Key Takeaways

- Marathon Petroleum's reliance on increased refining margins for revenue growth may be unstable, especially if global economic uncertainty continues.

- Aggressive share buyback strategies and capital expenditure investments may not sustainably support EPS growth due to potential operational cash flow pressures.

- Marathon Petroleum's strong cash flow, operational excellence, and strategic capital allocation bolster earnings stability and competitive positioning, supporting robust revenue prospects and shareholder returns.

Catalysts

About Marathon Petroleum- Operates as an integrated downstream energy company primarily in the United States.

- Marathon Petroleum's potential overvaluation may be tied to expectations of increased refining margins driven by anticipated demand growth for refined products exceeding capacity additions and rationalizations, impacting future revenue positively.

- Uncertainty around global economic growth and refining margins could pressure future net margins, especially if the volatility experienced in Q3 persists, leading to potential compressions.

- The capability of MPLX to grow its distribution may overly boost expectations for Marathon’s future earnings; though the current growth supports cash flow, future variances could affect EPS projections negatively.

- Expected capital expenditure increases with investments in projects like those in the Permian Basin could potentially face higher-than-anticipated costs, impacting net margins and thus affecting future profitability assessments.

- Marathon's aggressive share buyback strategy, including $5 billion additional authorization, may not sustainably support EPS growth, especially if cash flow from operations decreases due to external pressures, hence impacting earnings valuations.

Marathon Petroleum Future Earnings and Revenue Growth

Assumptions

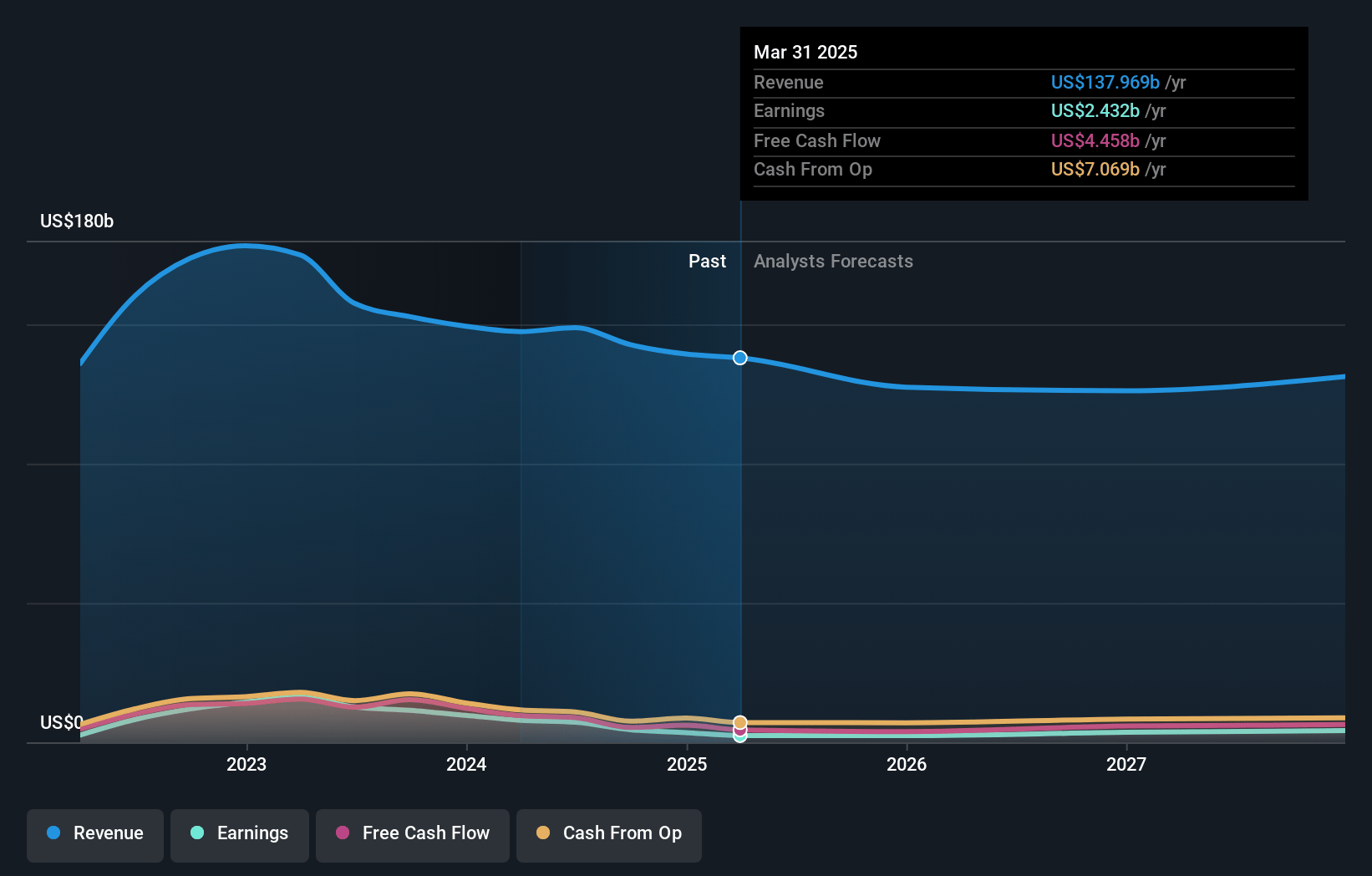

How have these above catalysts been quantified?- Analysts are assuming Marathon Petroleum's revenue will decrease by -5.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.2% today to 2.8% in 3 years time.

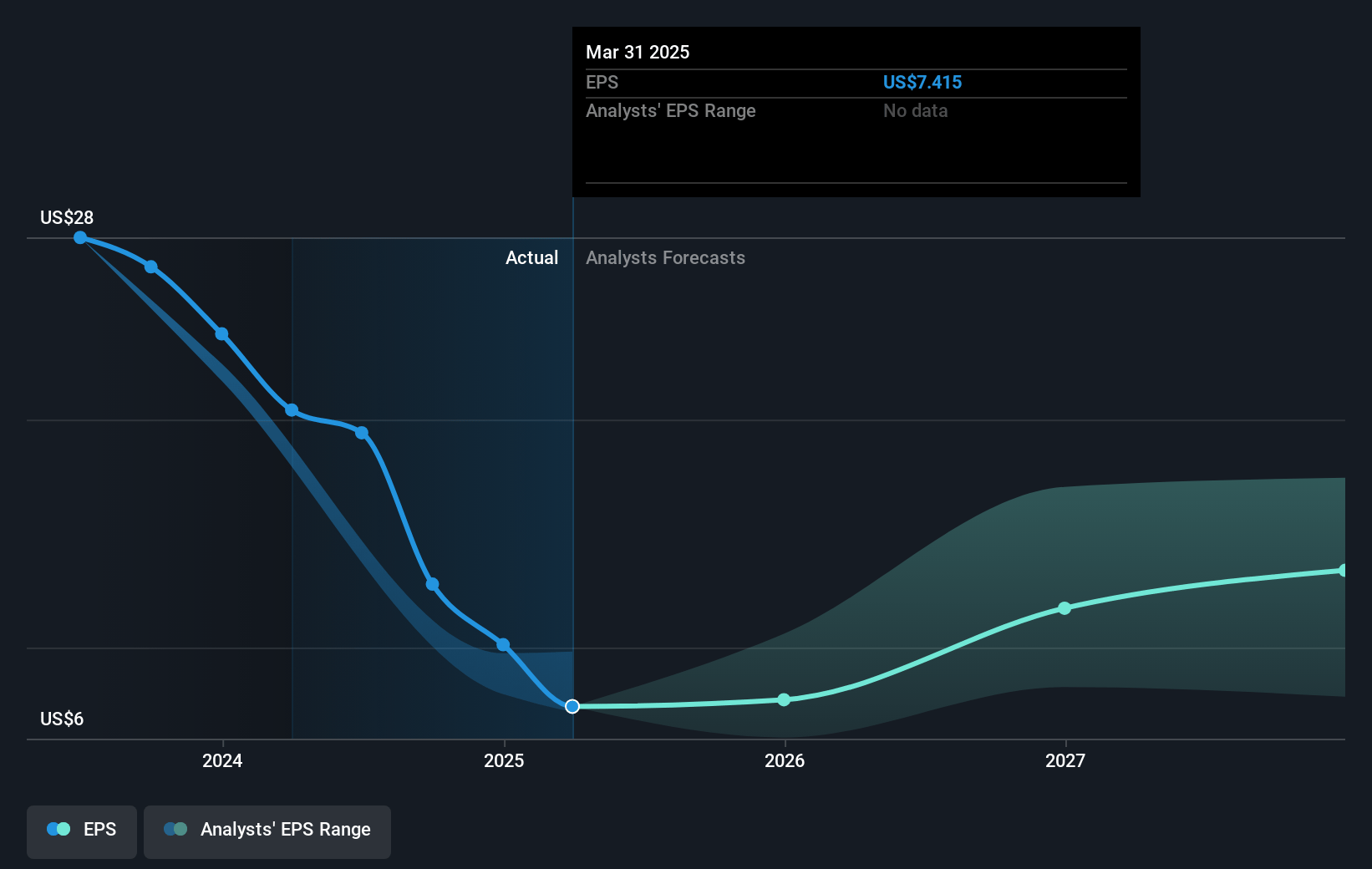

- Analysts expect earnings to reach $3.4 billion (and earnings per share of $13.25) by about December 2027, down from $4.5 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $4.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2027 earnings, up from 10.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.1x.

- Analysts expect the number of shares outstanding to decline by 7.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.28%, as per the Simply Wall St company report.

Marathon Petroleum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing global refined product demand growth, including steady year-over-year demand for gasoline, diesel, and growth in jet fuels, suggests robust revenue prospects for Marathon Petroleum Corporation (MPC).

- MPC's operational excellence and utilization rates, particularly in regions like the West Coast and Mid-Con with utilization in the upper 90s, contribute to stable and potentially improving operating margins.

- As MPLX, MPC’s Midstream segment, continues to execute high-value projects and grows its adjusted EBITDA, it provides a durable cash flow that strengthens MPC’s earnings stability.

- The company's disciplined capital allocation strategy, with projects expected to achieve attractive returns, positions it to enhance its competitiveness and bolster long-term earnings and profitability.

- Share repurchase authorizations and a commitment to return capital to shareholders highlight MPC’s strong cash generation and financial flexibility, potentially supporting stable or increasing share prices.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $170.16 for Marathon Petroleum based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $195.0, and the most bearish reporting a price target of just $141.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $122.2 billion, earnings will come to $3.4 billion, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $151.97, the analyst's price target of $170.16 is 10.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives