Key Takeaways

- Extremely limited new vessel supply, regulatory changes, and aging fleets could drive a sustained surge in freight rates, boosting Scorpio Tankers' earnings and market position.

- Rising free cash flow and capital allocation flexibility are set to support significant shareholder returns through accelerated buybacks and special dividends.

- Structural decline in petroleum demand, fleet renewal costs, and market volatility threaten long-term growth, profitability, and stability due to sector concentration and overcapacity risks.

Catalysts

About Scorpio Tankers- Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

- Analyst consensus sees a modest supply-demand tightening from refinery rationalization and fleet aging, but this likely underestimates the compounding effect of multi-year refinery closures and extremely limited net newbuild supply, which could trigger a structural and sustained spike in freight rates, significantly boosting Scorpio Tankers' revenue and earnings through the end of the decade.

- While analysts broadly agree that a strengthened balance sheet and debt reduction will lower interest costs and improve earnings stability, the market underappreciates Scorpio's capital allocation flexibility, which-combined with rising free cash flow and minimal future dry docking needs-sets the stage for substantial accelerated share buybacks and special dividends, maximizing total shareholder return and EPS growth.

- Long-term global population growth and urbanization, particularly in Asia and Africa, is driving persistent structural demand for refined products; this sustained underlying growth translates into higher vessel utilization over the next decade, underpinning consistently elevated revenues and supporting long-term earnings visibility.

- The slow pace of the global energy transition means oil and refined products will remain critical for developing economies for years to come; Scorpio Tankers' eco-efficient modern fleet is uniquely positioned to capture a greater share of this enduring demand, leading both to above-peer market share gains and higher average charter rates, amplifying both top-line growth and net margins.

- Intensifying regulatory hurdles and enforcement (especially around Russian and shadow fleet trade) are accelerating obsolescence of older tonnage and pushing up asset values for modern ships, enabling Scorpio Tankers to capture premium rates and enjoy rising vessel values, directly supporting balance sheet strength, net asset value growth, and potential gains from S&P activity.

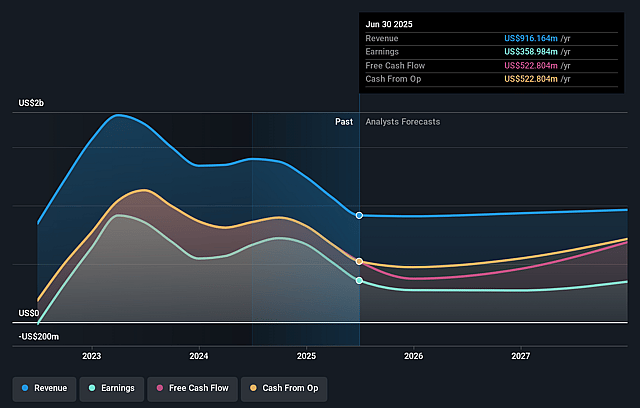

Scorpio Tankers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Scorpio Tankers compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Scorpio Tankers's revenue will grow by 5.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 39.2% today to 43.8% in 3 years time.

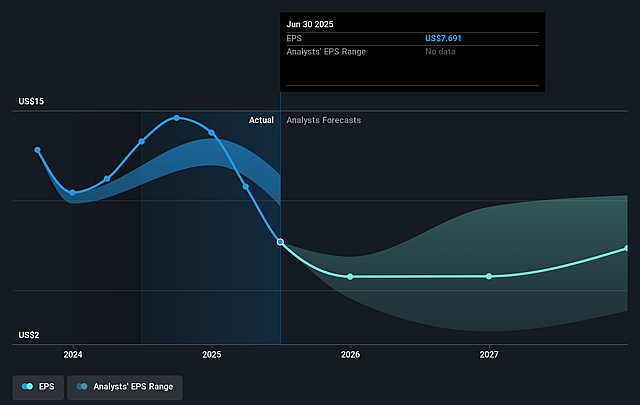

- The bullish analysts expect earnings to reach $473.9 million (and earnings per share of $9.84) by about September 2028, up from $359.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, up from 7.5x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.65%, as per the Simply Wall St company report.

Scorpio Tankers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift away from fossil fuels, combined with tightening regulatory decarbonization targets, threatens to structurally reduce long-term demand for refined petroleum products, which could eventually lower Scorpio Tankers' future revenues and vessel utilization rates.

- Technological advancements in alternative fuels, electrification, and changing energy infrastructure over time may reduce the need for petroleum product shipping, constraining Scorpio Tankers' addressable market and limiting long-term growth in both revenues and earnings.

- The company's relatively young but inevitably aging fleet will require significant capital investment for renewal or upgrades to comply with increasingly rigorous emissions standards, potentially pressuring free cash flow and reducing net margins as drydocking and capex requirements rise over time.

- The high operational leverage and dependence on volatile spot rates in a market that could gradually shrink exposes Scorpio Tankers to sharp swings in earnings and less predictable net income, limiting the consistency and reliability of profitability in the coming years.

- Persistent industry risks such as an expanding order book and potential overcapacity from cyclical newbuild orders may erode charter rates and create downward pressure on profitability, while limited diversification outside of product tankers increases the company's vulnerability to sector downturns and negatively impacts its revenue base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Scorpio Tankers is $75.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Scorpio Tankers's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $54.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $473.9 million, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 9.7%.

- Given the current share price of $57.13, the bullish analyst price target of $75.0 is 23.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.