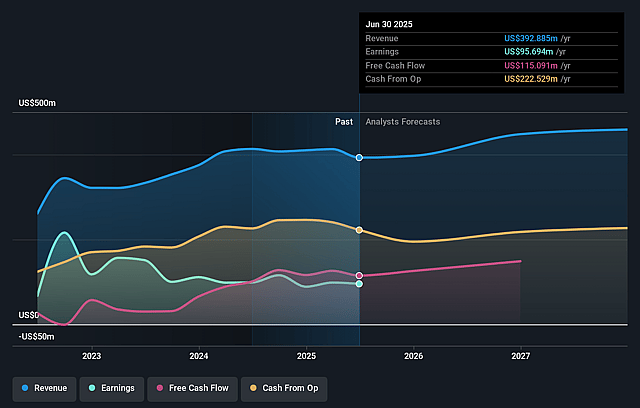

How have these above catalysts been quantified?- Analysts are assuming Riley Exploration Permian's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.7% today to 46.3% in 3 years time.

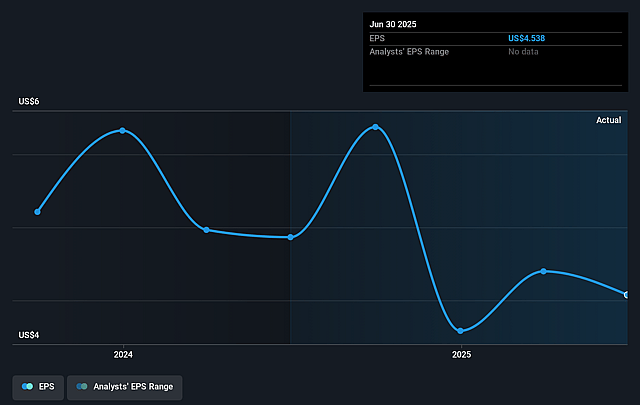

- Analysts expect earnings to reach $203.1 million (and earnings per share of $9.07) by about May 2028, up from $88.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.3x on those 2028 earnings, up from 6.0x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Riley Exploration Permian Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company plans significant capital expenditures related to the New Mexico midstream project and ERCOT power generation, which may strain financial resources or delay free cash flow generation, affecting its overall earnings.

- Shifting focus to New Mexico for development involves risk from regulatory hurdles and right-of-way approvals, potentially impacting the timeline for production and revenue growth.

- The company's reliance on infrastructure investments for growth carries execution risk; any delays or operational issues could hinder revenue from new projects and impact net margins.

- Competitive and operational challenges in the ERCOT power market or gas market fluctuations could limit the expected increase in third-party revenue, affecting net income and long-term financial outlook.

- Increased drilling activity and development costs, especially with a back-end weighted approach in 2025, may not immediately convert to production gains, potentially impacting revenues and cash flow in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $50.5 for Riley Exploration Permian based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $438.7 million, earnings will come to $203.1 million, and it would be trading on a PE ratio of 6.3x, assuming you use a discount rate of 6.7%.

- Given the current share price of $24.96, the analyst price target of $50.5 is 50.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.