Key Takeaways

- Secular energy transition and ESG pressures threaten long-term hydrocarbon demand, undermining revenue growth and making financing increasingly challenging for HighPeak.

- Operational concentration in the Permian elevates risk, exposing the company to potential abrupt production and revenue shocks amid ongoing commodity price volatility.

- Enhanced operational efficiency, strong capital discipline, and a robust inventory of low-cost drilling sites position the company for resilient margins and superior long-term shareholder value.

Catalysts

About HighPeak Energy- Operates as an independent crude oil and natural gas exploration and production company.

- The accelerating transition to renewable energy and expanding decarbonization initiatives threaten to erode long-term demand for hydrocarbons, placing persistent downward pressure on HighPeak's projected revenues and reducing the lifespan of its drilling inventory.

- Growing environmental scrutiny and tightening ESG standards are steadily driving institutional capital away from fossil fuels, which is expected to hinder HighPeak's ability to access affordable financing, raising the company's cost of capital and constraining both earnings growth and future net margins.

- The company's highly concentrated Permian Basin asset base, while efficient in the short term, exposes HighPeak to above-average operational and geological risks; any adverse event in this region or pipeline bottlenecks could translate to abrupt declines in production, unpredictable revenue drops, and margin compression.

- Advances in electric vehicle adoption and a shift toward greater fuel efficiency globally will likely cap petroleum demand over the long run; for HighPeak, this translates into a secular headwind for oil prices, potentially driving structurally lower realized prices and shrinking both the company's revenue and cash flow.

- Persistent commodity price volatility, exacerbated by periodic global regulatory actions such as potential carbon taxes and new emissions restrictions, injects uncertainty into HighPeak's investment planning, with elevated risk that cash flows fall below debt service requirements or necessitate further capital discipline that could stunt medium-term production and earnings.

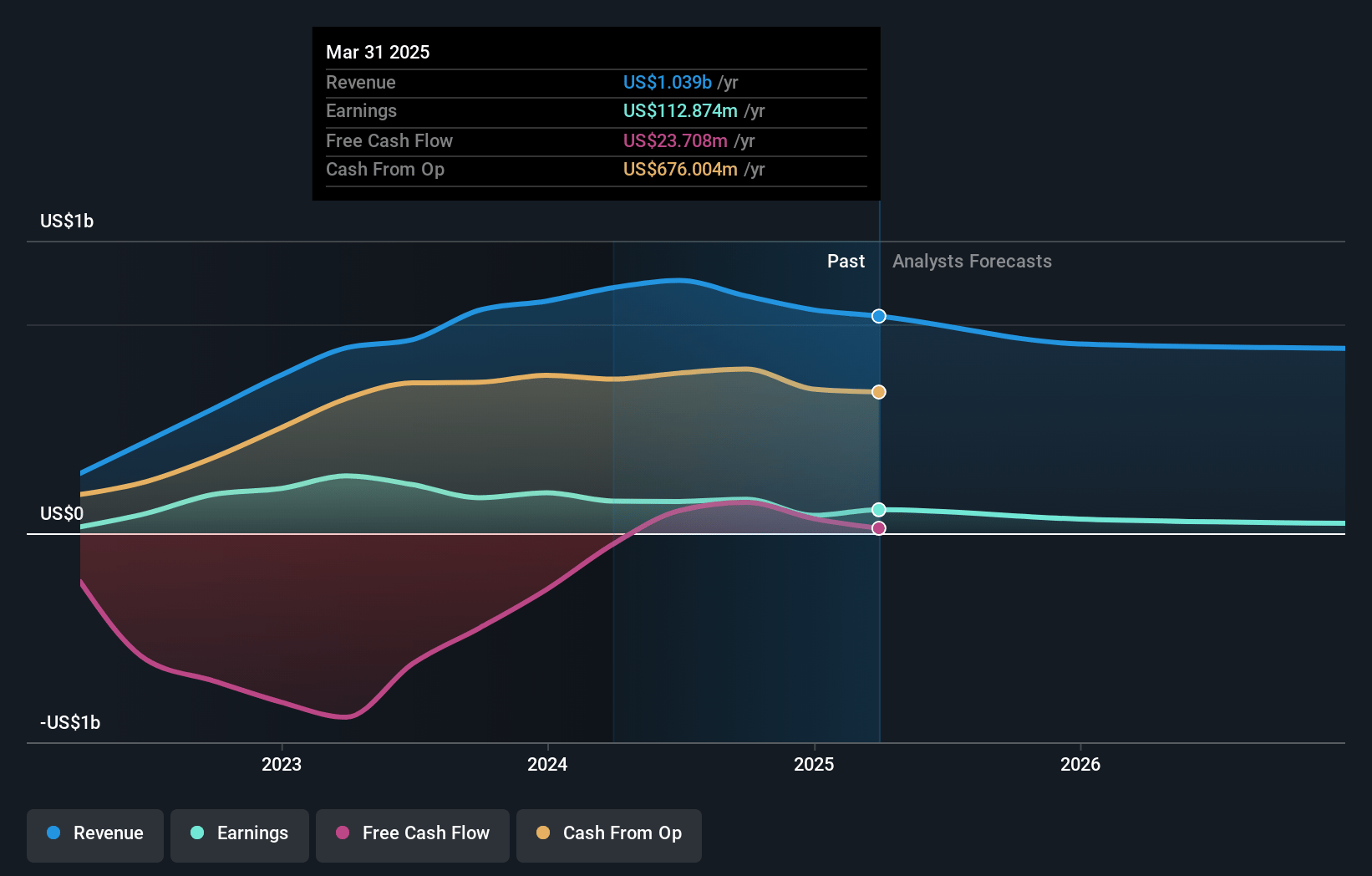

HighPeak Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on HighPeak Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming HighPeak Energy's revenue will decrease by 10.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 10.9% today to 2.4% in 3 years time.

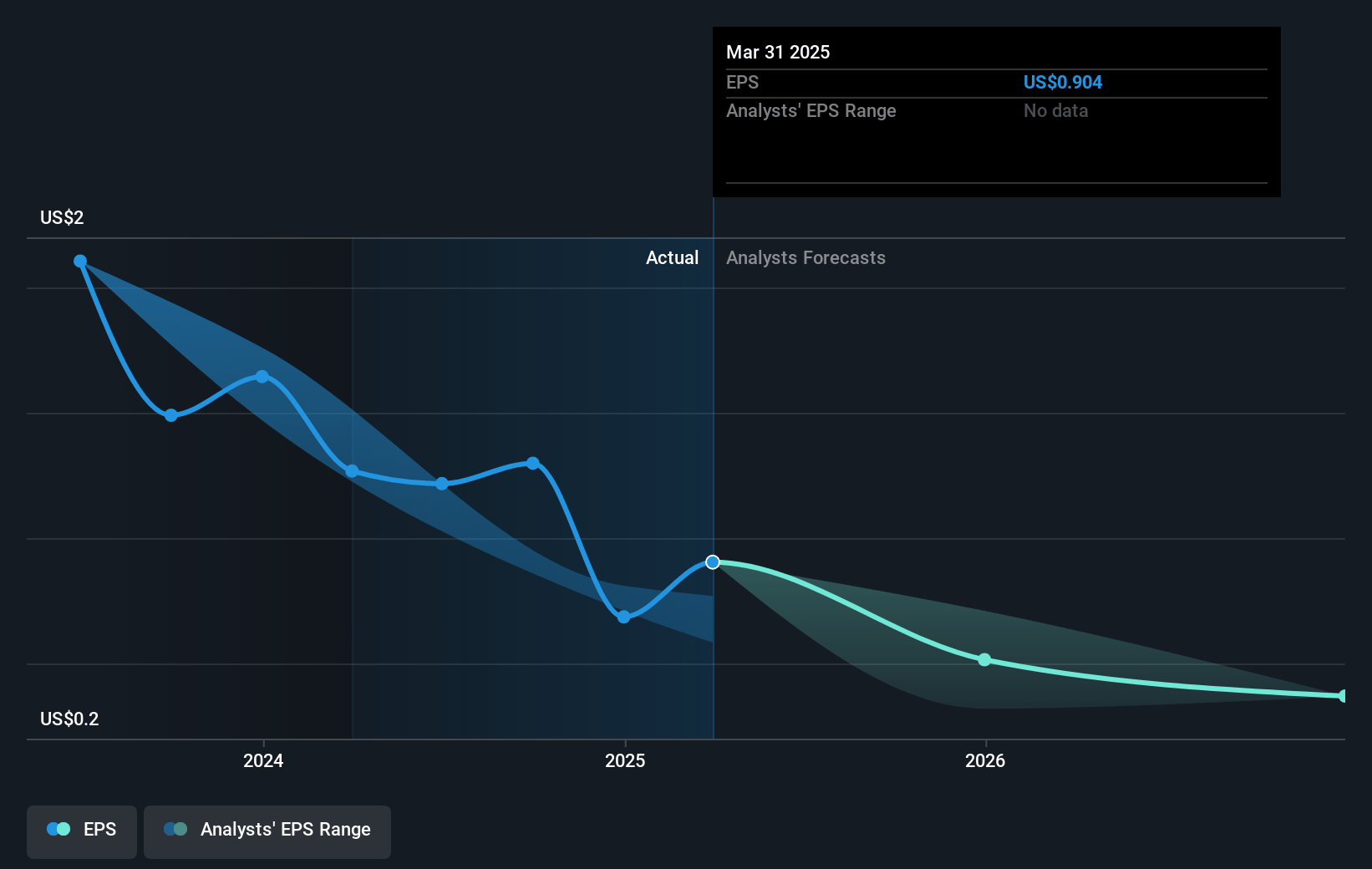

- The bearish analysts expect earnings to reach $17.7 million (and earnings per share of $0.13) by about July 2028, down from $112.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 60.5x on those 2028 earnings, up from 9.3x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

HighPeak Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- HighPeak Energy's continuous improvements in drilling and completion efficiencies, including the adoption of simul-frac operations and a consistent reduction in drilling days, are driving materially lower costs per foot and increasing net margins, which positions the company for enhanced earnings resilience through commodity cycles.

- The company's recent infrastructure investments are largely complete, leading to a projected step change in corporate efficiency and freeing up more capital for productive drilling rather than maintenance, which should significantly boost free cash flow and support a stronger balance sheet going forward.

- HighPeak's large inventory of sub-$50 breakeven drilling locations continues to expand, particularly with successful delineation of the Middle Spraberry formation, providing a long runway of high-margin drilling opportunities that support sustained revenue and profitability even in moderate oil price environments.

- The company is demonstrating strong capital discipline by maintaining flexibility to scale development up or down in response to market conditions, which reduces downside risk in volatile oil markets and helps protect both cash flow and earnings.

- HighPeak's reserve replacement ratio is substantially above peers due to organic growth, and its superior cost structure results in higher profit margins at current oil prices, which could lead to persistent outperformance in revenue growth and shareholder value relative to other E&P companies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for HighPeak Energy is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of HighPeak Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.5, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $743.6 million, earnings will come to $17.7 million, and it would be trading on a PE ratio of 60.5x, assuming you use a discount rate of 7.8%.

- Given the current share price of $8.35, the bearish analyst price target of $7.0 is 19.3% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.