Key Takeaways

- High dependence on a few federal and utility contracts creates substantial revenue volatility and exposure to policy-driven risk.

- Rising operational costs, regulatory pressures, and infrastructure needs threaten long-term earnings and may necessitate significant outside capital.

- Unique leadership in advanced nuclear fuel, policy tailwinds, and long-term contracts position Centrus for stable revenue, growth, and higher margins as nuclear markets expand.

Catalysts

About Centrus Energy- Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

- Intensifying global momentum toward renewable energy and rapid deployment of advanced storage solutions could dramatically limit the expansion of nuclear power in the overall energy mix, shrinking Centrus Energy's long-term addressable market and suppressing future topline revenue growth.

- The company's very high customer concentration, relying primarily on a small number of federal and utility contracts, exposes it to material revenue volatility and downside risk in earnings if key contracts lapse or shift due to regulatory or policy changes, especially as public spending priorities are subject to political cycles.

- Potential overcapacity in uranium enrichment may develop if new entrants, including aggressive state-backed foreign competitors, ramp up production or accelerate licensing in key markets. This scenario could put sustained downward pressure on contract prices and compress Centrus's future net margins.

- Significant future capital expenditure requirements-especially to upgrade aging infrastructure and expand capacity-create the risk that Centrus will need substantial outside capital just to keep pace, potentially resulting in financial strain and disappointing returns on invested capital as amortization costs rise faster than anticipated revenue.

- Escalating regulatory burdens, compliance costs, and heightened geopolitical barriers to export-particularly in light of tightening nuclear non-proliferation controls and risk of international market access restrictions-are likely to increase ongoing operational expenses and diminish the company's earnings power over the long term.

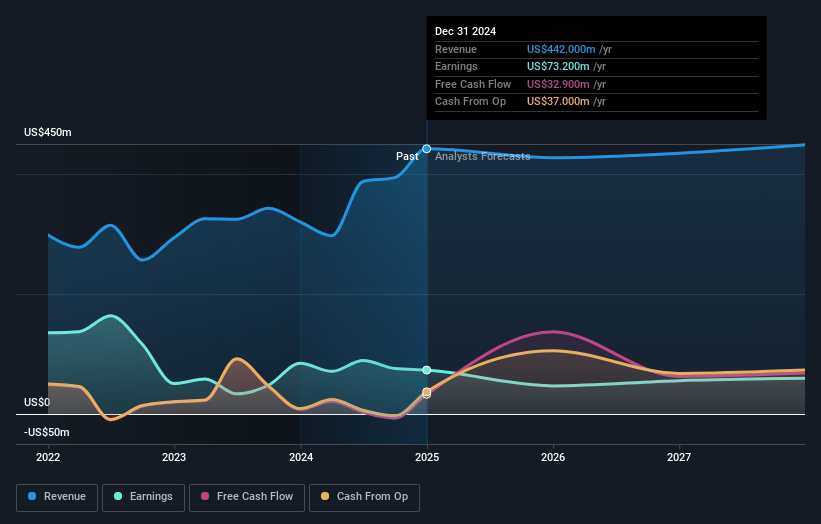

Centrus Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Centrus Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Centrus Energy's revenue will decrease by 2.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 22.6% today to 5.7% in 3 years time.

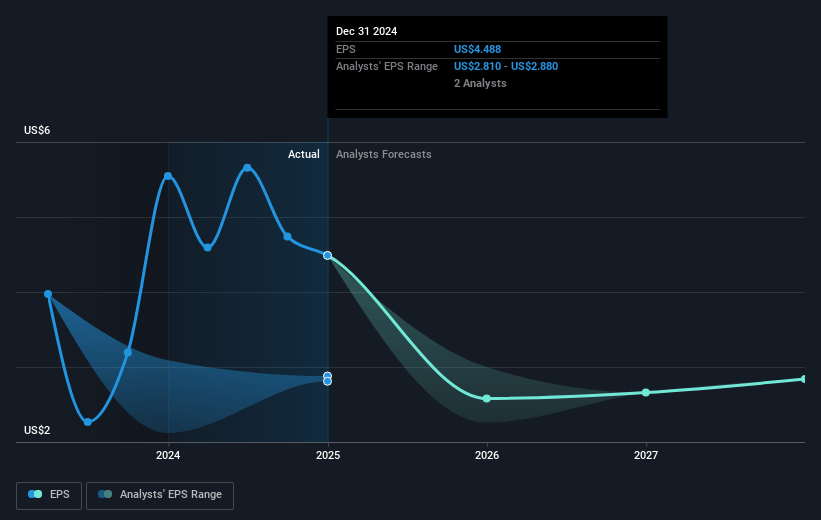

- The bearish analysts expect earnings to reach $25.0 million (and earnings per share of $1.21) by about July 2028, down from $106.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 93.5x on those 2028 earnings, up from 36.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 4.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.42%, as per the Simply Wall St company report.

Centrus Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Centrus Energy is uniquely positioned as the only U.S.-based licensed producer of High-Assay Low-Enriched Uranium (HALEU), which gives it a first-mover advantage for supplying advanced reactors and national security needs-this could support strong revenue growth and higher margins as new nuclear technologies commercialize.

- The company has a robust $3.8 billion backlog running through 2040, underpinned by long-term, multi-year customer contracts and significant contingent LEU sales agreements that offer earnings stability and predictable recurring revenue.

- Centrus is benefiting from a global push for decarbonization and energy security, with bipartisan political support in the U.S. and direct advocacy from Congressional leaders-this trend is likely to drive sustained investment in nuclear energy, expanding the company's future addressable market and positively impacting top-line growth.

- The U.S. government has appropriated $3.4 billion for domestic nuclear fuel production, and Centrus is competitively positioned to receive a sizable portion of these funds due to its proven technology and domestically sourced supply chain, potentially providing significant funding for growth, increased enrichment capacity, and improved profitability.

- Continuous investment in supply chain resiliency, technology readiness, and expanding production capacity is likely to enhance Centrus' ability to capture premium pricing and realize economies of scale, contributing to improved net margins and overall financial strength over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Centrus Energy is $102.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Centrus Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $102.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $439.8 million, earnings will come to $25.0 million, and it would be trading on a PE ratio of 93.5x, assuming you use a discount rate of 6.4%.

- Given the current share price of $227.26, the bearish analyst price target of $102.0 is 122.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.