Key Takeaways

- Strategic acquisitions in the Midstream and Chemicals segments are set to boost revenue and earnings growth through increased EBITDA.

- Portfolio optimization, including asset divestitures and shareholder returns, is expected to improve net margins and enhance shareholder value.

- High debt and refinery closure are squeezing margins, with renewable fuel uncertainties and asset disposals posing risks to future revenues.

Catalysts

About Phillips 66- Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

- The expansion and optimization of Phillips 66's Midstream business, including the acquisition of EPIC NGL and ongoing organic growth projects, are expected to significantly increase Midstream's mid-cycle adjusted EBITDA, supporting revenue and earnings growth.

- The achievement of cost reductions through business transformations and asset divestitures, combined with strategic investments to enhance clean product yield, positions the company to improve net margins in their Refining operations.

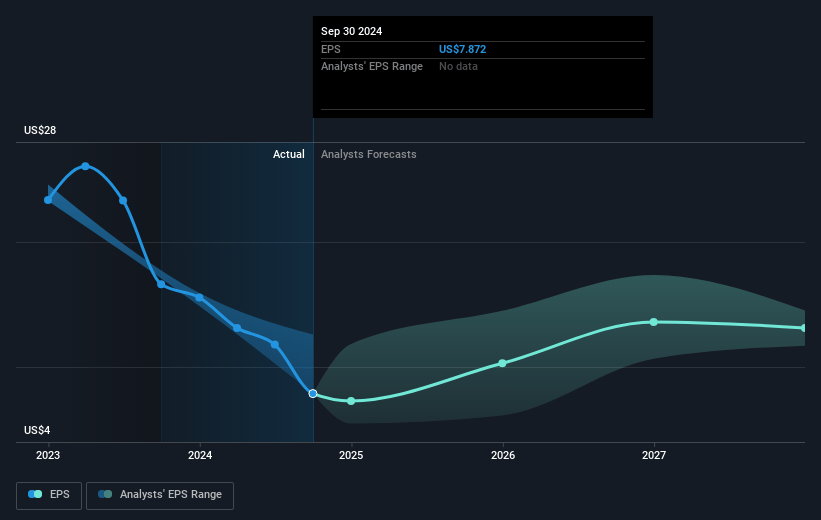

- Phillips 66's commitment to returning over 50% of operating cash flow to shareholders, coupled with strategic asset divestitures and debt reduction plans, is expected to significantly enhance earnings per share (EPS) through increased shareholder value.

- The anticipated startup of mega-projects in the Chemicals segment in the U.S. Gulf Coast and Qatar is expected to contribute to growth in Chemicals mid-cycle adjusted EBITDA, positively impacting revenue and earnings growth over the long term.

- The company's aggressive portfolio optimization strategy, which includes $3.5 billion in non-core asset dispositions, positions Phillips 66 to enhance its balance sheet and invest in higher-return initiatives, potentially leading to improved net margins and capital efficiency.

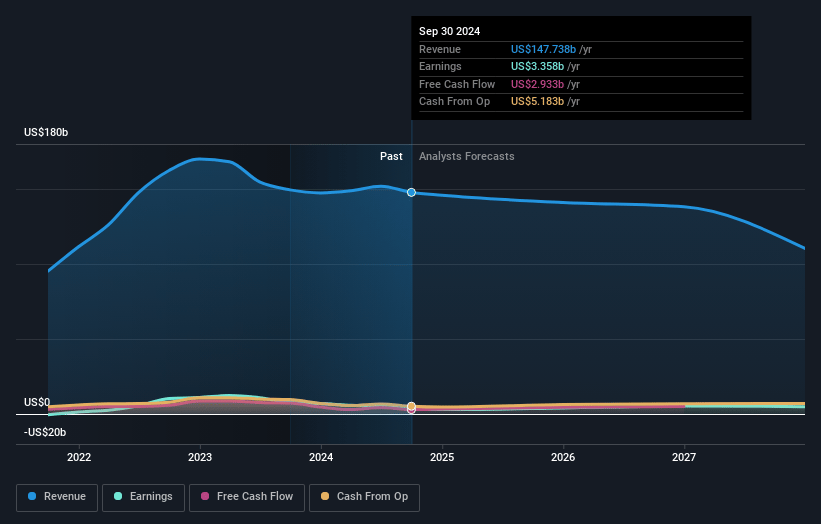

Phillips 66 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Phillips 66's revenue will decrease by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.5% today to 4.4% in 3 years time.

- Analysts expect earnings to reach $5.5 billion (and earnings per share of $14.64) by about March 2028, up from $2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, down from 24.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to decline by 3.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Phillips 66 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is managing a high net debt-to-capital ratio, which ended higher than its target level, impacting their balance sheet stability and potential future earnings.

- The planned closure of the Los Angeles Refinery by the end of 2025 will result in accelerated depreciation costs, affecting net margins and earnings.

- There is ongoing uncertainty in renewable fuels margins due to pending regulatory clarifications on credits like the PTC and BTC, creating potential volatility in future revenues.

- The refining segment is currently affected by weaker crack spreads and higher turnaround expenses, leading to lower earnings and posing a risk to future financial performance.

- The company's asset disposition strategy, while generating cash, could lead to an impact on future revenue streams if not carefully managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $137.448 for Phillips 66 based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $162.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $125.4 billion, earnings will come to $5.5 billion, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 8.1%.

- Given the current share price of $126.18, the analyst price target of $137.45 is 8.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

MS

mschoen25

Community Contributor

room for higher margins

GPT-4o Phillips 66 (PSX) is often considered undervalued for several reasons. Investment analysis typically looks at various factors to determine if a company's stock might be undervalued and whether it has the potential to achieve higher profit margins.

View narrativeUS$634.10

FV

80.1% undervalued intrinsic discount4.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

4 months ago author updated this narrative