Last Update07 May 25Fair value Decreased 3.09%

Key Takeaways

- Structural shifts toward renewables and improving energy storage technology threaten long-term demand, revenue growth, and competitive advantage in natural gas markets.

- Rising regulatory, ESG, and regional infrastructure challenges are set to increase costs, limit pricing power, and constrain future profitability and shareholder returns.

- Superior cost structure, revenue diversification, and disciplined capital allocation position Antero Resources for robust growth, margin resilience, and increased shareholder value as energy demand rises.

Catalysts

About Antero Resources- An independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States.

- Ongoing global decarbonization efforts and the rapid deployment of renewable energy are likely to structurally erode long-term demand for natural gas and related products, threatening Antero’s ability to maintain current revenue growth rates as utility, power generation, and industrial customers accelerate the shift away from fossil fuels.

- Technological advancements in energy storage and distributed grid solutions are expected to lower the competitive advantage of natural gas as a “bridge fuel,” increasing the risk that Antero’s key markets for both gas and NGLs will face prolonged stagnation or even absolute declines, which would compress future revenues and put persistent downward pressure on earnings.

- Intensifying ESG scrutiny and the prospect of stricter global emissions regulations, methane taxes, and carbon pricing will likely escalate Antero’s compliance costs over the long term, directly reducing net margins and raising the risk that fossil fuel divestment will limit access to affordable capital, making debt refinancing more expensive and constraining shareholder returns.

- Exposure to regional transportation constraints in the Appalachian Basin creates significant risk that Antero will be unable to realize favorable pricing on future production, particularly if legacy pipeline infrastructure becomes inadequate amid static or declining local demand, limiting the company’s ability to grow free cash flow and ultimately squeezing net profits.

- Over the coming years, the risk of persistent oversupply in North American natural gas markets, further exacerbated by increased global LNG competition and alternative fuels, could push realized prices near or below Antero’s breakeven levels, severely undermining both revenue and free cash flow generation regardless of current hedging strategies.

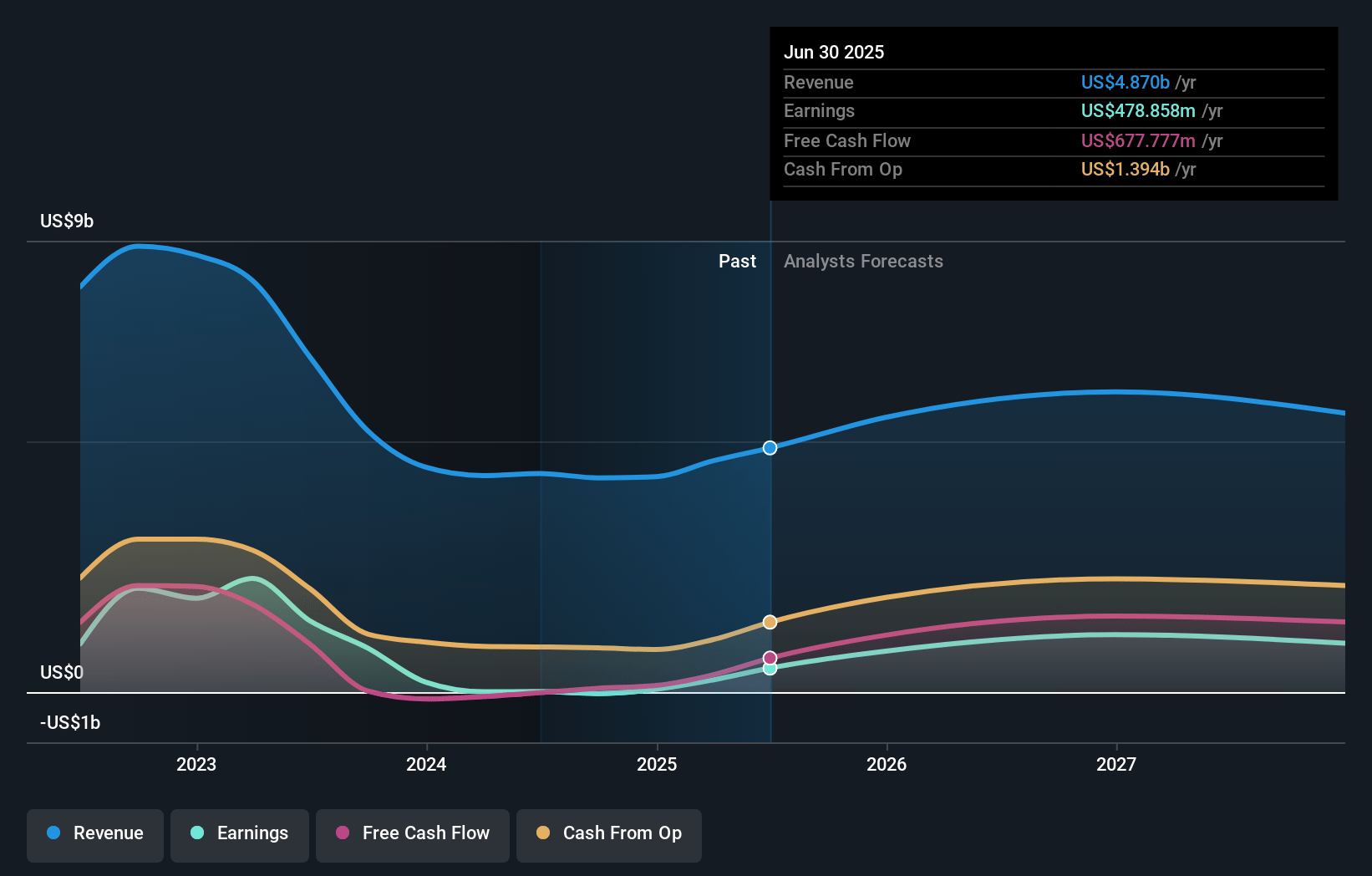

Antero Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Antero Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Antero Resources's revenue will grow by 4.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.3% today to 9.8% in 3 years time.

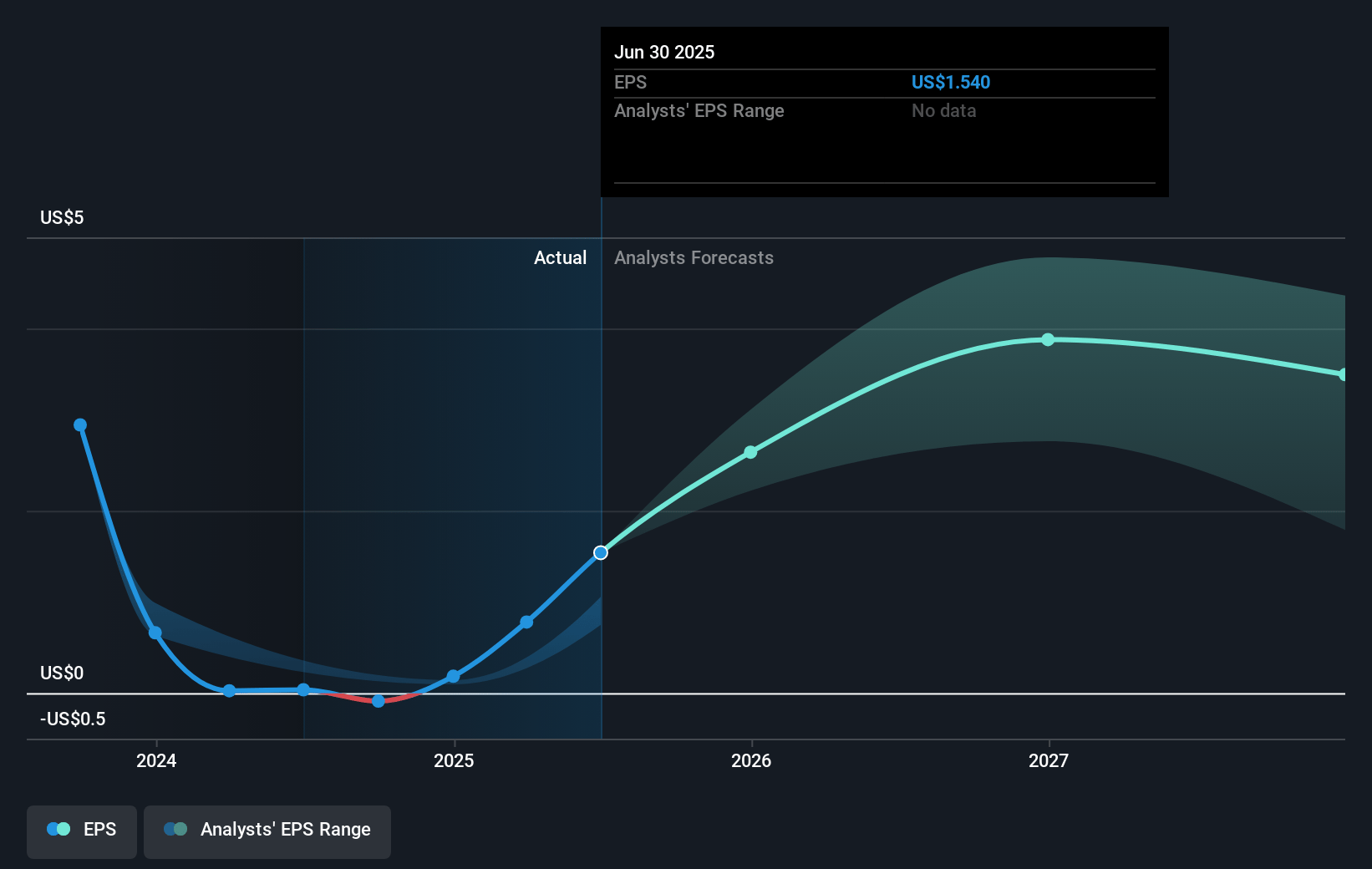

- The bearish analysts expect earnings to reach $508.8 million (and earnings per share of $1.71) by about May 2028, up from $242.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.9x on those 2028 earnings, down from 47.0x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.5%, as per the Simply Wall St company report.

Antero Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing expansion of global LNG demand, particularly from Asia and Europe, together with rapid ramp-up at new Gulf Coast export facilities, supports higher natural gas prices and export volumes, which could drive increased revenue for Antero Resources over the long term.

- Antero’s core position in the Appalachian Basin, with leading capital efficiency and among the lowest maintenance capital per unit in the peer group, creates competitive cost advantages that may help sustain elevated net margins even during downcycles in commodity prices.

- The company’s integrated, liquids-rich production profile captures premium pricing through strategic sales agreements and export infrastructure, driving strong revenue diversification and supporting margin expansion, as highlighted by record NGL premiums above Mont Belvieu.

- Accelerating electrification, data center buildouts, and natural gas-fired power plant developments in Antero’s operating region are likely to underpin steadily rising natural gas demand, giving the company robust visibility into long-term production growth and the potential for higher earnings.

- Consistently strong free cash flow generation and a disciplined, flexible approach to capital allocation—combining aggressive debt reduction with opportunistic share buybacks—positions Antero Resources to enhance shareholder value by improving return on equity and lowering interest expense in future periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Antero Resources is $31.15, which represents two standard deviations below the consensus price target of $43.71. This valuation is based on what can be assumed as the expectations of Antero Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $56.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $508.8 million, and it would be trading on a PE ratio of 22.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of $36.71, the bearish analyst price target of $31.15 is 17.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.