Key Takeaways

- Expansion into high-spec, energy-efficient vessels and long-term contracts may drive stable, annuity-like revenue streams and higher market valuation multiples.

- Strategic asset optimization and possible segment spinoffs could unlock significant stock re-rating, positioning the company ahead of less compliant competitors.

- Heavy reliance on crude transport, regulatory pressures, and capital constraints increase earnings volatility and threaten future profitability amid the accelerating global energy transition.

Catalysts

About Tsakos Energy Navigation- Provides seaborne crude oil and petroleum product transportation services internationally.

- While analysts broadly agree that the 9 new DP2 shuttle tankers with secured 15-year employment will add revenue stability, they may be underestimating the impact; the sheer scale, high-spec nature, and long contractual duration of these vessels could create an almost annuity-like revenue stream, fundamentally altering the company's earnings profile and supporting a structural uplift in both revenue consistency and valuation multiples.

- Analyst consensus recognizes the benefits of the $3.7 billion in forward-contracted revenues and the move to larger, more modern, energy-efficient vessels, but this view may be too conservative-TEN is not only expanding its fleet by over 30 percent with newer, greener ships, but is also poised to leap ahead of competitors as tightening global regulations and the aging world tanker fleet force high-cost, non-compliant operators to exit, bolstering TEN's market share and net margin well beyond current estimates.

- TEN's proven ability to consistently engage with major oil companies-even securing multiple, long-term renewals for vessels over 20 years old-shows an unrivaled reputation for operational safety and quality, positioning the company as a carrier of choice as global population growth and urbanization drive long-term energy consumption and demand for reliable transport, underpinning elevated charter rates and topline growth.

- With geopolitical tensions and shifting energy trade routes increasing voyage lengths and ton-mile demand, TEN's diversified, globally deployed fleet is disproportionately exposed to high-yield routes, offering outsized upside to revenue and earnings as regional and long-haul crude flows accelerate in a more fragmented market environment.

- Management's indication of potential strategic actions such as a spinoff of the shuttle/LNG segment-combined with disciplined divestment of older assets and prudent capital allocation-creates the potential for material multiple expansion, re-rating the stock from its abnormally low 2-3 times EBITDA valuation toward a level more appropriate for an industrial, cash-generative infrastructure-like business, thereby unlocking value that profoundly impacts both EPS and share price.

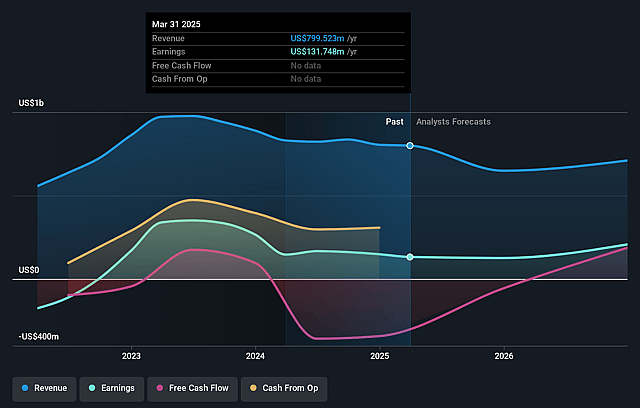

Tsakos Energy Navigation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tsakos Energy Navigation compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Tsakos Energy Navigation's revenue will decrease by 2.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.5% today to 42.0% in 3 years time.

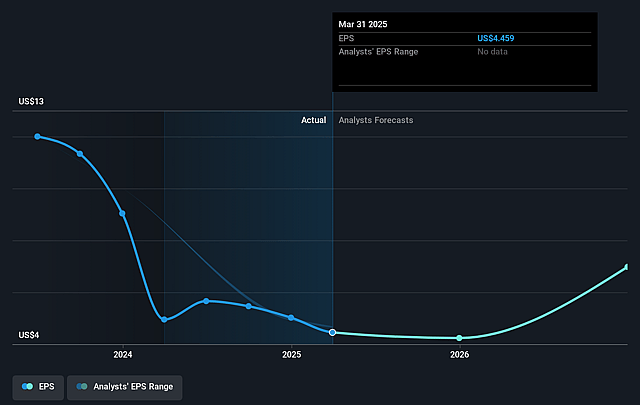

- The bullish analysts expect earnings to reach $313.2 million (and earnings per share of $10.52) by about August 2028, up from $131.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, up from 4.6x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.8x.

- Analysts expect the number of shares outstanding to grow by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.89%, as per the Simply Wall St company report.

Tsakos Energy Navigation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global shift toward renewable energy and electrification presents a long-term structural risk to Tsakos Energy Navigation, as decreasing global demand for seaborne crude oil transportation is likely to put pressure on vessel utilization rates and reduce the company's future revenue opportunities.

- Intensifying climate change regulations and mounting carbon pricing initiatives could substantially increase compliance and fleet upgrade costs, which may erode the company's net margins over the long run, especially as older vessels may not meet stricter environmental standards.

- The industry-wide move towards ESG investing has resulted in reduced investor appetite and tighter capital access for fossil fuel-linked companies like Tsakos, making it more difficult and expensive to fund future fleet modernization, which could in turn dampen earnings growth and depress the share price.

- Overcapacity risk remains a concern, as aggressive ordering of newbuilds-including Tsakos's ongoing expansion and the industry's history of cyclic over-ordering-could lead to a surplus of tankers, driving down freight rates and compressing both revenues and profit margins in the medium to long term.

- Despite some diversification into shuttle and LNG tankers, the company remains primarily focused on crude and product tankers, increasing its earnings volatility and long-term vulnerability as oil transport shrinks due to global decarbonization trends and evolving international trade patterns, which threatens stable revenue and long-term earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tsakos Energy Navigation is $40.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tsakos Energy Navigation's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $745.0 million, earnings will come to $313.2 million, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 15.9%.

- Given the current share price of $19.96, the bullish analyst price target of $40.0 is 50.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.