Key Takeaways

- Decarbonization trends and stricter regulations threaten long-term demand, earnings, and require costly upgrades that pressure profitability.

- Fleet aging and investor reluctance toward fossil fuel shipping heighten financial risk, making future growth and funding more challenging.

- Diversified charters, fleet modernization, revenue mix expansion, contract stability, and prudent financial management position Tsakos for resilient long-term earnings and margin growth.

Catalysts

About Tsakos Energy Navigation- Provides seaborne crude oil and petroleum product transportation services internationally.

- The accelerating global shift toward decarbonization and energy transition is expected to lead to a steady decline in oil demand over the coming decades, directly reducing the need for crude and product tanker shipping, which threatens long-term revenue and utilization rates for Tsakos Energy Navigation.

- Rapid adoption of electric vehicles and renewables in both established and emerging markets is projected to undercut future seaborne oil trade volumes and ton-mile demand, putting structural downward pressure on day rates and constraining the company's earnings growth potential.

- Escalating international regulatory mandates to cap greenhouse gas emissions, such as progressively tighter IMO targets, will likely force significant and recurring capital expenditures on vessel retrofits or replacements while also creating the risk of premature obsolescence for parts of the fleet, ultimately eroding net margins and free cash flow.

- Even with the current fleet renewal and diversification, an aging vessel profile exposes the company to rising operational costs and maintenance outlays, especially as older ships struggle to meet impending compliance standards, resulting in greater earnings volatility and weaker profitability over time.

- Potential capital flight from institutional investors avoiding fossil fuel-linked shipping operators may make it increasingly difficult or expensive for Tsakos to fund large-scale fleet investments or manage refinancing needs, leading to higher leverage ratios and financial stress that restricts future profit growth and dividend sustainability.

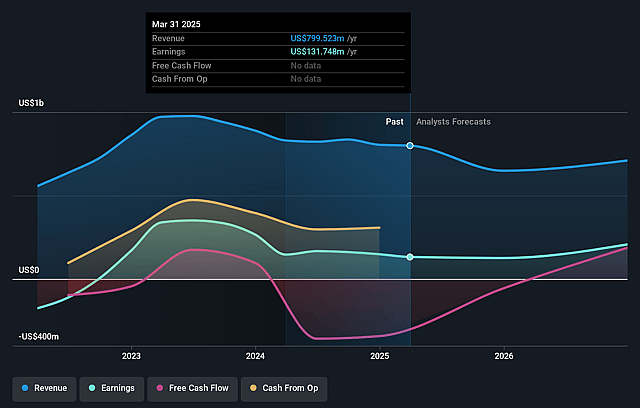

Tsakos Energy Navigation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tsakos Energy Navigation compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tsakos Energy Navigation's revenue will grow by 2.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 16.5% today to 30.6% in 3 years time.

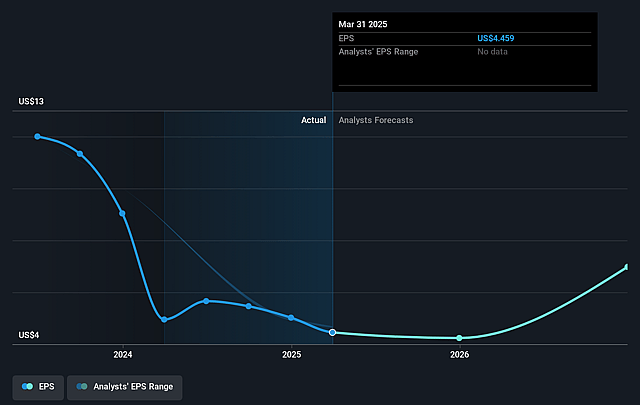

- The bearish analysts expect earnings to reach $264.3 million (and earnings per share of $8.9) by about June 2028, up from $131.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 3.7x on those 2028 earnings, down from 4.7x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.66%, as per the Simply Wall St company report.

Tsakos Energy Navigation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has secured a substantial $3.7 billion backlog of long-term, accretive charters with blue-chip clients such as ExxonMobil, Equinor, Shell, Chevron, TotalEnergies, and BP, which supports predictable and stable revenue and shields against short-term market volatility, thus helping to preserve earnings and net margins over time.

- Tsakos is executing a significant fleet renewal and modernization program, selling older vessels and replacing them with 30 contracted and newly acquired, energy-efficient and dual fuel-capable ships, which supports lower operating costs and enables compliance with environmental regulations, likely improving long-term profitability and margins.

- The company is strategically diversifying into LNG and shuttle tanker segments, including a major deal with Transpetro in Brazil for 9 shuttle tankers, which expands revenue sources beyond conventional oil transport and can contribute to future earnings stability and growth.

- Nearly 83% of Tsakos' fleet is employed on secured revenue contracts, while the company retains market upside through profit-sharing and spot-exposed vessels, providing a balance between stable cash flows and the opportunity to benefit from elevated spot rates, all of which support revenue and net income resilience.

- Long-term trends such as persistent global energy demand growth, fleet aging across the industry, and limited new tanker supply continue to support strong utilization and robust charter rates, which, combined with Tsakos' proactive balance sheet management and modest net debt, could help sustain or increase profit margins and earnings over the long-term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tsakos Energy Navigation is $21.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tsakos Energy Navigation's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $862.9 million, earnings will come to $264.3 million, and it would be trading on a PE ratio of 3.7x, assuming you use a discount rate of 15.7%.

- Given the current share price of $20.72, the bearish analyst price target of $21.0 is 1.3% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.