Key Takeaways

- Fleet modernization and prudent capital management strengthen margins, earnings resilience, and financial flexibility while supporting compliance with environmental regulations.

- Strong long-term contracts with major oil companies and selective exposure to rising freight rates drive revenue stability and potential dividend growth.

- Heavy reliance on oil transport, mounting debt, and client concentration leave Tsakos Energy Navigation vulnerable to sector volatility, decarbonization pressures, and tightening financing conditions.

Catalysts

About Tsakos Energy Navigation- Provides seaborne crude oil and petroleum product transportation services worldwide.

- The company's significant investment in fleet modernization-with a focus on eco-friendly, dual-fuel, and high-specification vessels-positions it to secure higher time charter rates from energy majors, control operating expenses, and meet upcoming environmental regulations, all of which should improve net margins and earnings resilience.

- Growing long-term contracted revenue backlog ($3.7–4.0 billion, representing more than $120 per share) with blue-chip oil majors amid global energy security concerns provides strong revenue visibility and reduces earnings volatility, supporting prospective dividend growth and underpinning a higher intrinsic valuation.

- Persistent global energy demand growth, especially from emerging markets and increased ton-mile demand due to supply diversification and shifting trade routes, is translating into fleet utilization rates near 97% and solid daily revenues, indicating a positive trajectory for top-line growth.

- The company's strategic pivot toward more profit-sharing contracts and selective spot exposure allows it to capture upside from potentially higher freight rates as aging global fleets and regulatory-driven scrapping constrain supply, contributing positively to earnings growth.

- Prudent capital management-highlighted by consistent debt reduction, sale of older vessels at premium prices, and reinvestment into modern ships-strengthens the balance sheet, lowers interest expense, and enhances financial flexibility, supporting both future earnings and return on equity.

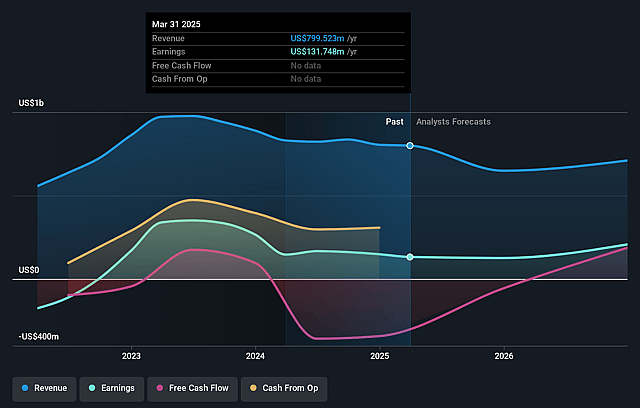

Tsakos Energy Navigation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tsakos Energy Navigation's revenue will decrease by 12.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.5% today to 24.4% in 3 years time.

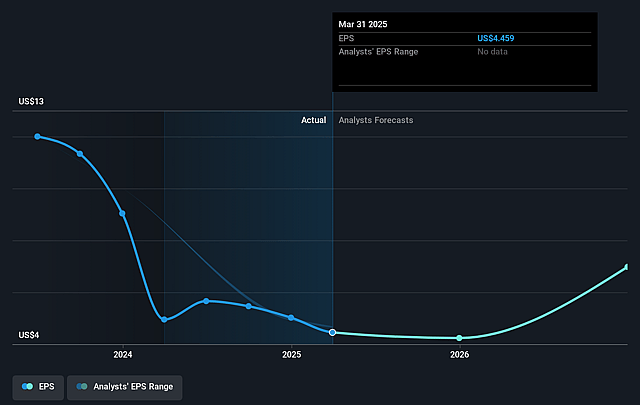

- Analysts expect earnings to reach $128.7 million (and earnings per share of $4.31) by about September 2028, down from $131.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, up from 5.1x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.78%, as per the Simply Wall St company report.

Tsakos Energy Navigation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy dependence on oil and fossil fuel transport exposes Tsakos Energy Navigation to long-term risks from global decarbonization efforts, increased adoption of renewables, and the potential plateau or decline in oil demand, which could negatively impact future revenues and utilization rates.

- The company continues to invest heavily in newbuilds and eco-friendly vessels, but this results in rising capital expenditures and increased depreciation; if freight rates weaken or fleet oversupply emerges, this could pressure net margins and earnings sustainability.

- Although the company touts a young fleet and strong relations with major energy clients, there is concentration risk, as revenues depend on a small number of major oil companies; regulatory changes, geopolitical tensions, or shifts in client strategies could result in volatile earnings or bad debt.

- Some improvement in revenues and utilization stems from asset divestitures and a cyclical spot market, but with spot exposure being reduced in favor of time charters, Tsakos may have limited upside in peak markets and could be locked into lower rates if shipping demand falters, impacting overall earnings growth.

- High net debt levels (net debt to capital over 40%) and ongoing refinancing needs could lead to elevated interest expenses, particularly as ESG concerns make accessing cheap financing more difficult for oil transporters, thereby affecting profitability and balance sheet flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.333 for Tsakos Energy Navigation based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $527.8 million, earnings will come to $128.7 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 15.8%.

- Given the current share price of $22.43, the analyst price target of $30.33 is 26.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.