Key Takeaways

- Deepening partnerships, multi-year contracts, and advanced rig capabilities are set to drive sustained global growth, reduced cyclicality, and robust earnings visibility.

- Innovation in technology, sustainability, and successful integration of acquisitions bolster margin expansion, cash flow, and position the company for superior shareholder returns.

- Long-term viability faces challenges from declining drilling demand, high debt, shrinking rig margins, aging assets, and exposure to volatile and concentrated markets.

Catalysts

About Nabors Industries- Provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the United States and internationally.

- Analyst consensus recognizes robust energy demand and major multi-year contracts as supporting growth, but the scale of SANAD's 10-year, 50-rig program-combined with follow-on tranche awards and near-total gas rig specialization-could turbocharge international revenues and provide unmatched multi-year earnings visibility, as tight partnership with Aramco solidifies Nabors as the region's drilling leader.

- While consensus notes margin expansion from automation and digital solutions, Nabors' Drilling Solutions gross margin is already at a best-in-class 53% with surging international tech adoption; rapid penetration of high-value regions and broad product line expansion can enable a major step-up in companywide EBITDA and net profit.

- Unprecedented international fleet optionality-with advanced, modular rigs ready for rapid redeployment across the Middle East, Latin America, and Asia-positions Nabors to capture outsized upside from global energy security initiatives and shifting resource development patterns, driving sustained topline growth and reducing cyclicality.

- Company-led innovation in enhanced oil recovery, carbon capture, and intelligent downhole tools aligns Nabors directly with emerging low-carbon mandates, opening new premium service streams and supporting revenue resilience as the oil & gas sector evolves under ESG pressures.

- Accelerating integration of Parker Wellbore is outpacing synergy forecasts, expanding Nabors' reach into offshore, Alaska, and complex international markets; this sets the stage for substantial, above-consensus free cash flow improvement and faster deleveraging, potentially enabling aggressive future shareholder returns.

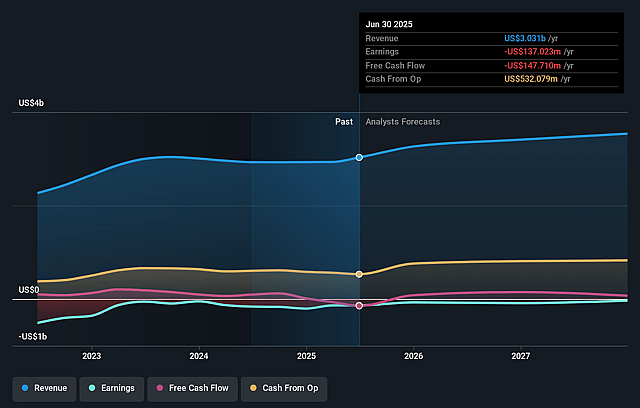

Nabors Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nabors Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nabors Industries's revenue will grow by 6.9% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Nabors Industries will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Nabors Industries's profit margin will increase from -4.5% to the average US Energy Services industry of 7.0% in 3 years.

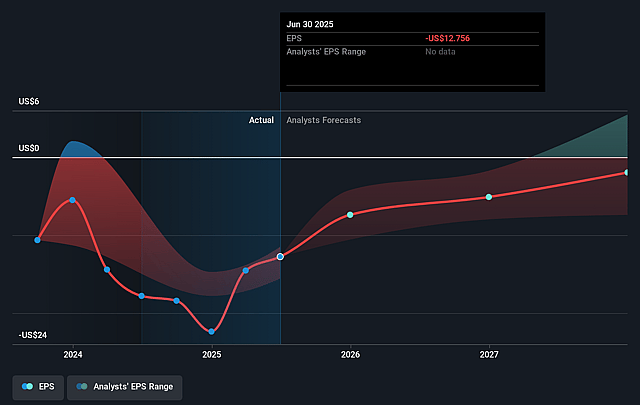

- If Nabors Industries's profit margin were to converge on the industry average, you could expect earnings to reach $259.4 million (and earnings per share of $15.26) by about September 2028, up from $-137.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 4.2x on those 2028 earnings, up from -4.3x today. This future PE is lower than the current PE for the US Energy Services industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

Nabors Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global transition towards renewable energy and stricter ESG mandates continue to put long-term pressure on oil drilling activity and investor capital flows, which could negatively impact Nabors Industries' revenue and share valuation as fossil fuel demand structurally declines.

- Nabors continues to operate with a high debt burden and significant interest expenses, limiting financial flexibility and increasing the risk to future net earnings and potential equity dilution, especially if market downturns or credit disruptions persist.

- The company's average rig margins in the U.S. Lower 48 have been declining due to competitive pricing pressures and contract renewals at lower day rates, which could continue to compress net margins and affect profitability if industry overcapacity persists.

- An aging rig fleet and the need for ongoing high capital expenditures, particularly with delayed newbuild deployments and fluctuating maintenance costs, raise concerns about underinvestment in next-generation drilling technology compared to peers, potentially eroding the company's competitive advantage and affecting long-term top-line growth.

- Revenue visibility remains vulnerable due to geographic concentration and exposure to North American shale as well as uncertain collections from international markets such as Mexico; these factors introduce unpredictability in revenue and cash flow, heightening the risk to sustained earnings improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nabors Industries is $50.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nabors Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $259.4 million, and it would be trading on a PE ratio of 4.2x, assuming you use a discount rate of 8.4%.

- Given the current share price of $40.25, the bullish analyst price target of $50.0 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nabors Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.