Key Takeaways

- Strong contract coverage and modernization efforts position Tsakos for market-leading operational efficiency, margin expansion, and dividend growth despite industry volatility.

- Unique fleet advantages and trusted industry relationships enable Tsakos to benefit from tightening supply, rising demand, and shifting global energy dynamics.

- Heightened regulatory, environmental, and financial pressures threaten Tsakos Energy Navigation's profitability, operational flexibility, and long-term demand for crude oil shipping.

Catalysts

About Tsakos Energy Navigation- Provides seaborne crude oil and petroleum product transportation services worldwide.

- While analyst consensus expects long-term revenue stability from the $4 billion in contracted revenue and shuttle tanker employment, this likely understates the full earnings power, as nearly 87% of the fleet is now on secured contracts, positioning Tsakos to weather downturns and potentially surprise the market with outsized earnings consistency and dividend growth.

- Analyst consensus sees fleet modernization and divestment of older vessels improving margins, but the impact may be even greater-management's focus on building critical mass in high-spec VLCCs and adoption of dual-fuel technology could allow Tsakos to command market-leading charter rates and operating efficiencies, resulting in structural net margin expansion far ahead of peers.

- The market appears to overlook the compounding benefit from global energy demand growth, especially from emerging markets, which is likely to drive both utilization and day rates to record highs for Tsakos's modern, flexible fleet-setting the stage for sustained multi-year revenue acceleration.

- The acute supply squeeze from underinvestment in global tanker newbuilds and an aging competitor fleet stands to dramatically increase asset values and spot rates, giving Tsakos-with one of the youngest, most compliant fleets-tangible asset appreciation and potential windfall profits directly boosting book value and earnings.

- With tightening regulatory and geopolitical focus on energy security and marine logistics, Tsakos's status as a trusted partner to top-tier oil majors uniquely positions it to capture premium, multi-year contracts as global routes shift, underappreciated drivers of forward cash flow and long-term earnings power.

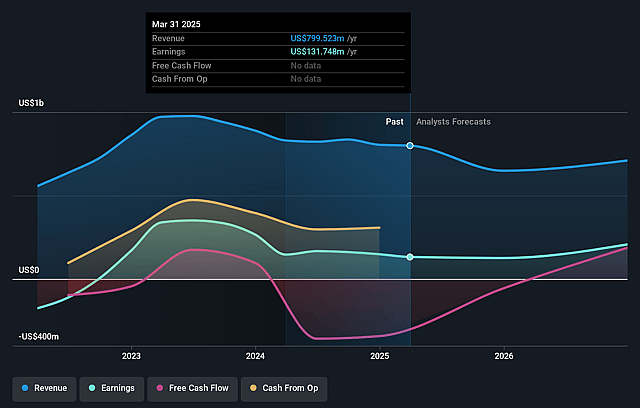

Tsakos Energy Navigation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tsakos Energy Navigation compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Tsakos Energy Navigation's revenue will decrease by 7.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.5% today to 27.2% in 3 years time.

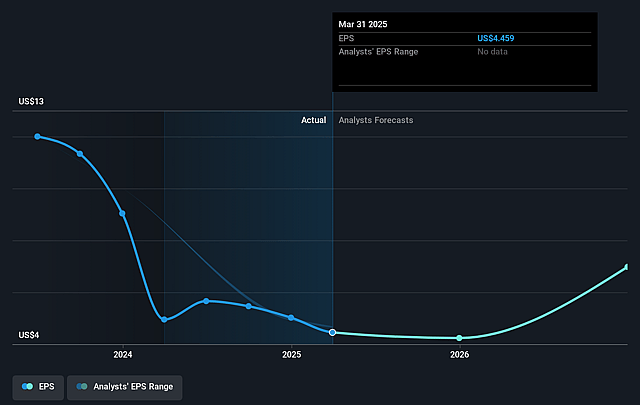

- The bullish analysts expect earnings to reach $174.6 million (and earnings per share of $5.86) by about September 2028, up from $131.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, up from 5.1x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.78%, as per the Simply Wall St company report.

Tsakos Energy Navigation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing global decarbonization and stricter emissions regulations will likely erode long-term demand for crude oil shipping, which poses structural risk to Tsakos Energy Navigation's ability to maintain or increase revenue over time.

- Rising adoption of alternative and renewable energy sources is expected to reduce the scale of global seaborne crude oil trade, undermining the long-run earnings base for Tsakos even as their current contracted backlog appears strong.

- Despite stated investments in newer vessels, the company remains exposed to regulatory and competitive pressures from IMO emissions standards (such as EEXI and CII) that could necessitate costly retrofitting or accelerated scrapping of less-efficient ships, leading to higher operating expenses and pressure on net margins.

- Persistent ESG-driven divestment from hydrocarbon-linked companies may restrict Tsakos Energy Navigation's access to financing and increase borrowing costs, which would negatively impact profitability and restrict strategic flexibility in capital deployment.

- The heavy reliance on spot and short-term profit-sharing charters, combined with a rising debt load from ongoing fleet renewal, increases exposure to revenue volatility and refinancing risk, which could depress earnings and dilute shareholder value if tanker market cycles turn less favorable.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tsakos Energy Navigation is $40.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tsakos Energy Navigation's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $642.3 million, earnings will come to $174.6 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 15.8%.

- Given the current share price of $22.43, the bullish analyst price target of $40.0 is 43.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Tsakos Energy Navigation?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.