Last Update19 Aug 25Fair value Increased 5.70%

Analysts have raised Gran Tierra Energy’s price target to $6.58, citing potential growth and diversification from its Canadian expansion and i3 Energy integration, while highlighting execution and balance sheet risks.

Analyst Commentary

- Company’s repositioning and entrance into Canada offer potential for differentiated growth and increased geographic diversification.

- Integration of the i3 Energy acquisition remains a key near-term focus and potential uncertainty for investors.

- Balance sheet improvement continues to be a primary area of investor scrutiny.

- The new market presence in Canada is viewed positively, but execution risks remain.

- Bearish analysts see comparatively more attractive investment opportunities among Canadian peers in the sector at this time.

What's in the News

- Repurchased 239,754 shares (0.67%) for CAD 1.05 million from April to July 2025, completing buyback of 1,180,752 shares (3.53%) for CAD 6.78 million under the November 2024 program.

- Reported working interest production before royalties of 47,196 boe/d for Q2 2025, up from 32,776 boe/d a year earlier; six-month production at 46,923 boe/d versus 32,509 boe/d previously.

Valuation Changes

Summary of Valuation Changes for Gran Tierra Energy

- The Consensus Analyst Price Target has risen from $6.14 to $6.58.

- The Future P/E for Gran Tierra Energy has risen from 2.93x to 3.11x.

- The Net Profit Margin for Gran Tierra Energy remained effectively unchanged, moving only marginally from 14.80% to 14.97%.

Key Takeaways

- Production growth and operational efficiencies are driving higher sales potential, improved margins, and extended field life across key geographies.

- Disciplined capital management and strategic project participation enhance financial resilience, reduce risk, and support the company's long-term growth prospects.

- Heavy reliance on vulnerable regional operations, volatile oil prices, and high leverage exposes future profitability to market, operational, refinancing, and energy transition risks.

Catalysts

About Gran Tierra Energy- Engages in the exploration and production of oil and gas properties in Colombia, Canada, and Ecuador.

- Despite weaker Brent pricing, Gran Tierra is demonstrating strong production growth across Colombia, Ecuador, and Canada, supported by successful drilling, operational efficiencies, and enhanced oil recovery-positioning the company to benefit from sustained global oil demand in hard-to-abate sectors, pointing to potential upside for future sales volumes and revenue.

- Significant reductions in per-barrel operating costs through technology adoption and waterflood optimizations (notably in Cohembi, Costayaco, and Acordionero) are expanding margins and set to extend field life, directly supporting higher long-term production and improved net margins.

- The company's proactive capital management, including accelerated debt reduction, asset sales, portfolio optimization, non-core divestments, and securing competitive prepayment facilities, is likely to improve balance sheet resilience and lower interest expenses, leading to enhanced net income and long-term equity returns.

- Participation in large-scale, low-cost international resource plays (notably the Azerbaijan MOU) offers the prospect for significant reserve and production additions, potentially amplifying future growth as global upstream underinvestment sustains a supportive oil price environment-positively impacting both long-term revenue and cash flow visibility.

- Gran Tierra's disciplined approach to capital allocation, systematic hedging, and strategic focus in politically favorable jurisdictions such as Colombia helps secure reliable cash flows and mitigates price volatility, supporting stable earnings while positioning the company to capture upside as industry supply discipline underpins medium-term margin expansion.

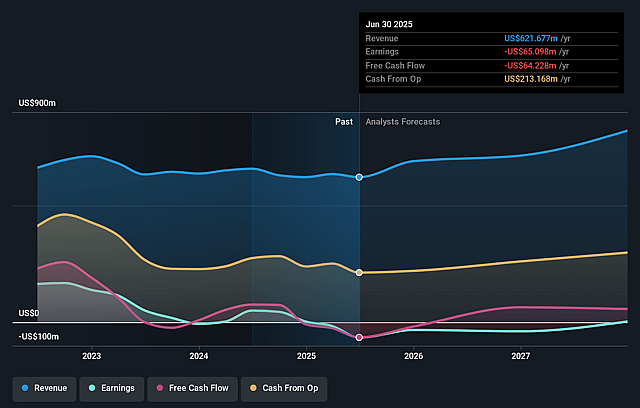

Gran Tierra Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gran Tierra Energy's revenue will grow by 10.7% annually over the next 3 years.

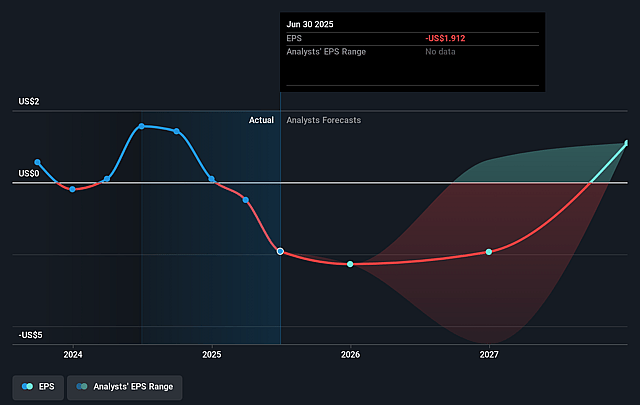

- Analysts are not forecasting that Gran Tierra Energy will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Gran Tierra Energy's profit margin will increase from -10.5% to the average US Oil and Gas industry of 14.8% in 3 years.

- If Gran Tierra Energy's profit margin were to converge on the industry average, you could expect earnings to reach $124.4 million (and earnings per share of $2.89) by about September 2028, up from $-65.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.1x on those 2028 earnings, up from -2.2x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.5%, as per the Simply Wall St company report.

Gran Tierra Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained weakness or volatility in Brent oil prices, as evidenced by an 11% QoQ and 22% YoY decline and the resulting decrease in sales revenue despite record production, signals ongoing exposure to macro oil price trends and the risk that long-term oil demand erosion or oversupply could pressure Gran Tierra's future revenues and net margins.

- Concentration of reserves and operations in Colombia and Ecuador increases the company's exposure to local disruptions (e.g., blockades, pipeline interruptions, heavy rains, regulatory delays in field development approvals), which could impair reliability of production and adversely impact revenue and earnings stability over the long term.

- Despite recent improvements, persistent high leverage (12-month trailing net debt to adjusted EBITDA at 2.3x) and reliance on credit facilities and prepayment loans for liquidity introduce refinancing and interest rate risks, which may limit flexibility for capital investments and weigh on future net income and shareholder returns.

- Execution risk remains on new explorations (e.g., in Ecuador and potential future entry into Azerbaijan) and mature field management, where failure to maintain or grow output could lead to declining production volumes, undermining future revenue streams and eroding overall profitability.

- The global energy transition-driven by accelerating regulatory pressures, rising ESG scrutiny, and long-term secular decline in fossil fuel demand-poses financial headwinds through potentially higher compliance and financing costs, future stranded asset risk, and the prospect of institutional investor divestment, collectively threatening Gran Tierra's long-term earnings and capital access.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.492 for Gran Tierra Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $843.0 million, earnings will come to $124.4 million, and it would be trading on a PE ratio of 3.1x, assuming you use a discount rate of 11.5%.

- Given the current share price of $4.06, the analyst price target of $6.49 is 37.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.