Last Update 20 Aug 25

Fair value Decreased 9.70%The lower analyst price target for Granite Ridge Resources reflects a decline in the projected future P/E ratio, signaling tempered expectations for earnings growth, with fair value revised downward from $7.06 to $6.62.

What's in the News

- Q2 2025 oil production rose 46% year-over-year to 16,009 barrels per day; natural gas production increased 28% to 93,404 Mcf per day; total daily production grew 37% to 31,576 Boe per day.

- Full-year 2025 production guidance was raised by 10% at the midpoint to 31,000–33,000 Boe per day, driven by early Permian well startups and strong Utica results, implying 28% YoY growth.

- Luke Brandenberg stepped down as CEO and was succeeded by Tyler Farquharson, a finance veteran with over 19 years of oil and gas industry experience.

- Kim Weimer was promoted to Interim CFO, bringing more than 20 years of energy accounting leadership, including previous CFO roles at Titanium Exploration Partners and Enduro Resource Partners.

Valuation Changes

Summary of Valuation Changes for Granite Ridge Resources

- The Consensus Analyst Price Target has fallen from $7.06 to $6.62.

- The Future P/E for Granite Ridge Resources has fallen from 8.79x to 8.25x.

- The Discount Rate for Granite Ridge Resources remained effectively unchanged, at 6.90%.

Key Takeaways

- Strategic acquisitions and a diversified, flexible operating model support sustained growth, resilient cash flow, and high margins amid a favorable U.S. energy market backdrop.

- Focus on disciplined capital allocation and strong liquidity enables growth opportunities while maintaining shareholder returns and reducing structural revenue risk.

- Aggressive acquisition-driven growth and concentration in key basins heighten financial, operational, and regulatory risks amid volatile commodity prices and evolving energy market trends.

Catalysts

About Granite Ridge Resources- Operates as a non-operated oil and natural gas exploration and production company.

- Granite Ridge is actively acquiring high-quality, long-duration inventory at attractive entry prices due to a lack of private equity capital in the upstream oil and gas sector and the increased focus of remaining private capital on larger transactions; this positions the company to capture value from constrained asset supply and will likely support sustained production and revenue growth over the coming years.

- The company's diversified asset base and flexible, non-operating model across multiple premier U.S. basins enables efficient scaling of output with lower operational risk and capital intensity, supporting higher net margins and more resilient free cash flow, particularly as investments in both operated and non-operated partnerships continue to accelerate.

- Ongoing U.S. economic growth, coupled with global energy security concerns and the reshoring of manufacturing, is increasing the value of reliable domestic oil and gas supply-Granite Ridge's U.S.-centric portfolio is well-positioned to benefit from stable demand and potentially favorable pricing, supporting both long-term revenue and asset values.

- Limited progress in commercializing renewables in hard-to-abate industrial sectors means oil and gas will remain a crucial part of the global energy mix for the foreseeable future; this underpins baseline demand for Granite Ridge's products and reduces the risk of structural revenue declines.

- The company's disciplined capital allocation-emphasizing returns over production targets and returning capital via dividends-together with a strong balance sheet and increasing liquidity, provides Granite Ridge with flexibility to pursue growth while protecting net margins and free cash flow, setting the stage for long-term earnings upside as new acquisitions are brought online.

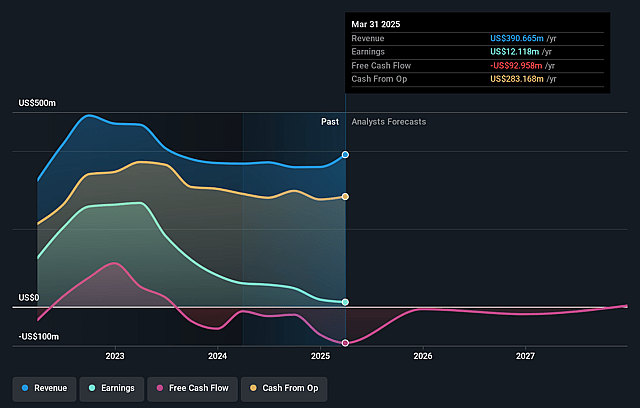

Granite Ridge Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Granite Ridge Resources's revenue will grow by 15.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 20.7% in 3 years time.

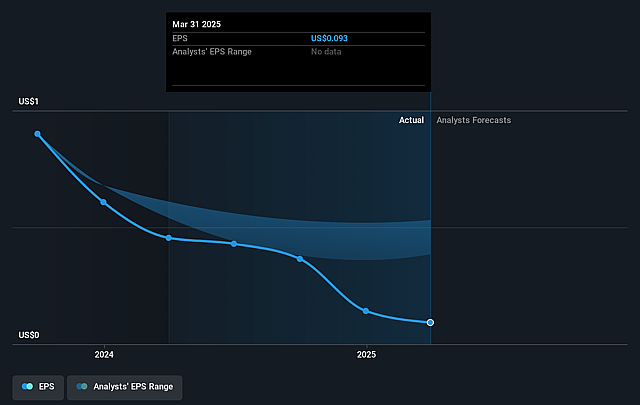

- Analysts expect earnings to reach $129.5 million (and earnings per share of $0.7) by about September 2028, up from $32.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.0x on those 2028 earnings, down from 21.3x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Granite Ridge Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Granite Ridge's significant increase in capital expenditures-outspending operating cash flow and raising leverage to fund acquisitions-introduces heightened balance sheet risk, which, if commodity prices weaken or capital availability tightens, could squeeze free cash flow and limit the company's flexibility to invest for growth or return capital to shareholders.

- Growing reliance on asset acquisitions and operated partnership teams exposes Granite Ridge to concentration risks in key U.S. basins (primarily the Permian and Appalachian), making the company vulnerable to basin-specific regulatory changes, local development challenges, or production declines, all of which could impact long-term revenue and earnings stability.

- As a non-operating and investment-focused energy company, Granite Ridge's production results and operational efficiency are dependent on third-party operating partners; delays, underperformance, or misalignment of incentives with these partners may lead to inconsistent production outcomes, higher costs, and margin pressure over time.

- While management is taking advantage of a constructive acquisition market now, the text acknowledges persistent oil and gas price volatility and recent declines in commodity prices-if these price headwinds persist or worsen, there could be downward pressure on realized prices, revenue growth, and overall profitability.

- The company's bullish approach is predicated on the current scarcity of private capital in upstream oil & gas; however, long-term secular trends-such as the shift to renewables, increased ESG-focused capital restrictions, and potential for stricter environmental regulation-could eventually return capital costs to structurally higher levels or erode hydrocarbon demand, compressing margins and placing downward pressure on share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.375 for Granite Ridge Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $624.8 million, earnings will come to $129.5 million, and it would be trading on a PE ratio of 8.0x, assuming you use a discount rate of 7.0%.

- Given the current share price of $5.19, the analyst price target of $6.38 is 18.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Granite Ridge Resources?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.