Key Takeaways

- Centrus is positioned to dominate U.S. nuclear fuel supply, with policy support and first-mover advantages driving superior revenue and margin growth prospects.

- Their localized supply chain and proven technology insulate operations from geopolitical risks, securing sustained pricing power and high-margin, long-term contracts.

- Reliance on a limited customer base, regulatory shifts, technological changes, and global supply risks threaten Centrus Energy's revenue stability, growth prospects, and profit margins.

Catalysts

About Centrus Energy- Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

- While analyst consensus acknowledges Centrus' HALEU and LEU contract wins as significant for revenue, it likely understates the compounded impact of an accelerating U.S. policy push for nuclear fuel independence; Centrus' unique position as the only proven, U.S.-owned enricher means they are on track to dominate a national supply buildout, which could lead to step-changes in revenues far beyond current backlog.

- Analysts broadly agree that a $60 million centrifuge investment secures a first-mover advantage, but this could actually mark the start of exponential operating leverage for Centrus; as the only domestic manufacturer scaling rapidly, they could achieve best-in-class margins through cost leadership, driving substantial EBITDA expansion as the market for domestic fuel booms.

- The surge in demand for secure, domestically-sourced nuclear fuel, accelerated by government tariffs and growing bipartisan support, puts Centrus in a near-monopolistic position for both current and future advanced reactor fuel needs, supporting long-term pricing power and sustainably elevated gross margins.

- As the global decarbonization trend drives heightened investment in nuclear to support AI, data center, and electrification loads, Centrus' established technology and proven delivery record uniquely enables them to capture multi-decade, high-margin supply deals, reflecting in both revenue and backlog well beyond what is currently disclosed.

- Centrus' deep supply chain localization-now spanning numerous states-insulates them almost entirely from geopolitical shocks, enabling uninterrupted operation and delivery while foreign competitors face rising risk and costs, which will further enhance net margins and reduce downside earnings risk as energy security becomes a national imperative.

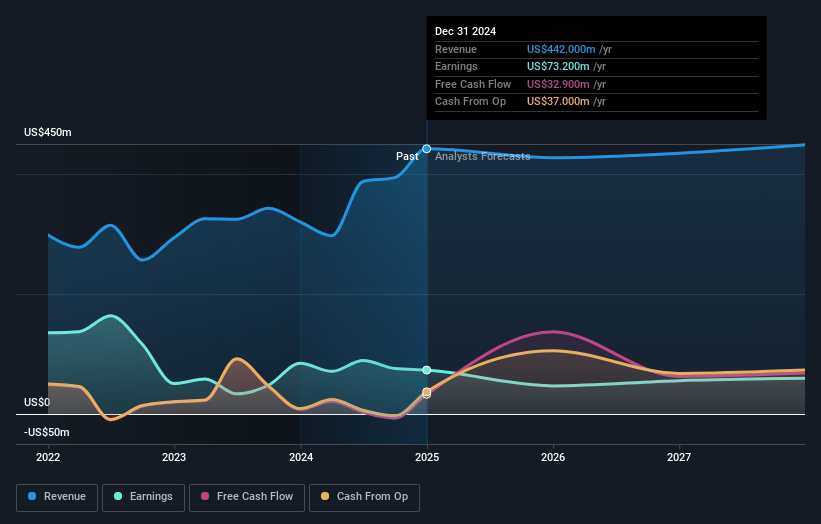

Centrus Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Centrus Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Centrus Energy's revenue will grow by 21.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 22.6% today to 11.8% in 3 years time.

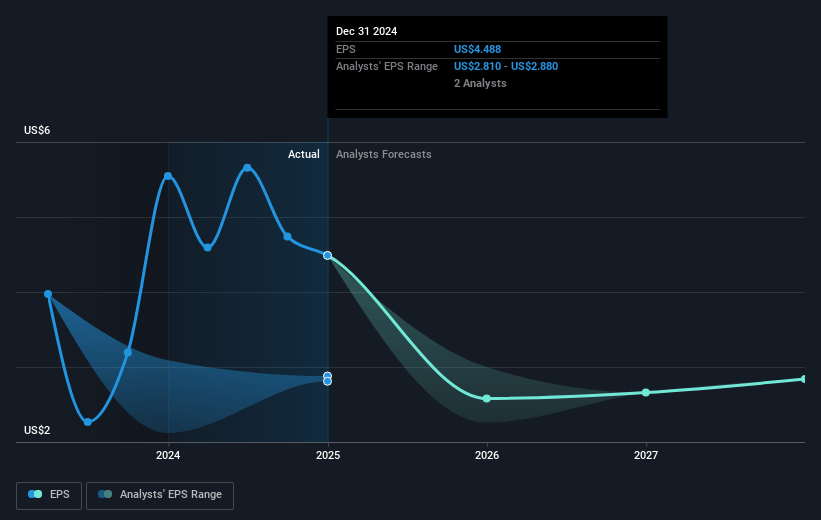

- The bullish analysts expect earnings to reach $100.4 million (and earnings per share of $5.94) by about July 2028, down from $106.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 68.5x on those 2028 earnings, up from 33.0x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.5x.

- Analysts expect the number of shares outstanding to grow by 4.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

Centrus Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term secular opposition to nuclear power and increased policy focus on renewable energy and decarbonization efforts may constrain future nuclear plant build-outs, reducing demand for Centrus Energy's enrichment services and negatively affecting top-line revenue growth over time.

- Centrus' business remains heavily reliant on multi-year contracts with a small number of large customers, including the U.S. government and government-related entities, making it vulnerable to contract loss or renegotiation which creates risk to revenue stability and could cause volatility in annual earnings.

- Despite a strong cash balance, Centrus faces significant capital expenditure requirements to modernize, expand, and maintain enrichment capabilities, and failure to secure timely public and private funding or government awards could strain cash flow, limit investment in growth opportunities, and pressure net margins.

- Proliferation of new reactor technologies, such as small modular reactors and alternative enrichment methods, may alter the nuclear fuel supply chain and bypass traditional enrichment models, ultimately reducing market share and compressing Centrus Energy's future revenues and profit margins.

- Geopolitical risks and continued reliance on enriched uranium imports from Russia and global suppliers expose Centrus to supply chain disruptions, regulatory changes, and trade restrictions, potentially leading to inventory issues or cost overruns that could harm operating income and diminish earnings reliability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Centrus Energy is $300.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Centrus Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $102.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $852.1 million, earnings will come to $100.4 million, and it would be trading on a PE ratio of 68.5x, assuming you use a discount rate of 6.4%.

- Given the current share price of $206.4, the bullish analyst price target of $300.0 is 31.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.