Key Takeaways

- Strong international project activity and focus on maximizing recovery from mature fields are driving sustained, high-margin demand for Core Labs’ specialized services and recurring revenues.

- Innovation, environmental solutions, and operational optimization are enhancing customer retention, pricing power, operating efficiency, and positioning Core Labs as a premium technical partner.

- Rising geopolitical risk, regulatory pressures, and industry shifts toward renewables and client insourcing threaten Core Laboratories’ revenue stability, pricing power, and long-term profitability.

Catalysts

About Core Laboratories- Provides reservoir description and production enhancement services and products to the oil and gas industry in the United States, and internationally.

- Robust international upstream oil and gas project activity, especially in high-growth markets across Asia, the Middle East, and Africa, is expected to drive sustained demand for Core Laboratories’ reservoir optimization and description services as non-OECD economies account for the majority of incremental global energy demand. This is likely to support multi-year revenue expansion as these regions invest heavily in maximizing hydrocarbon recovery.

- Steadily increasing focus among global oil and gas operators on maximizing recovery from existing, mature fields—given the natural decline of legacy reserves and limited new large-scale discoveries—creates durable, high-margin demand for Core Labs’ specialized laboratory analytics, digital solutions, and enhanced oil recovery technologies, which should underpin growth in both recurring service revenues and margin expansion.

- Growing environmental and regulatory pressures on energy producers to reduce emissions, improve well productivity, and deploy more efficient extraction techniques catalyze the adoption of Core Labs’ proprietary, environmentally-focused offerings such as SPECTRASTIM tracers and advanced diagnostic services, reinforcing customer stickiness and potential for pricing power, thus supporting gross margin and net margin improvements over time.

- Strategic operational initiatives, including targeted cost realignment, optimization of global footprint, and accelerating deployment of digital and data analytics solutions, are expected to drive structural improvements in operating efficiency, further boosting free cash flow generation and return on invested capital as revenue recovers above recent, sanction-driven lows.

- Continuing innovation in high-value offerings, such as next-generation perforation, abandonment technologies and diagnostics for complex well completions, is positioning Core Labs as a premium technical partner for major global operators—supporting both top-line growth and the expansion of higher-margin, value-added service lines as well as recurring contract wins.

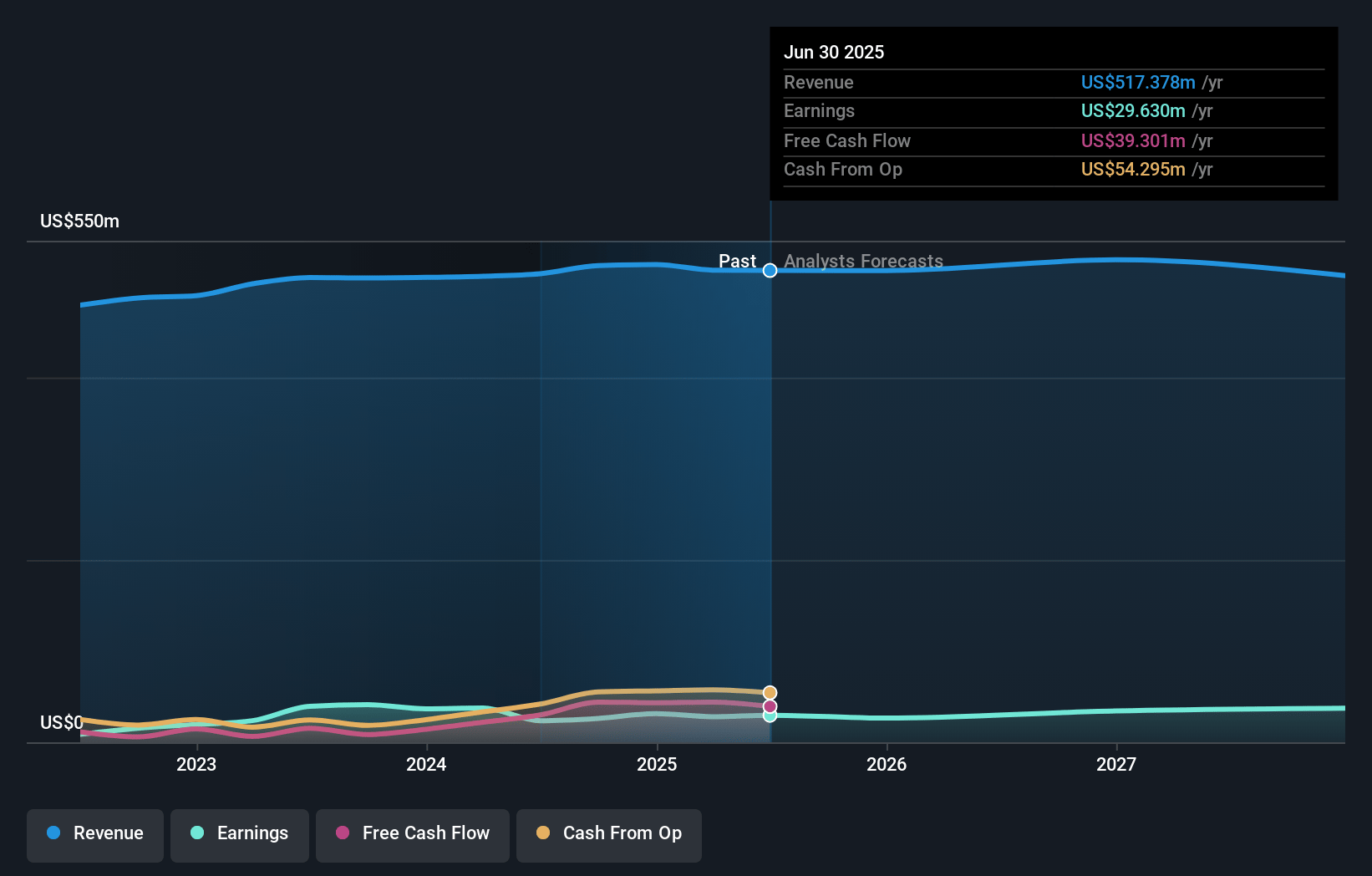

Core Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Core Laboratories compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Core Laboratories's revenue will decrease by 0.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.4% today to 7.7% in 3 years time.

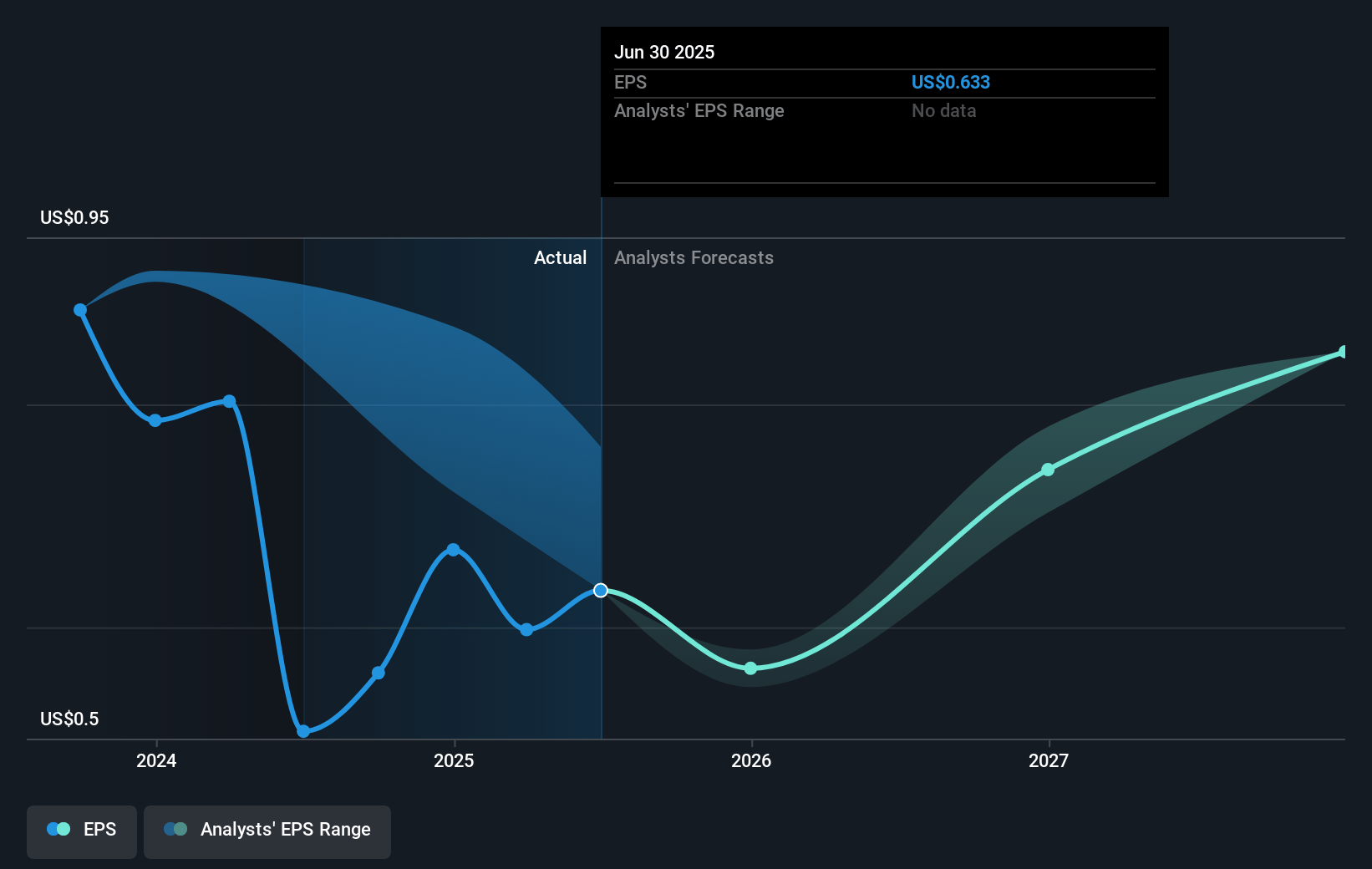

- The bullish analysts expect earnings to reach $39.5 million (and earnings per share of $0.91) by about July 2028, up from $28.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 34.7x on those 2028 earnings, up from 21.5x today. This future PE is greater than the current PE for the GB Energy Services industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.55%, as per the Simply Wall St company report.

Core Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid expansion of global decarbonization efforts and growth in renewable energy adoption threaten to reduce long-term demand for fossil fuels, potentially shrinking the market for Core Laboratories’ services and constraining revenue growth in the coming years.

- Ongoing geopolitical conflicts, such as those in Russia, Ukraine, and the Middle East, along with the expansion of sanctions, have recently created material disruptions for Core Laboratories, resulting in quarter-over-quarter declines in revenue and margins; continued or escalating political risk could undermine revenue consistency and operating income.

- The increasing regulatory scrutiny around carbon emissions and the likelihood of future carbon-pricing mechanisms for oil and gas activity may raise costs for Core’s client base, leading to cuts in exploration and development budgets and lower demand for Core’s specialized services, which would negatively impact revenue and earnings.

- Intensifying competition, as well as a trend toward client insourcing of specialized laboratory services, may diminish Core’s pricing power and erode net margins over time, particularly if peers or clients accelerate digital transformation more rapidly than Core Laboratories.

- The industry’s structural exposure to capital spending volatility and client consolidation, combined with Core’s concentration in regions like North America and certain international markets, increases vulnerability to cyclical downturns and changes in customer activity that may result in unpredictable swings in revenue and pressure on long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Core Laboratories is $24.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Core Laboratories's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $513.2 million, earnings will come to $39.5 million, and it would be trading on a PE ratio of 34.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $12.86, the bullish analyst price target of $24.0 is 46.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives