Key Takeaways

- Heavy reliance on oil and gas, limited diversification, and client concentration expose the company to secular decline and unpredictable earnings.

- Advances in digital technologies and regulatory shifts threaten pricing power, margins, and long-term growth prospects.

- International expansion, advanced technology services, operational and capital discipline, and a focus on high-growth markets position Core Laboratories for improved margin, cash flow, and earnings resilience.

Catalysts

About Core Laboratories- Provides reservoir description and production enhancement services and products to the oil and gas industry in the United States, and internationally.

- The accelerating shift in global capital allocation towards renewable energy and stricter environmental regulations is expected to continue reducing oil and gas investment, diminishing Core Laboratories’ long-term addressable market and leading to persistent revenue stagnation or decline. This secular transition could result in lower project backlogs and shrinking top-line growth over the next decade.

- Core Laboratories remains highly exposed to upstream oil and gas reservoir services and has made limited progress diversifying into adjacent or less cyclical markets, leaving it vulnerable to cyclical downturns and the possibility of secular decline, which would put long-term pressure on revenues and cash generation.

- The company’s heavy reliance on a concentrated client base of supermajors and National Oil Companies means that any consolidation, budget cuts, or strategic shifts by these entities would have a direct and outsized negative impact on operating margins and earnings visibility.

- Rapid technological advances in automation, AI-driven analytics, and digital reservoir management threaten to commoditize Core Laboratories’ core offerings; larger, better-capitalized peers could capture share through more integrated solutions, compressing Core’s pricing power and eroding margins over time.

- Persistent industry volatility driven by oil price cycles and increasing regulatory friction is likely to result in periods of sharply reduced client spending, leading to irregular earnings, weak utilization rates, and margin compression, undermining Core Laboratories’ long-term ability to grow free cash flow.

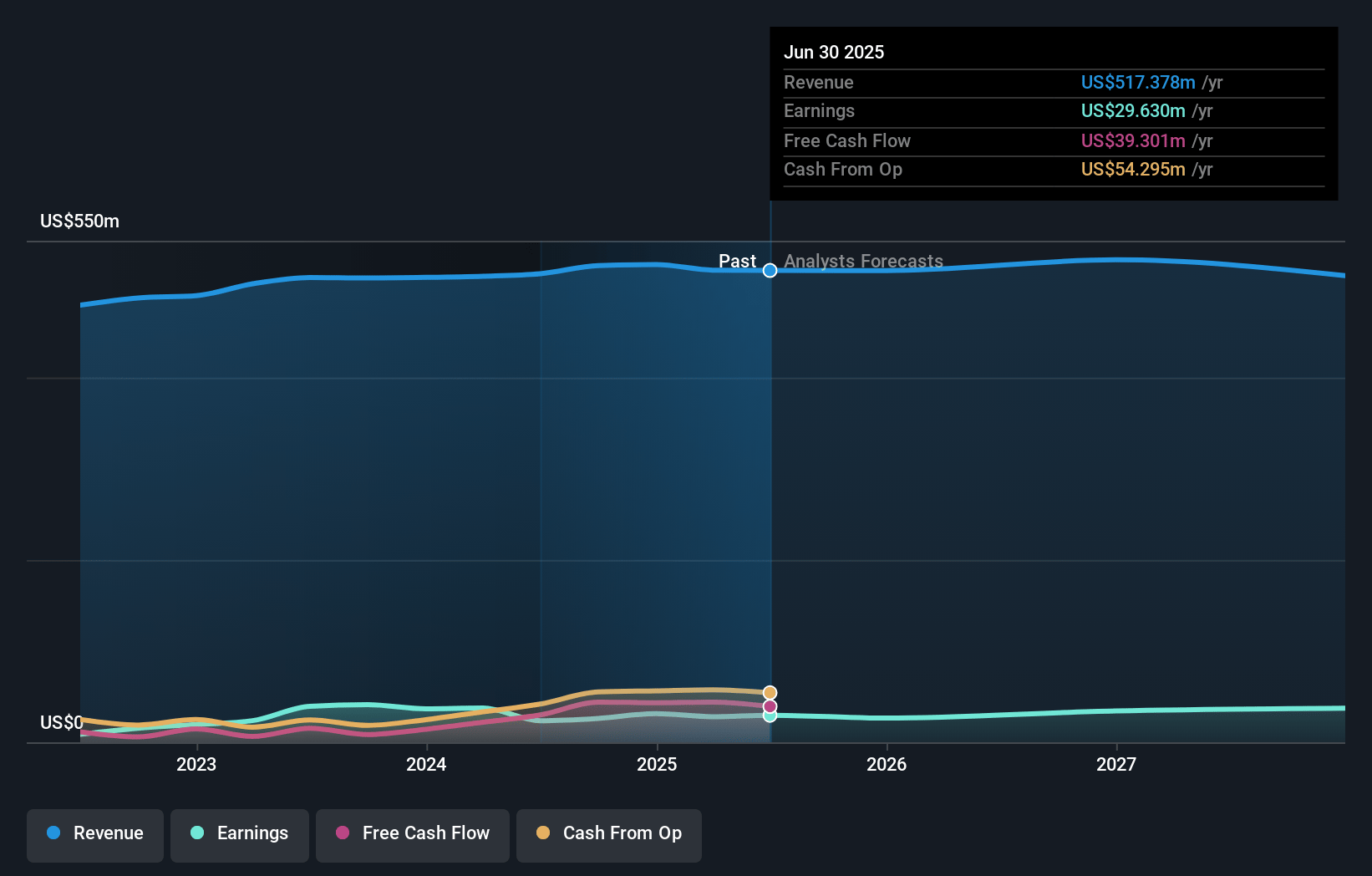

Core Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Core Laboratories compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Core Laboratories's revenue will decrease by 0.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.4% today to 7.7% in 3 years time.

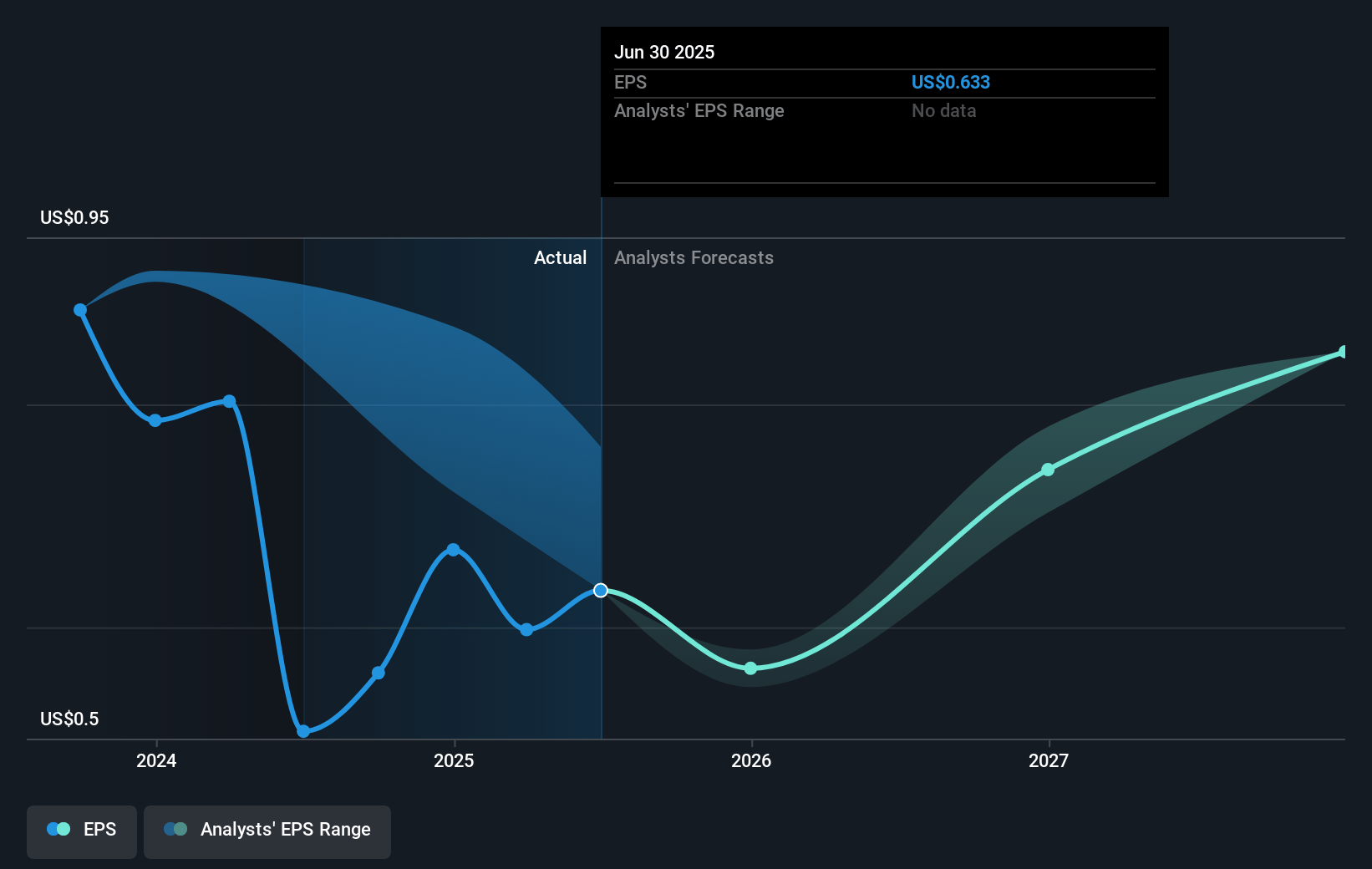

- The bearish analysts expect earnings to reach $39.6 million (and earnings per share of $0.91) by about July 2028, up from $28.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, down from 19.0x today. This future PE is greater than the current PE for the GB Energy Services industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.53%, as per the Simply Wall St company report.

Core Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Stabilizing and growing international demand for Core’s reservoir description and production enhancement technologies, particularly in non-OECD countries across Asia, the Middle East, Africa, and Brazil, could drive top-line revenue growth and diversify the business away from more volatile U.S. markets.

- Strong long-term secular trends in global energy consumption, including forecast growth in worldwide crude oil demand and the need for new production to offset declines in existing wells, may result in sustained demand for Core’s specialized lab and diagnostic services, positively impacting revenue and earnings over multiple years.

- Expansion of high-margin diagnostic and proprietary technology services—such as SPECTRASTIM tracers and HERO-HardRock perforating charges—positions Core for margin improvement and earnings growth as clients increasingly require advanced solutions for both mature fields and complex well environments.

- Operational discipline including significant cost reductions, leaner organization, manufacturing efficiencies, and supply chain optimization is likely to enhance net margins and overall free cash flow, providing resilience even amid near-term market headwinds.

- Core’s established commitment to capital discipline, consistent debt reduction, maintenance of the lowest leverage ratio in eight years, and shareholder returns through both dividends and buybacks could support higher earnings per share and improved valuation over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Core Laboratories is $10.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Core Laboratories's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $513.1 million, earnings will come to $39.6 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of $11.33, the bearish analyst price target of $10.0 is 13.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives