Key Takeaways

- Platform expansion and global trading innovations position the company to capture growth in issuers and trading volumes, supporting sustainable recurring revenues and higher margins.

- Regulatory reforms and enhanced technology infrastructure enable increased market legitimacy, data monetization, and new product cross-selling, driving long-term earnings potential.

- Competitive pressures, regulatory risk, declining issuer engagement, unpredictable trading volumes, and rising costs together threaten revenue growth, market share, and sustained profitability.

Catalysts

About OTC Markets Group- Operates regulated markets for trading 12,000 U.S.

- The launch of the OTCID basic market opens OTC Markets Group's platform to a broader range of issuers, lowering barriers for domestic and foreign companies to access U.S. capital and enabling a larger recurring subscription base; this expansion should drive sustainable revenue growth within the Corporate Services segment.

- The company is capitalizing on the growth in 24-hour global trading and increased cross-border issuer interest (as seen by the 60% year-over-year uptick in international premium listings), positioning itself to benefit from globalization of financial markets and regulatory harmonization, which should increase issuer-related revenues and overall trading volumes.

- The buildout of overnight trading (OTC Overnight and MOON ATS) and further integration with global broker-dealer platforms responds to increased demand for round-the-clock electronic market access, which can boost transaction-based revenues and enhance the scalability of the platform, ultimately supporting higher margins over time.

- OTC Markets is leveraging technology and data infrastructure (including SEDAR/EDGAR integration and expanded data feeds) to drive high-margin growth in market data licensing, professional user price increases, and new product cross-selling, potentially accelerating earnings expansion beyond core trading fees.

- Recent regulatory reforms (such as SEC's 15c2-11 amendments and FINRA oversight enhancements) clarify the legitimacy and transparency of OTC platforms, increasing regulatory acceptance of alternative venues and raising the appeal of OTC Markets' offerings, which supports retention, upselling, and long-term net margin expansion.

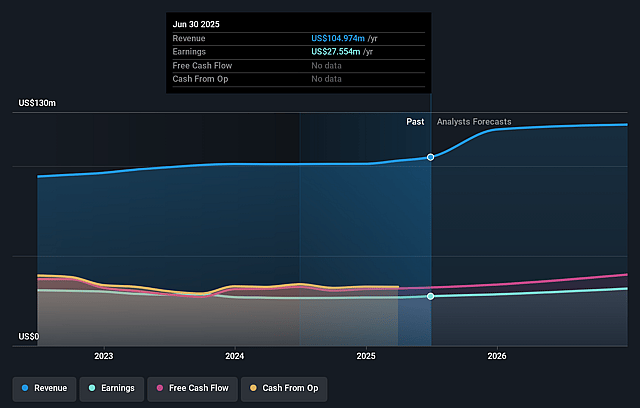

OTC Markets Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OTC Markets Group's revenue will grow by 11.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.1% today to 25.2% in 3 years time.

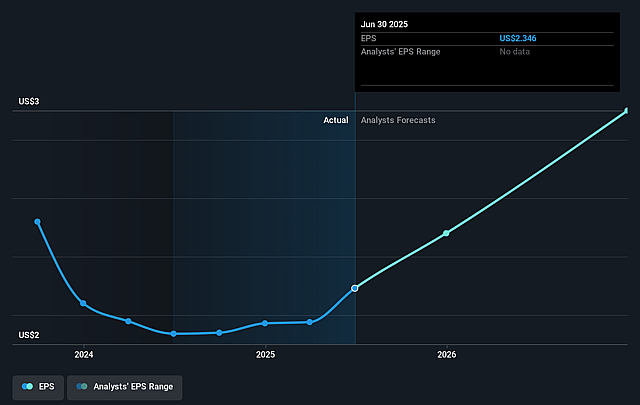

- Analysts expect earnings to reach $36.8 million (and earnings per share of $3.0) by about September 2028, up from $27.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.8x on those 2028 earnings, up from 22.8x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

OTC Markets Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining numbers of OTCQX and OTCQB issuers, as well as a reduction in PINK companies subscribing to corporate services, reveal difficulty in maintaining and growing the pool of engaged issuers; this threatens the steady flow of corporate services revenue and overall topline stability.

- High unpredictability in trading volumes, reliance on increased market volatility, and continued pricing sensitivity-especially notable given the concentration of revenue growth in transaction-based fees-expose the company to sudden revenue slowdowns if market activity or retail participation reverts lower.

- Increased operating expenses, including rising compensation, IT infrastructure costs, and compliance-related professional fees, combined with only modest operating margin improvements, suggest that margin expansion could be difficult to achieve and sustained earnings growth may be limited if costs continue to escalate faster than revenues.

- Rising regulatory and legislative scrutiny (e.g., SEC and FINRA rule changes, focus on market structure and digital assets) creates ongoing uncertainty and risk of stricter compliance requirements, which could reduce the number of qualified issuers, raise compliance costs further, or make OTC platforms less attractive, directly impacting both revenues and net margins.

- Emerging competition from national securities exchanges entering the 24-hour and overnight trading space, as well as possible future disintermediation by digital asset or blockchain-based platforms, could erode OTC Markets' customer base and relevance, leading to loss of market share and lower future revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $63.0 for OTC Markets Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $145.8 million, earnings will come to $36.8 million, and it would be trading on a PE ratio of 23.8x, assuming you use a discount rate of 8.0%.

- Given the current share price of $53.0, the analyst price target of $63.0 is 15.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.