Key Takeaways

- Supportive policies and regulatory momentum for low-carbon fuels are set to drive strong revenue growth, margin expansion, and broadened market access for Aemetis.

- Technology upgrades, project commercialization, and financial strategies will reduce costs, strengthen cash flow, and improve overall profitability and growth prospects.

- Heavy reliance on regulatory credits, subsidies, and geographically concentrated contracts creates significant policy, execution, and market risks for sustained revenue and earnings stability.

Catalysts

About Aemetis- Operates as a renewable natural gas and renewable fuels company.

- Newly adopted federal and state policies supporting low-carbon fuels, such as California’s 20-year Low Carbon Fuel Standard extension and the federal 45Z tax credit, are poised to sharply increase prices and demand for renewable fuels. This creates a strong near-term and multi-year tailwind for revenue growth and margin expansion, especially as Aemetis secures LCFS pathway approvals and begins monetizing production tax credits.

- Rapid scaling of Dairy RNG operations—driven by both production growth (targeting 1 million MMBtu by 2026) and CARB approvals—will unlock high-margin revenue streams through LCFS credits, D3 RINs, and federal incentives. This operational ramp and policy-driven value premium are likely to meaningfully bolster overall net margins and cash flow starting in the second half of 2025.

- The commercialization of new technologies (such as mechanical vapor recompression at the ethanol plant) and capital projects (e.g., Sustainable Aviation Fuel and carbon capture at Riverbank) will materially reduce production costs, enhance margins, and open access to premium end-markets—all of which position Aemetis for structurally higher earnings and stronger free cash flow as these projects come online.

- Strong global and domestic regulatory momentum behind decarbonization in transport—illustrated by rising SAF targets, expanded ethanol blending (E15 adoption), and firm government purchasing in India—directly broadens Aemetis’ accessible markets, sustains elevated product pricing, and underpins long-term revenue growth visibility.

- The planned IPO of Aemetis’ India business and continued monetization of investment/production tax credits provide non-dilutive liquidity for debt reduction and reinvestment, lowering interest expense and risk while expanding capacity for future growth—thereby supporting improved net income and EPS outlook.

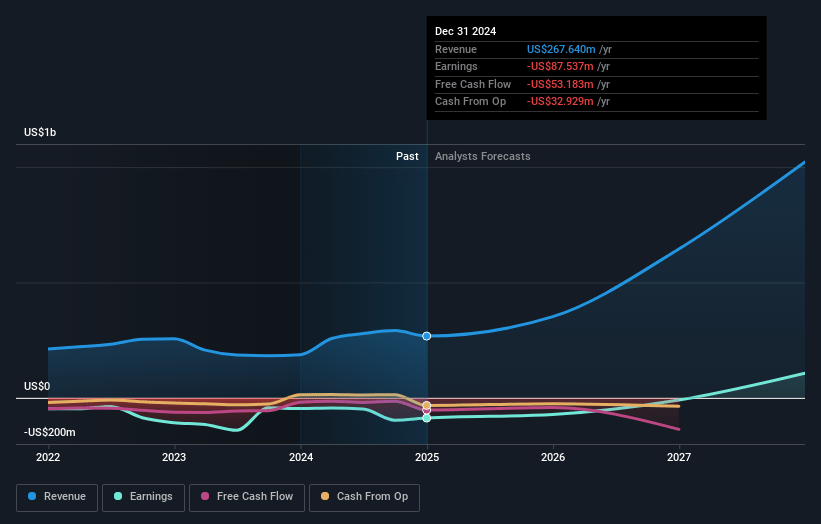

Aemetis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aemetis's revenue will grow by 63.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -36.9% today to 12.7% in 3 years time.

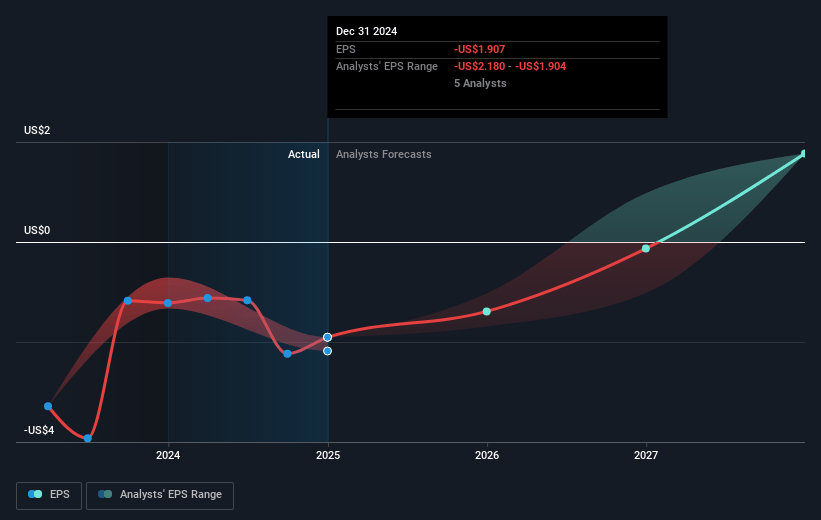

- Analysts expect earnings to reach $132.3 million (and earnings per share of $2.03) by about July 2028, up from $-87.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, up from -1.9x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.44%, as per the Simply Wall St company report.

Aemetis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent net losses and significant interest expense indicate ongoing negative free cash flow and high leverage, increasing the risk of refinancing challenges or shareholder dilution, which may negatively impact future earnings per share and company valuation.

- Heavy reliance on regulatory credits (such as LCFS and RINs), government subsidies, and pending approvals (e.g., CARB pathway, Section 45Z IRS guidance) exposes Aemetis to policy risks, potential delays, or unfavorable regulatory changes, leading to revenue volatility and unpredictable net margins.

- Recent revenue decline from $72.6 million to $42.9 million due to delayed India biodiesel contracts and dependency on OMC tenders points to geographic and customer concentration risks, which could create recurring revenue instability and adversely affect overall sales growth.

- Execution risk on large capital-intensive projects (MVR, SAF plant, CO2 sequestration) carries the possibility of substantial cost overruns, delays or underperformance, which could erode net margins and increase depreciation or amortization expenses, especially given the company’s limited cash reserves.

- Long-term secular trends, such as increased electrification of transport and the growing share of electric vehicles, paired with the emergence of alternative zero-carbon fuels (like green hydrogen or synthetic fuels), could reduce long-term demand for Aemetis’ core biofuel products, putting future revenue growth at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.5 for Aemetis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $132.3 million, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 10.4%.

- Given the current share price of $2.99, the analyst price target of $13.5 is 77.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.