Narratives are currently in beta

Key Takeaways

- Heavy refinery maintenance and weak refining margins may pressure earnings, potentially impacting future growth if these conditions persist.

- High shareholder returns through payouts and buybacks could challenge earnings per share if not supported by strong operational cash flow.

- Successfully executed strategic projects and capital discipline indicate confidence in enhanced earnings, margin strength, and revenue growth amidst tightening supply-demand fundamentals.

Catalysts

About Valero Energy- Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

- Heavy refinery maintenance and a weak margin environment in the refining segment have pressured recent earnings, potentially impacting future revenue growth if similar conditions persist.

- Although there's commitment to capital projects aimed at enhancing earnings, such as the Diamond Green Diesel Sustainable Aviation Fuel (SAF) project, heavy investments could put pressure on net margins if returns do not materialize as expected.

- Improving diesel demand and anticipated OPEC+ crude supply increases could boost refining margins, but if these do not materialize or are offset by higher costs, it could dampen earnings.

- Announced refinery shutdowns and limited capacity additions beyond 2025 are expected to tighten supply-demand balances, but any delays or changes could impact long-term revenue and margin expectations.

- Aggressive shareholder returns through high payout ratios and buybacks have been emphasized, but sustaining this in a lower margin environment might challenge earnings per share if not supported by cash flow from operations.

Valero Energy Future Earnings and Revenue Growth

Assumptions

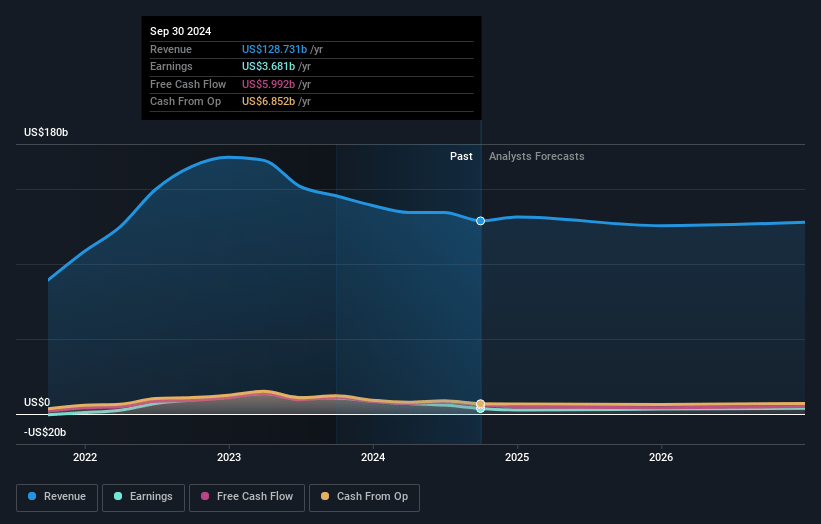

How have these above catalysts been quantified?- Analysts are assuming Valero Energy's revenue will decrease by -4.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 2.9% today to 2.7% in 3 years time.

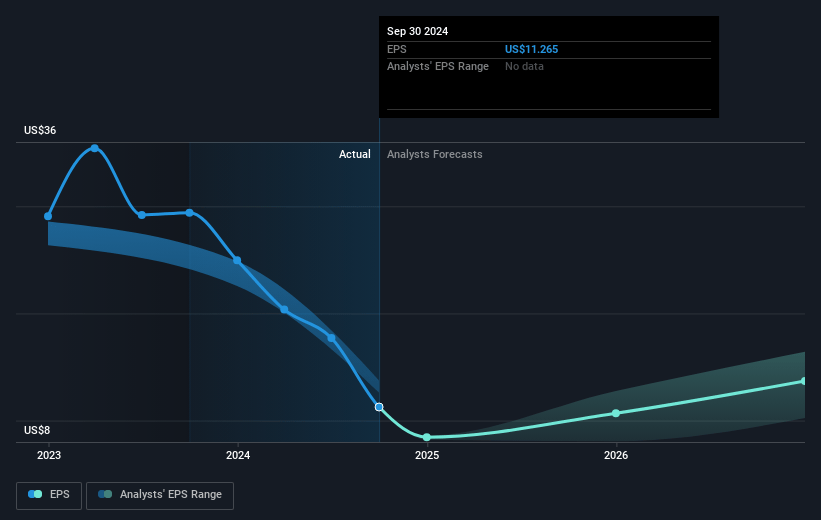

- Analysts expect earnings to reach $3.0 billion (and earnings per share of $10.29) by about November 2027, down from $3.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.2 billion in earnings, and the most bearish expecting $2.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2027 earnings, up from 12.0x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 2.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Valero Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Valero Energy has successfully executed strategic projects like the Diamond Green Diesel Sustainable Aviation Fuel (SAF) project, which was completed on schedule and under budget. This could enhance earnings capability and expand their competitive advantage, potentially supporting revenue growth.

- The company reported strong shareholder returns with a high payout ratio, and their commitment to this strategy, coupled with capital discipline, suggests confidence in continued earnings and margin strength.

- Valero is optimistic about improving diesel demand and believes that increasing OPEC crude supply will widen sour crude differentials, potentially boosting refining margins and benefiting net margins and earnings.

- The existing announced refinery shutdowns and limited capacity additions beyond 2025 are expected by Valero to tighten product supply-demand fundamentals over the long term, which could support revenue and margin improvement.

- Even though refining capacity is being added globally, Valero anticipates that long-term demand growth will surpass these additions, which indicates confidence in revenue growth through improved operating conditions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $150.96 for Valero Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $176.0, and the most bearish reporting a price target of just $123.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $113.6 billion, earnings will come to $3.0 billion, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of $139.56, the analyst's price target of $150.96 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives